Insta

12 Public Sector Bank CEOs Demand Another Restructuring Window For Companies With Lower Provision Rate

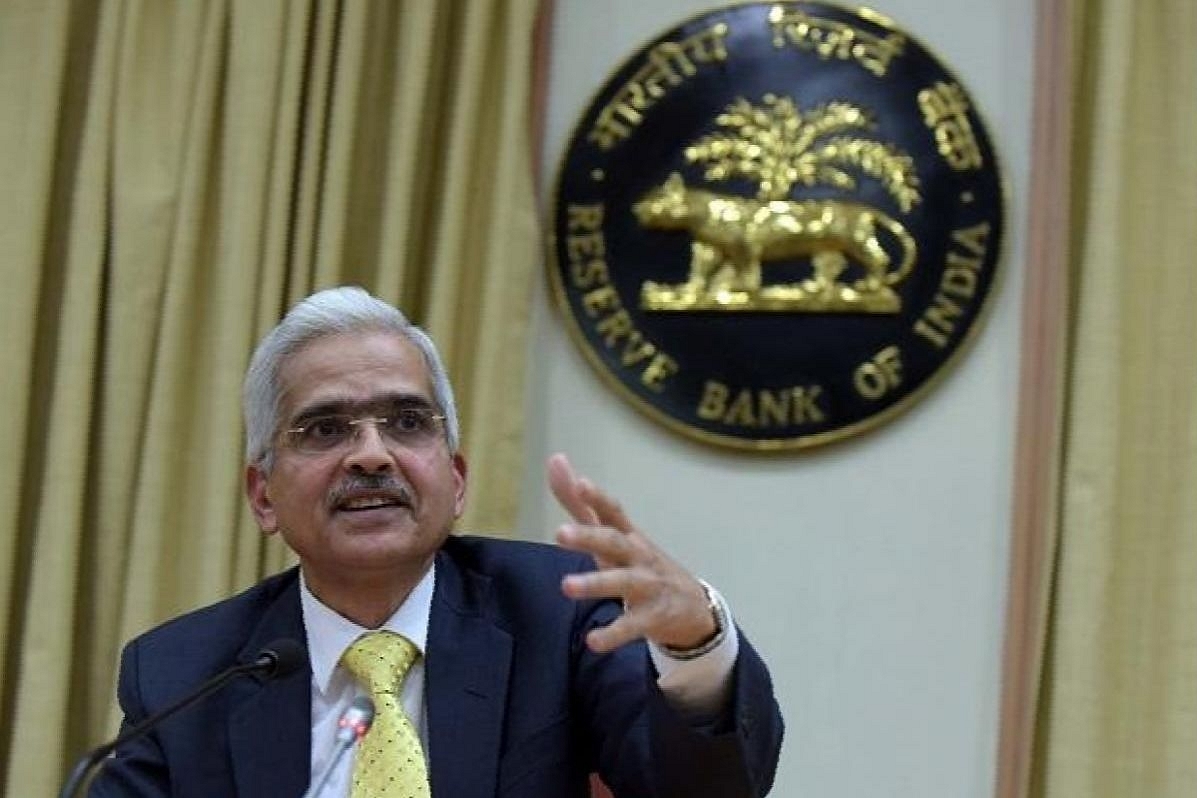

RBI Governor Shaktikanta Das.

The CEOs of all 12 Public Sector Banks (PSBs) have called upon the RBI Governor Shaktikanta Das to extend the second round of restructuring for all companies along with a comparatively reduced provision rate of 5 per cent as compared to 10 per cent that was done last year.

“Restructuring has been extended to micro and small enterprises and individuals up to an outstanding amount of Rs 25 crore. But the need is much more because the damage around us is immense,” one of the individuals present in the meeting told the Economic Times.

He added, “Business wise we have seen collection efficiencies drop sharply and companies, our branches are working with 50 per cent staff and reaching customers for recovery is difficult. The loss of lives has added to the complexities.”

The Indian Banks’ Association (IBA) is set to send a consolidated list to the RBI in a week though the banks might also separately lodge their personal suggestions too.

Banks are pursuing a straight restructuring this time around unlike a moratorium on loans like last time around. They also desire the RBI to offer more time to companies in order to complete their funded internal term loans (FITL) by the end of September 2021.

Banks believe that another moratorium could potentially have an adverse effect on the credit culture. However, a restricting could give them the needed immunity booster in order to get the economy back to its feet. Also, the reduction of provision requirements on restructured loans to 5 per cent can assist them in conserving capital as well.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest