News Brief

Explained: India's New Income Tax Reforms Like Faceless Assessment, Appeals For More Transparency And Compliance

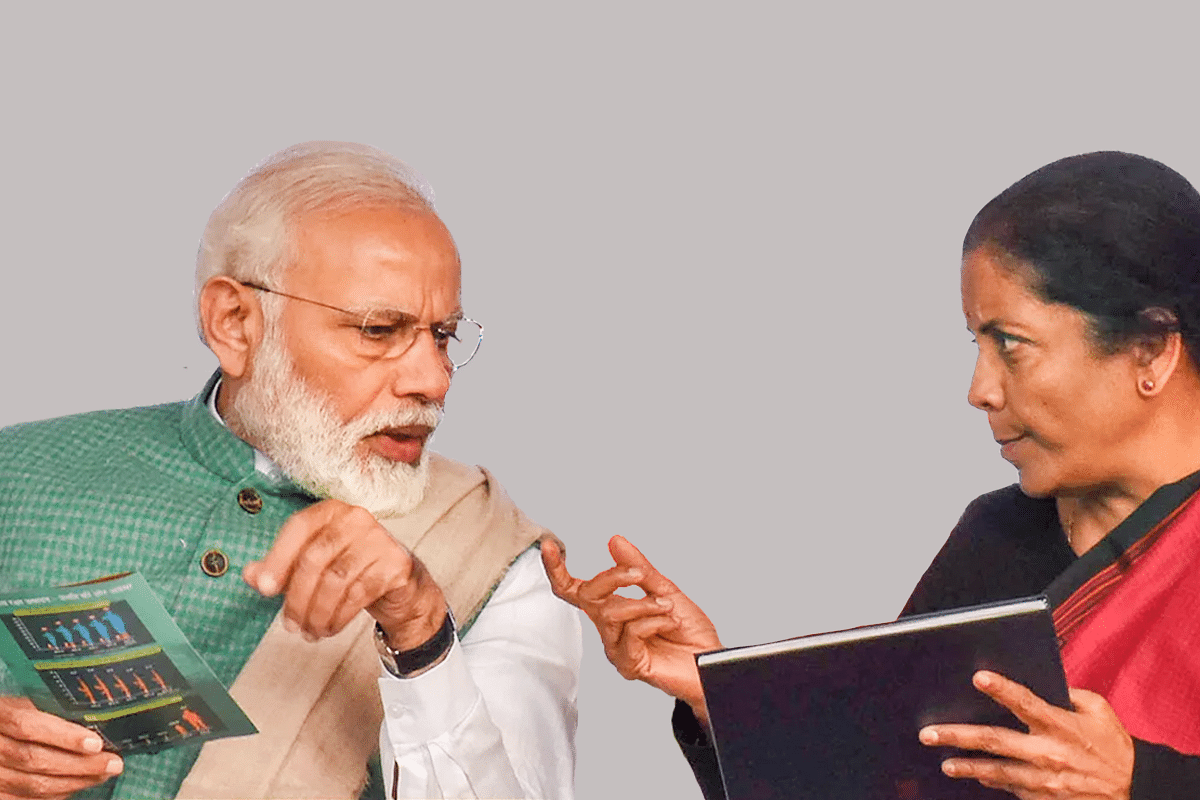

Prime Minister Narendra Modi with Finance Minister Nirmala Sitharaman.

Prime Minister Narendra Modi today (13 August) launched the ‘Transparent Taxation, Honoring the Honest’ platform said the ongoing structural reforms have "reached new heights today" and will strengthen efforts of "reforming and simplifying our tax system".

The 'Transparent Taxation - Honoring the Honest' platform will have faceless assessments, faceless appeal and taxpayer charter. It is put in place by the Central Board of Direct Taxes (CBDT).

“..a transparent efficient and accountable tax administration is what this platform brings in. It uses technology, data analytics, and also uses artificial intelligence... It eases compliance burden, it brings in fair objective and a just system, there shall not be any physical interface between the department and the tax payer and to an extent it shall bring in certainty of Information," Finance Minister Nirmala Sitharaman said.

Faceless Assessment & Faceless Appeal

In this year’s budget, Finance Minister Nirmala Sitharaman had talked about a faceless electronic assessment system to minimise human interface. This will reduce harassment and opportunities of corruption.

Under this new Faceless Assessment scheme, the government seeks to eliminate the human element when it comes to choosing which Income tax returns to scrutinise.

The returns for scrutiny will now be flagged with the help of tools like data analytics and artificial intelligence. The cases may also not be scrutinised in the same territory as that of the taxpayer and may be randomly assigned to locations outside the taxpayer's city.

The taxpayer will also not be required to visit the Income Tax office or the officer during the course of the assessment. Additionally, in a bid to further reduce potential harassment of the the taxpayer, the assessment draft, review and finalisation will be carried out by different teams in different cities.

The platform also provides for ‘Faceless Appeals’, wherein the taxpayers will be able to file appeals digitally from 25 September onward.

In case of faceless appeals, in case the taxpayer wishes to appeal the assessment order, the appellate officer will be randomly allocated from any part of the country. His or her identity will also be kept a secret to prevent undue influence or pressure on the officer. The appellate decision will also be taken by a team and will be subsequently reviewed.

This faceless assessment scheme though is not applicable for serious frauds, sensitive matters and major tax evasion.

Taxpayer Charter

In her budget speech in February this year, Finance Minister Nirmala Sitharaman had announced a 'taxpayer charter'. She said that the charter will ensure trust between a taxpayer and the administration and reduce harassment, as well as increase efficiency of the department.

The Taxpayers' Charter was released by the Income Tax Department. It said that the department was committed to provide fair and reasonable treatment, treat taxpayer as honest, provide a mechanism for appeal and review, provide timely decisions, and reduce cost compliance among others.

Union Minister of State for Finance & Corporate Affairs Anurag Thakur shared infographics regarding the taxpayer’s charter.

The charter also contains the responsibilities of a taxpayer:

Widening the tax base

While the tax base has increased by 2 to 2.5 crore people in the last 6-7 years, given the population of the country at 130 crore, it is still not enough.

Reportedly, there is only one taxpayer for 16 voters in the country. Around six crore file IT returns, and around 5 crore of them pay practically no tax. Only 1.46 crore people pay tax on their income in the country.

The government also launched several measures to widen the tax net, including increasing the scope of the transactions to be reported.

Direct Tax Reform

The government also launched several measures for direct tax reforms, including those that the government has taken to curb black money like the Black Money Act 2015, Fugitive Economic Offenders Act 2019, along with investigations into shell companies in the aftermath of the demonetisation, etc.

The government has also offered several relief measures on account of Covid-19 pandemic.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest