Insta

No Options For Declaring Foreign Accounts, Property And Bullion Under New Tax Amnesty Scheme

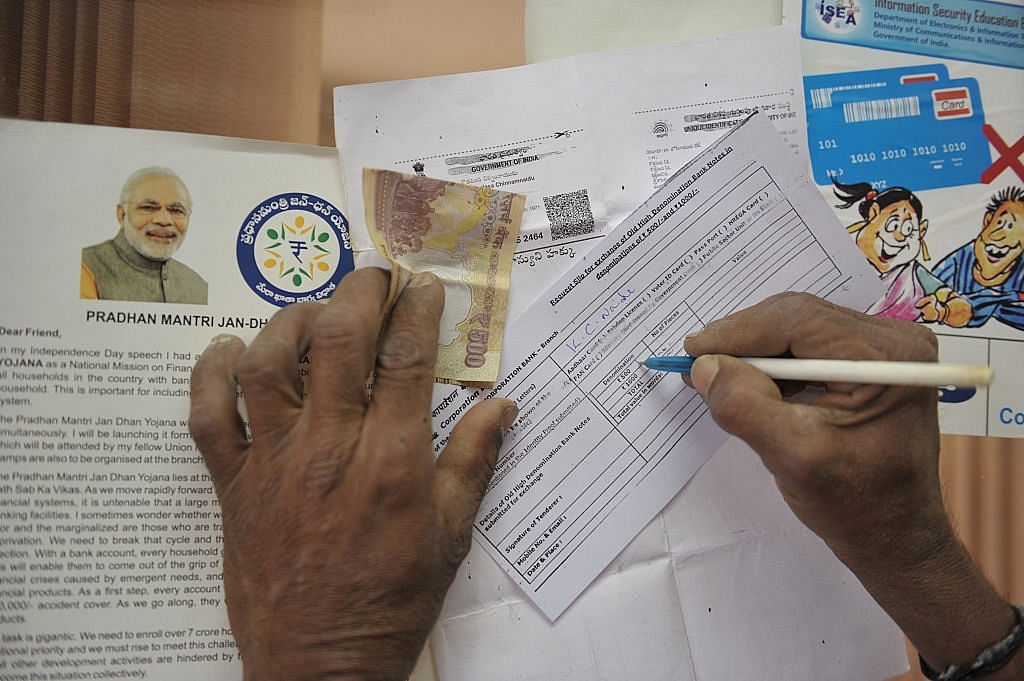

Demonetisation (NOAH SEELAM/AFP/Getty Images)

The government on Wednesday clarified that only unaccounted domestic cash holding can be declared under the new tax amnesty scheme announced after demonetisation and not jewellery, stocks, immovable property or overseas accounts. "The Scheme is hence not available for declaration of an income which is represented in the form of assets like jewellery, stock or immovable property," the government said by way of the second set of FAQs on the Pradhan Mantri Garib Kalyan Yojana (PMGKY) announced in November.

The Central Board of Direct Taxes (CBDT) said that a person "against whom a search/survey operation has been initiated is eligible to file declaration under the Scheme. Undisclosed income represented in the form of deposits in foreign bank account is not eligible for the Scheme."

Announced following government decision to scrap Rs 500 and Rs 1,000 notes, PMGKY commenced on 17 December 2016 and will remain open until 31 March 2017. Under this scheme, undisclosed income can be declared by paying 50 per cent of the amount in taxes and surcharges. Besides, a quarter of the total sum is to be put in a non-interest bearing deposit for four years.

CBDT added that a declaration under the PMGKY scheme can be filed in respect of deposits made in an account maintained by an specified entity by any mode such as cash, cheque, RTGS, NEFT or any electronic transfer system. No credit for advance tax paid, TDS or TCS will be allowed under the scheme.

With inputs from IANS

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest