News Brief

Nvidia's $40bn Takeover Of Arm: U.S Regulators Sue To Block Largest Ever Semiconductor Deal, Says It Will Stifle Innovation

- The U.S. Federal Trade Commission has filed a suit to block leading chip company Nvidia's $40 billion acquisition of SoftBank Group-owned chip designer Arm, on the grounds that the proposed deal would "stifle innovative next-generation technologies."

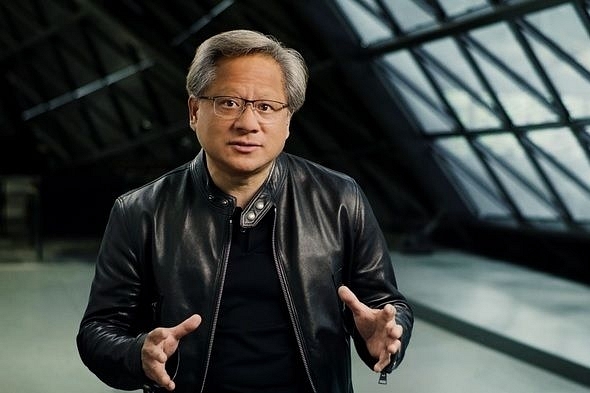

Nvidia co-founder and chief executive officer Jensen Huang.

The U.S. Federal Trade Commission has filed a suit to block leading chip company Nvidia's $40 billion acquisition of SoftBank Group-owned chip designer Arm, on the grounds that the proposed deal would "stifle innovative next-generation technologies."

In Sep 2020 Nvidia had announced its intention to buy the Britain-based chip-designer Arm for $40bn in what was the largest-ever acquisition in the semiconductor industry. The deal was expected to take 18 months to complete but has now faced regulatory hurdles from both EU, U.K and now U.S

"The FTC is suing to block the largest semiconductor chip merger in history to prevent a chip conglomerate from stifling the innovation pipeline for next-generation technologies." Holly Vedova director of the commission's Bureau of Competition, said in a statement.

"The proposed vertical deal would give one of the largest chip companies control over the computing technology and designs that rival firms rely on to develop their own competing chips." the statement further added.

The FTC argued that Arm licensees -- including rivals to Nvidia like Qualcomm, Samsung and Apple -- "routinely share competitively sensitive information with Arm." The deal is likely to decrease the incentive for Arm to pursue innovations it sees as conflicting with the company's own business interests, the commission said.

Nvidia develops and markets computer chips and devices and is best known as the dominant supplier of standalone graphics processing units, or GPUs, for personal computers and datacenters, which are used widely for artificial intelligence processing and graphics processing. Nvidia also develops and markets products for advanced networking, datacenter central processing units, and computer-assisted driving.

ARM primarily supplies IP relating to central processing units (CPU IP) to semiconductor suppliers and systems-on-chip (SoC) developers globally. ARM SoC run most of the world’s mobile phones.

Despite the adverse regulator action in U.S, Nvidia continued to defended the deal, saying it will invest in Arm's research and development and expand its offerings "in ways that boost competition [and] create more opportunities for all Arm licensees." It also said it is committed to preserving Arm's open licensing model and ensuring that the intellectual property remains available to all interested parties.

"As we move into this next step in the FTC process, we will continue to work to demonstrate that this transaction will benefit the industry and promote competition," Nvidia said.

In Aug this year, the Competition and Markets Authority (CMA) of U.K in its report observed that the merged business entity would have the ability and incentive to harm the competitiveness of Nvidia’s rivals by restricting access to ARM’s IP which is used by companies that produce semiconductor chips and related products, in competition with Nvidia.

The CMA has concluded that the merger will led to substantial loss of competition in many areas including global supply of CPUs for datacentre servers, network-interface controllers enabling the transfer of data in datacentres globally, GPUs for datacentre servers globally and SoCs for high performance internet-of-things applications.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest