Magazine

Budget 2016 Special - What We Are Up Against

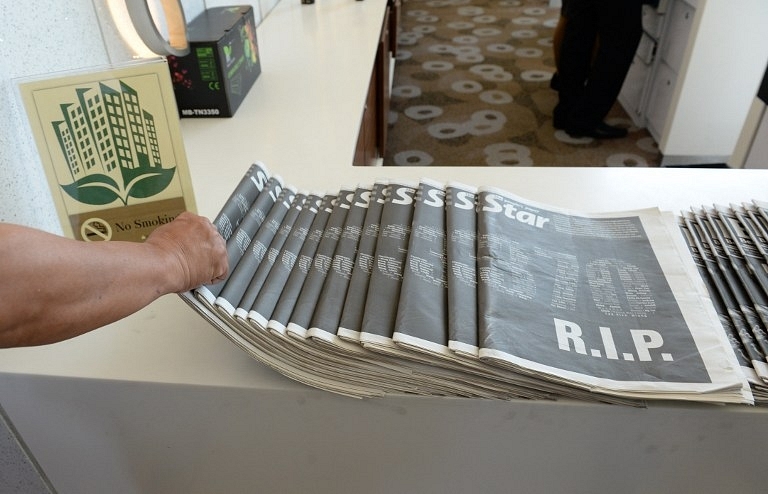

Newspapers

From China’s devaluation of the yuan to an Opposition hell-bent on playing hardball, Team Jaitley certainly has its task cut out to tackle myriad challenges. But the news is not all bad.

Arun Jaitley has always, but always, been known for his genial exterior. That no longer seems to be the case. That friendly face, ever ready with a smile, now wears a stern expression most of the time.

Blame it on North Block, that imposing British-era building that houses the Finance Ministry, which Jaitley now heads. Its dour interiors are not exactly mood-uplifting. But Jaitley’s grim look may also have to do with the somewhat gloomy backdrop in which he and his team have to frame his third Union Budget.

After all, the Mid-Year Economic Analysis 2015-16 penned by no less than the Chief Economic Advisor says that the economy is, in effect, running on two wheels: “…the Indian economy now is powered by private consumption and government investment. This is in sharp contrast to the boom years, when the economy was powered by all four components of demand.” And Jaitley has to get this economy running in top gear. No wonder, the smile has become occasional, and a frown is becoming habitual.

This time last year, Team Jaitley was bullish. The mid-year review for 2014-15 had been a bit cautious and had said that despite a lot of improvements, “India still needs to be watchful in terms of its macro-economic fundamentals”. But there was a greater feeling of optimism.

After all, the Narendra Modi government had got enormous political backing in the general elections nine months earlier. And it had in that brief time, taken some creditworthy steps—diesel prices had been deregulated, the direct benefit transfer scheme for LPG subsidy had been fast-tracked, environmental clearances had become more transparent and faster, coal auctions had been conducted successfully and transparently, caps on foreign direct investment in many sectors had been significantly eased or removed altogether, financial inclusion schemes had been rolled out, and the Planning Commission had been scrapped.

More importantly, an ordinance to bring in much needed amendments to the 2013 Land Acquisition Law had been promulgated and a Constitutional Amendment Bill to usher in a goods and services tax (GST) had been tabled in Parliament.

Almost everyone from the top honchos of India Inc to analysts at global credit rating agencies, from ivory tower economists to the ordinary person, believed the government would press all the right buttons to put the economy in high gear again.

The biggest advantage, however, was the fact that the government could pin the blame for poor performance on what was termed as “legacy issues”—the many problems that the United Progressive Alliance government had passed on to it in the form of a stressed exchequer, policy and implementation paralysis, and business confidence at rock bottom.

One year on, there’s a bit of defensiveness. Many of the big initiatives have fallen through. The land acquisition ordinance was withdrawn, the promise of the GST kicking in from April 1 proved empty. The Mid-Year Economic Analysis 2015-16 revised growth projections for the year downwards to 7-7.5 per cent range from the 8.1-8.5 per cent range that the Economic Survey predicted in February. And the legacy issues excuse doesn’t hold any more.

But the landscape isn’t entirely bleak; there are oases of hope.

The growth numbers for the first half of 2015-16 (the third quarter numbers came after the magazine went to press) were, no doubt, lower than in the first half of 2014-15 (7.2 per cent and 7.5 per cent respectively). But quarterly figures showed that the economy was clawing its way back to recovery. The second quarter (July-September) performance in the current fiscal—7.4 per cent growth—was significantly better than the first quarter (April-June) growth of 7 per cent. Indirect tax collections have posted healthy growth—above 10 per cent even after netting out the mid-year hikes in excise and service tax, which means India Inc is not doing too badly. Retail inflation has fallen to manageable levels, staying under 6 per cent for much of this financial year. Urban consumers have begun spending more.

But there are other signals that seem to contradict these. Private demand may be picking up, but not sufficiently enough to get factories churning out to full capacity.

External demand has not filled the gap, as is evident from the nearly year-long slump in exports. Industrial production numbers have been fluctuating and capacity utilization is stuck in the 70 per cent range.

Corporate balance sheets are stressed. One fallout of this has been that direct tax collections have been disappointing and this could result in the government’s tax revenue being less than what was budgeted last year. The other fallout is that with excess capacity and less-than-buoyant demand, India Inc is still not putting down money on new factories or expansion plans. The Centre for Monitoring Indian Economy (CMIE) recently pointed to a 74 per cent slump in new investment proposals in October-December 2015 compared to October-December 2014.

Look also at bank lending, growth of which has been subdued. Between November 2014 and November 2015, non-food credit grew only 8.8 per cent, against 10.5 per cent between November 2013 and November 2014. What’s more, there’s a skew in even this modest increase. The highest growth has been in personal loans—18 per cent. Credit to industry has grown a piffling 5 per cent and, within that, lending to medium enterprises has actually declined 6 per cent. This is the sector that provides the bulk of employment and this is not a good sign. A January HSBC Global Research report, Asian Economics, raises concerns of credit-less growth, pointing out that unlike previous recovery episodes, when credit growth picked up midway through the process, this time around, credit growth has been well below the long-term average.

Two crucial sectors of the economy are in an even more precarious state.

Two successive seasons of sub-par monsoons have created agricultural stress. Agricultural output in 2015 was not too badly affected by the monsoon deficit last year, though the unseasonal rains in April did do significant damage. But the El Nino threat looms large again and there have been early reports of pest damage to wheat crops. With rural demand accounting for half of overall demand, any prolonged agricultural sag will also drag the rest of the economy down.

The banking sector is teetering on the edge of a precipice and if it goes down, the consequences for the economy will be even more disastrous. According to the Reserve Bank of India’s Financial Stability Report, 5.1 per cent of all loans given by banks had turned bad—they were not being repaid. Over 80 per cent of these defaulting borrowers were from the corporate sector, which is already facing stress. Handling this conundrum will be extremely tricky.

There are even more serious challenges to deal with in the coming financial year. The government is caught in what everybody calls a trilemma. The implementation of the Seventh Pay Commission report, which gives handsome wage hikes to government employees, will give the much-needed spending boost to the economy (though how much is debatable). With private investment just not happening, public investment will have to step in to revive the economy.

But both these steps will punch a huge hole in the government’s finances and put to test Jaitley’s resolve to stick to the fiscal consolidation roadmap. Recall that last year, Jaitley had stuck to the 4.1 per cent fiscal deficit target set by his predecessor, but relaxed the goal for this year from 3.6 per cent to 3.9 per cent, for 2016-17 to 3.3 per cent, and aimed to reach the 3 per cent target only in 2017-18. Not sticking to this glide path will put macroeconomic stability at risk once again, which India just cannot afford.

The global economic situation too is mixed. The World Bank’s latest Global Economic Prospects (GEP) 2016 report expects a moderate recovery in the global economy. Though the advanced economies are expected to do better than in 2015, this may not translate into improved prospects for India’s exporters. World trade is likely to remain subdued. The continued slump in oil and commodity prices is good news (though the latter affects the prospects of domestic commodity companies). But this slump could also have a negative fallout if this impacts the economies of the Gulf countries and, as a consequence, the prospects of migrant workers there. Remittances, which contribute about 3.5 per cent to the economy, could slow down. In addition, the monetary tightening by the United States Fed could see some volatility in foreign portfolio flows.

The continuing meltdown in China will have both positive and negative consequences for India. Investors may be willing to look at other countries to do business and India can get some of these investments if it plays its cards right. But the immediate consequences could be worrying. The devaluation of the yuan will make Chinese imports cheaper than they already are and make Indian exports to that country costlier, further widening the trade deficit to China’s advantage. The competition in global markets could also get skewed by this development and will not be good news for the already troubled exports sector.

Looming over all these economic challenges is the political climate in the country. The Congress is in a newly aggressive mood, unlike a year earlier. It has successfully forced the withdrawal of the land acquisition ordinance and stalled the passage of the GST bill. It has tasted blood and is not going to give in easily.

Parliamentary Affairs Minister M. Venkaiah Naidu met Sonia Gandhi in the first week of January to discuss the GST bill but though he gave a positive account of the meeting, the Congress was quick to contradict him. So it is clear that the main opposition party is going to continue to play hardball on this and other reform initiatives.

Team Jaitley is certainly going to have its task cut out to tackle these myriad challenges. Budget 2016-17 will show if the frown is going to become a permanent feature on Jaitley’s visage or whether the smile will come back.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest