News Brief

Already Troubled Chinese Tech Giants Are Facing Economic Headwinds, While Some Look For New Growth Drivers

- China's economy expanded 4.9 per cent year over year in the third quarter, slipping substantially from the previous quarter's 7.9 per cent expansion pace.

- Several problems, including power crisis, supply-chain challenges and crackdown on private industries, have slowed economic growth, adding financial pressure to tech behemoths like Alibaba, Tencent and Baidu.

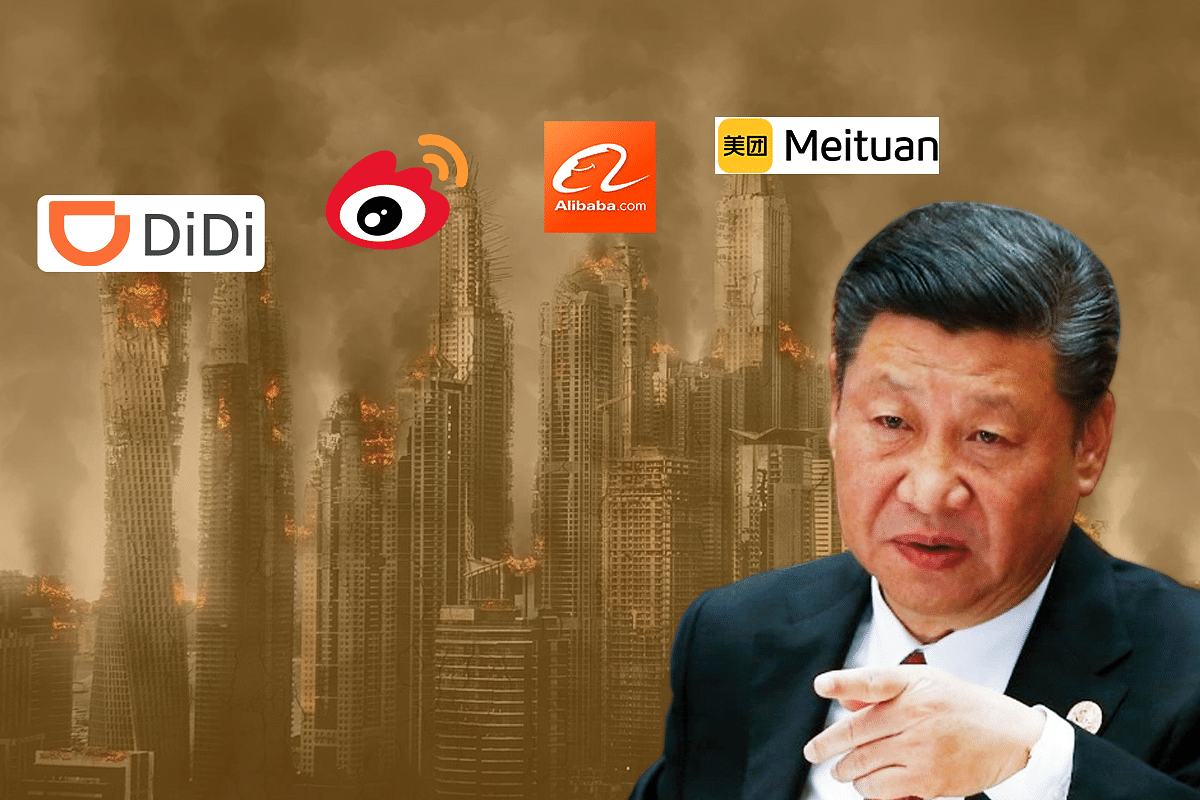

Chinese President Xi Jinping.

An economic slowdown is pinching China's digital behemoths—including Alibaba, Tencent and Baidu—adding financial pressure to a sector already troubled by a slew of new rules imposed by Chinese authorities this year.

Tencent Holdings Ltd., the social media and video games behemoth, saw its quarterly sales grow at the slowest rate since going public in 2004. Food delivery orders have slowed, according to Meituan, an online delivery company in China.

Baidu Inc., which is a search engine provider, announced a slowdown in advertising, while Alibaba Group Holding Ltd., the most talked about e-commerce powerhouse from China, lowered its fiscal year growth prediction.

The new difficulties, which these companies have been facing, contrast with the strong performance of several of their American contemporaries, such as Alphabet Inc.'s Google and Microsoft Corp., which benefited from a move to online purchasing and remote labour during the pandemic.

Despite the fact that Amazon's quarterly sales growth slowed due to supply-chain hurdles and workforce difficulties, along with Google, it also reported high demand for digital advertising.

Chinese companies have already seen the effects of new policies that tighten controls on data gathering, algorithms and minors' online time. In this case, Michael Norris, research and strategy manager at Shanghai-based consulting firm AgencyChina, said: “The question is whether those platforms are set up to service merchants in what you would describe as recession-proof or crackdown-proof industries. And there’s not many of those at this point in time.”

China's economy expanded 4.9 per cent year over year in the third quarter, missing economists' expectations and slipping substantially from the previous quarter's 7.9 per cent expansion pace. A number of problems, including power crisis, supply-chain challenges and a crackdown on private industries, have slowed economic growth which has resulted in lower demand for digital advertising for several Chinese tech behemoths.

For example, as a result of tougher regulation in industries like education, insurance, and online video gaming, Tencent's third-quarter online advertising revenue climbed 5 per cent year over year, down from a 23 per cent increase the previous quarter. Other industries, on the other hand, have been slow to pick up the slack, according to executive officials.

As per Wall Street Journal, James Mitchell, Tencent’s chief strategy officer, said: “Other categories will leap into the gap and sort of backfill and take advantage of the lower prices. I think that will happen over time, but in a more challenging macro environment, it happens less quickly.”

China’s top regulator announced draft guidelines for the online advertising business last week, including outlawing after-school training ads targeting children and holding advertisers, as well as internet platforms responsible for ad content.

The decline in advertising income, according to Baidu chief strategy officer Herman Yu, will certainly persist beyond the third quarter, particularly if pressures from Covid-19 shutdowns and greater regulation continue.

Similarly, ad income at ByteDance Ltd.—which is not publicly traded and does not report quarterly earnings—a company that manages the short-video platform TikTok and the Chinese counterpart Douyin, has been squeezed in the third quarter despite fast-growing e-commerce activities on those apps, said employees.

According to some sources, ByteDance created a TikTok app for vendors this week, its latest attempt to replicate its e-commerce success in China with Douyin. According to the people familiar with the matter, TikTok has also shifted several marketing professionals from China to Singapore to help its advertising and e-commerce businesses.

Meanwhile, Alibaba said its July-September results were hampered by slowing domestic spending and greater competition. However, it expects fiscal 2022 sales to rise by 20 per cent to 23 per cent, compared to a prediction of roughly 30 per cent in May.

It also stated that cloud computing and overseas commerce are areas of growth for the company, despite the fact that they only account for a small portion of Alibaba's core Chinese e-commerce operation.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest