Insta

RBI Announces Rs 50,000 Crore Liquidity Support To NABARD, SIDBI And NHB For Fresh Lending In FY22

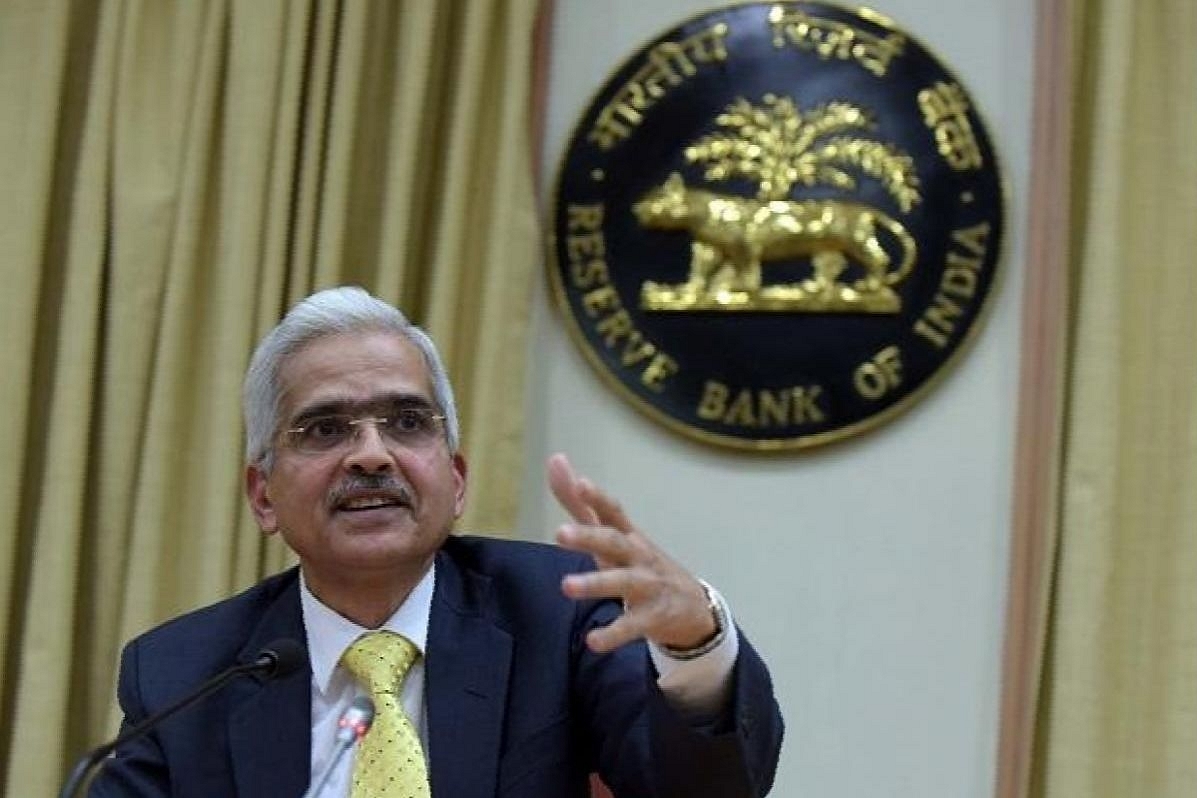

RBI Governor Shaktikanta Das.

In a liquidity boost to all-India financial institutions such as NABARD and National Housing Bank (NHB), the Reserve Bank of India (RBI) has announced a liquidity support of Rs 50,000 crore to such institutions for fresh lending in the current financial year.

"In consonance with the policy objective of nurturing the still nascent growth impulses, it has been decided to extend fresh support of Rs 50,000 crore to the AIFIs for new lending in 2021-22," said the RBI's statement on Developmental and Regulatory Policies.

Accordingly, NABARD will be provided a special liquidity facility (SLF) of Rs 25,000 crore for a period of one year to support agriculture and allied activities, the rural non-farm sector and non banking financial companies-microfinance institutions (NBFC-MFIs).

A special liquidity facility (SLF) of Rs 10,000 crore will be extended to NHB for one year to support the housing sector.

To meet the funding requirements of micro, small and medium enterprises (MSMEs), SIDBI will be sanctioned Rs 15,000 crore under this facility for a period of up to one year.

All these three facilities will be available at the prevailing policy repo rate.

To support the continued flow of credit to the real economy in the aftermath of the Covid-19 pandemic, special refinance facilities for a total amount of Rs 75,000 crore were provided during April-August 2020 to these all-India financial institutions (AIFIs).

These facilities were available for a period of one year. NABARD, SIDBI and NHB will repay the facilities extended to them during April-May 2020.

(This story has been published from a wire agency feed without modifications to the text. Only the headline has been changed.)

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest