Insta

Centre-States Reach Agreement On Dual Control Over Tax Payers

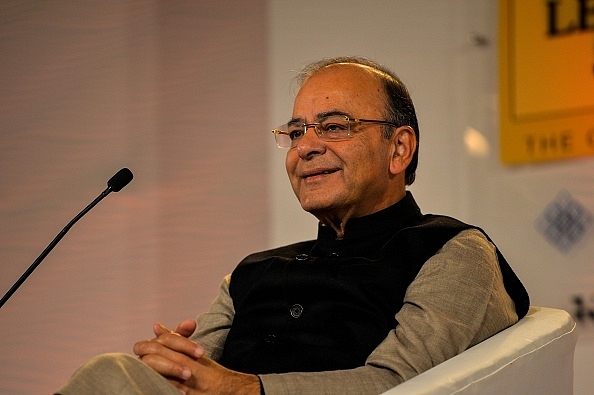

Arun Jaitley

The ninth meeting of the GST Council saw agreement on the issue of dual control or sharing of administrative powers between the Centre and states. The states will tax 90 per cent of all assessees with an annual turnover of Rs 1.5 crore or less with the remaining 10 per cent under the jurisdiction of the Centre, Finance Minister Arun Jaitley told reporters at the end of the Council meeting. Assessees with an annual turnover of more than Rs 1.5 crore will be shared in a 50:50 ratio.

The power to levy and collect Integrated GST (IGST) will lie with the Centre, said the finance minister said but by a special provision in law, states will also be cross-empowered. States can also tax any economic activity in territorial waters up to 12 nautical miles. States have also agreed on 1 July, 2017 as a realistic date to roll out the new indirect tax regime from the earlier 1 April deadline, said Jaitley. The next meeting of the GST Council will take place on 18 February after the Union Budget.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest