News Brief

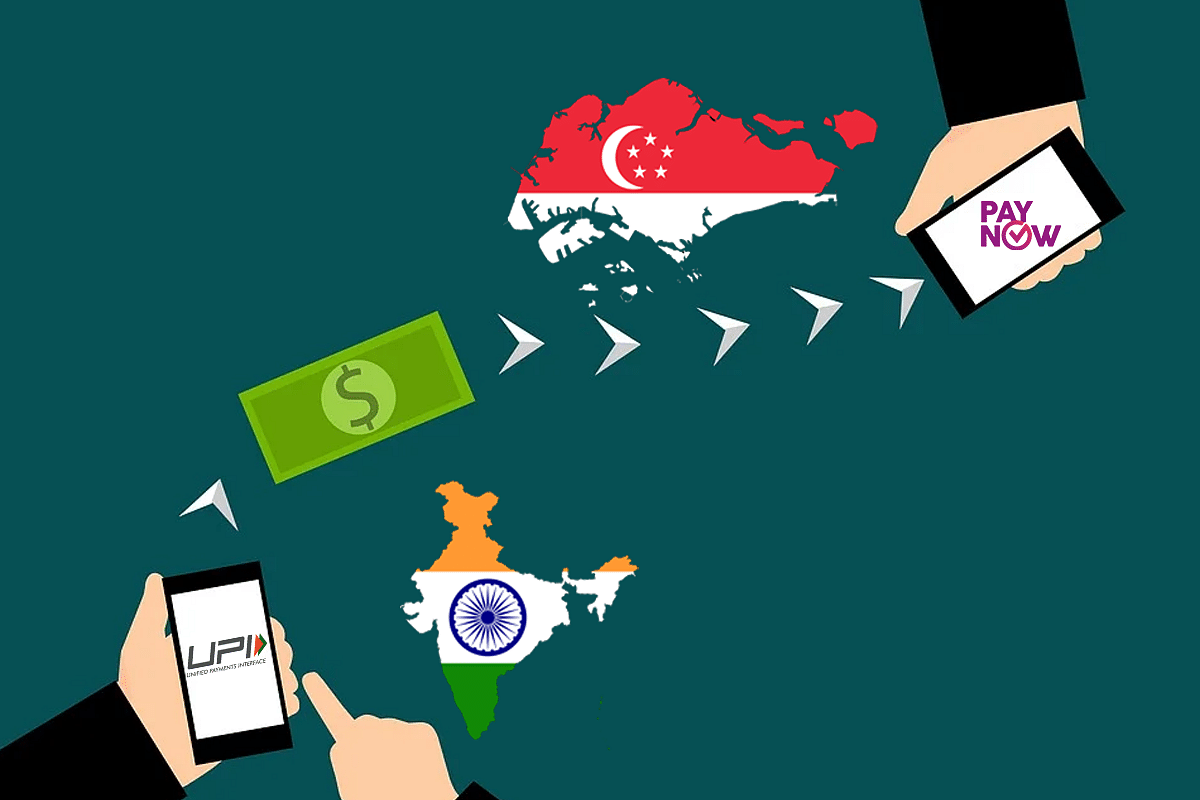

India's UPI And Singapore's PayNow To Link By 2022 For Fast Fund Transfer

- According to RBI, users will be able to make rapid, low-cost fund transfers between India and Singapore on a reciprocal basis without signing up for the other payment system after the UPI-PayNow linkage is completed in July 2022.

UPI-PayNow Linkage

Reserve Bank of India (RBI) and the Monetary Authority of Singapore (MAS) has announced a joint initiative to link Unified Payments Interface (UPI) with Singapore's PayNow for instant fund transfer.

According to a statement released by the RBI on 14 September, users will be able to make rapid, low-cost fund transfers on a reciprocal basis without having to sign up for the other payment system after the linkage is completed in July 2022.

RBI also said that the UPI-PayNow integration is a big step forward in the development of cross-border payment infrastructure between India and Singapore, and it closely matches with the G20's financial inclusion priorities of making cross-border payments faster, cheaper, as well as more transparent.

UPI is a mobile-based rapid payment system used in India that allows every user to make payments at any time using a Virtual Payment Address (VPA) that they generate. According to RBI, this eliminates the risk of the remitter disclosing bank account information. UPI offers both P2P or Person to Person and P2M or Person to Merchant payments, as well as allowing users to send and receive money.

However, PayNow is a peer-to-peer money transfer service offered by partner banks and Non-Bank Financial Institutions (NFIs) in Singapore, available to retail users. It allows users to deposit and receive funds instantly in Singapore from one bank or e-wallet account to another using only their cellphone number, Singapore NRIC/FIN (National Registration Identification Card/ Foreign Identification Number), or VPA.

According to the news release by RBI, "The linkage builds upon the earlier efforts of NPCI International Private Limited (NIPL) and Network for Electronic Transfers (NETS) to foster cross-border interoperability of payments using cards and QR codes, between India and Singapore and will further anchor trade, travel and remittance flow between the two countries."

The central bank of India also stated that the initiative is also in accordance with the Payment Systems Aim Document 2019-2021's vision of revising lanes and rates for inbound cross-border remittances.

In a news release from 2019, the RBI said: "The Payment Systems Vision 2021 with its core theme of 'Empowering Exceptional (E)payment Experience' aims at empowering every Indian with access to a bouquet of e-payment options that is safe, secure, convenient, quick and affordable."

It added that the Payment Systems Vision 2021 was formalised based on feedback from a variety of stakeholders and the Board for Payment and Settlement Systems' direction (BPSS). Additionally, RBI said: "It envisages to achieve a 'highly digital' and cash lite society through the goalposts of Competition, Cost-effectiveness, Convenience and Confidence (4Cs)."

"With concerted efforts and involvement of all stakeholders, the Payment Systems Vision 2021, with its 36 specific action points and 12 specific outcomes, aspires to (a) enhance Customer experience, including robust grievance redressal; (b) empower payment System Operators and Service Providers; (c) enable the payments Eco-system and Infrastructure; (d) put in place Forward-looking Regulations; and (e) undertake Risk-focused Supervision," the news release added while stating that the vision's "no-compromise" approach to payment system safety and security remains a defining feature.

However, the central bank of Singapore, MAS also released a statement regarding the latest announcement and said: "The linkage will provision for increased volumes of remittance traffic, multi-entity participation, automation of capital control rules, and enriched message formats to accommodate future innovation by linkage participants. These enhancements constitute a significant upgrade to the design of cross-border payment systems today."

When PayNow-UPI linkage is fully implemented, fund transfers between India and Singapore can be done using mobile phone numbers, while transfers between Singapore and India can be made using UPI VPA. It also stated that "the experience of making a PayNow transfer to a UPI VPA will be similar to that of a domestic transfer to a PayNow VPA".

The Chief FinTech Officer of MAS, Sopnendu Mohanty said, "By reducing the cost and inefficiencies of remittances between Singapore and India, the PayNow-UPI linkage will directly benefit individuals and businesses in Singapore and India that greatly rely on this mode of payment."

"Given that PayNow and UPI are integral components of their respective national digital infrastructures, the link between the two systems also paves the way for establishing more comprehensive digital connectivity and interoperability between the two countries," he added.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest