Insta

Jaitley’s Major Electoral Funding Reform: Rs 2,000 Cap And Electoral Bonds, Explained

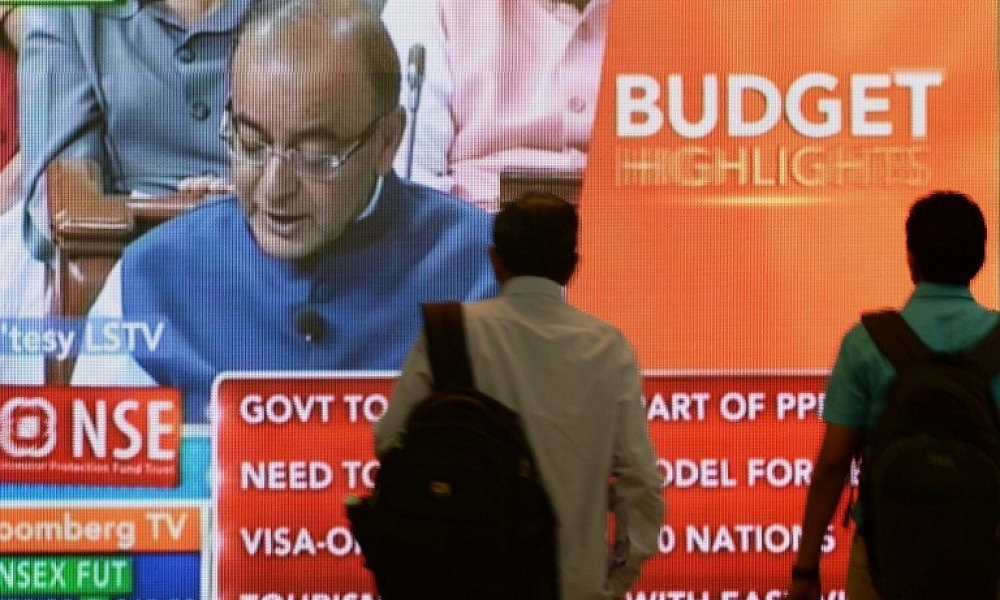

People listening to Finance Minister Arun Jaitley

One of the major takeaways of this year’s general budget, presented by Union Finance Minister Arun Jaitley, was the steps announced to initiate reforms in electoral funding.

While demonetisation broke the back of black money stashed in cash, it was equally important to make sure that no new black money was generated in future. Jaitley lamented that political parties continued to receive most funds through anonymous donations, which is one of the major contributors to the creation of black money.

Therefore, Jaitley declared that political parties wouldn’t be able to accept more than Rs 2,000 in donation in cash from one source. Political parties will be entitled to receive donations by cheque or digitally from their donors, he added.

He further announced that the government will amend the Reserve Bank of India Act to enable the issuance of electoral bonds for political funding.

How will the “electoral bonds” work?

The government will bring in a new scheme under which every political party will have one bank account attached to its name.

Any donor who wants to donate a certain sum to a political party of his choice can go to a registered entity (say, a state bank) and draw a bond of the amount he wants to donate.

This bond can then be given to the party. The party will then “encash” these bonds by depositing the bonds in the above mentioned registered bank account of the party.

This will not only eliminate the possibility of black money but also ensure anonymity of donations.

In another important step towards curbing the generation of new black money, Jaitley announced that the government has decided to act on the recommendation of the Special Investigation Team to outlaw cash transactions over Rs 3 lakh.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest