News Brief

No More Free Run For Cooperative Banks: How Finance Ministry, RBI Are Cracking Down After PMC Scam

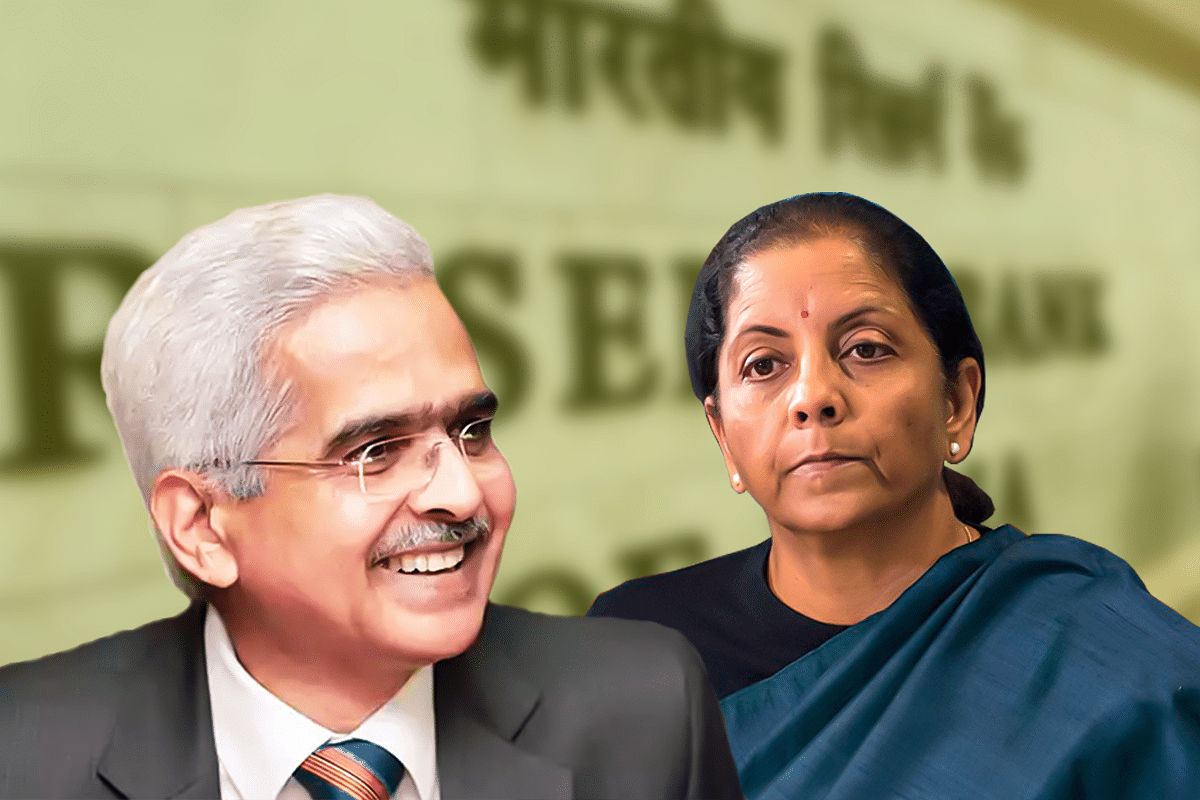

Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das

Both the Reserve Bank of India (RBI) and the Finance Ministry are now gearing up to enforce stronger regulations for cooperative banks in light of the Punjab and Maharashtra Cooperative (PMC) bank scam.

As per an Economic Times report, the RBI and Finance Ministry are now working to bring in an improved framework to monitor cooperative banks. It is expected that tougher regulations would be at the heart of this new framework and authorities have assured that the depositors’ interests and bank’s revival are their top priority.

Finance Minister Nirmala Sitharaman had met RBI Governor Shaktikanta Das on Saturday (12 October) to discuss the issue and assured that the concerns of depositors would be “comprehensively addressed”.

What Is PMC Bank Scam

On 24 September RBI virtually took over operations of the bank by superseding the management and dissolving the board. RBI took this step after detecting irregularities in its lending.

It has been alleged that almost 88 per cent of the $920 crore PMC loan book involves Housing Development and Infrastructure Limited which is now facing bankruptcy. It has been claimed that the disbursed loan exceeds the bank capital.

Investigative agencies claim that the PMC management replaced 44 loan accounts of the HDIL group with over 21,000 fictitious loan accounts.

It has been alleged that the promoters of HDIL - Rakesh and Sarang Wadhawan conspired with top bank officials Joy Thomas (Junaid Khan) and Waryam Singh to obtain these loans in a fraudulent manner. The total magnitude of this fraud has been pegged at almost Rs 4,355 crores.

Overhauling Regulations

In the aftermath of the scam, clamours have grown for tighter regulations for cooperative banks. Accounting firm Grant Thornton is now carrying out a forensic audit of PMC on behalf of the RBI to ascertain the authenticity of the depositor bank accounts.

The withdrawal limit placed on the RBI was designed to stop the bank management from siphoning off the bank’s cash reserves.

The RBI has also overhauled the reporting system employed by the cooperative banks by migrating them from email based reporting to a centralised system.

Under this new reporting system introduced by the RBI, cooperative banks would need to submit all information regarding opening, closing, conversion of branches, offices, non-administratively independent offices and ATMs in a single form to the Central Information System for Banking Infrastructure (CISBI).

The cooperative banks were instructed by the RBI to furnish this information within a week. They would also have to generate a “nil report” on the portal to prove the authenticity of the data.

The banks now have a month’s time to notify the RBI about the extent of their compliance.

What Should Be Done To Prevent Such Scams

Various analysts have argued that the PMC bank scam reflects the high-level of regulatory oversight and auditor ignorance. It has been advised that the RBI impose severe penalties on the management and the auditors.

To ensure this, it has been advocated that a predictable punishment mechanism be put in place that acts as a deterrent for all stakeholders - regulators, auditors, and management of companies.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest