Technology

Long Read: Why EV Battery Crisis May Be The Next 'Chip Shortage'

- With battery raw material prices soaring, the price sustainability of EVs is under stress.

- It can disrupt the transition to electric mobility, which is a promising global strategy for decarbonising the transport sector.

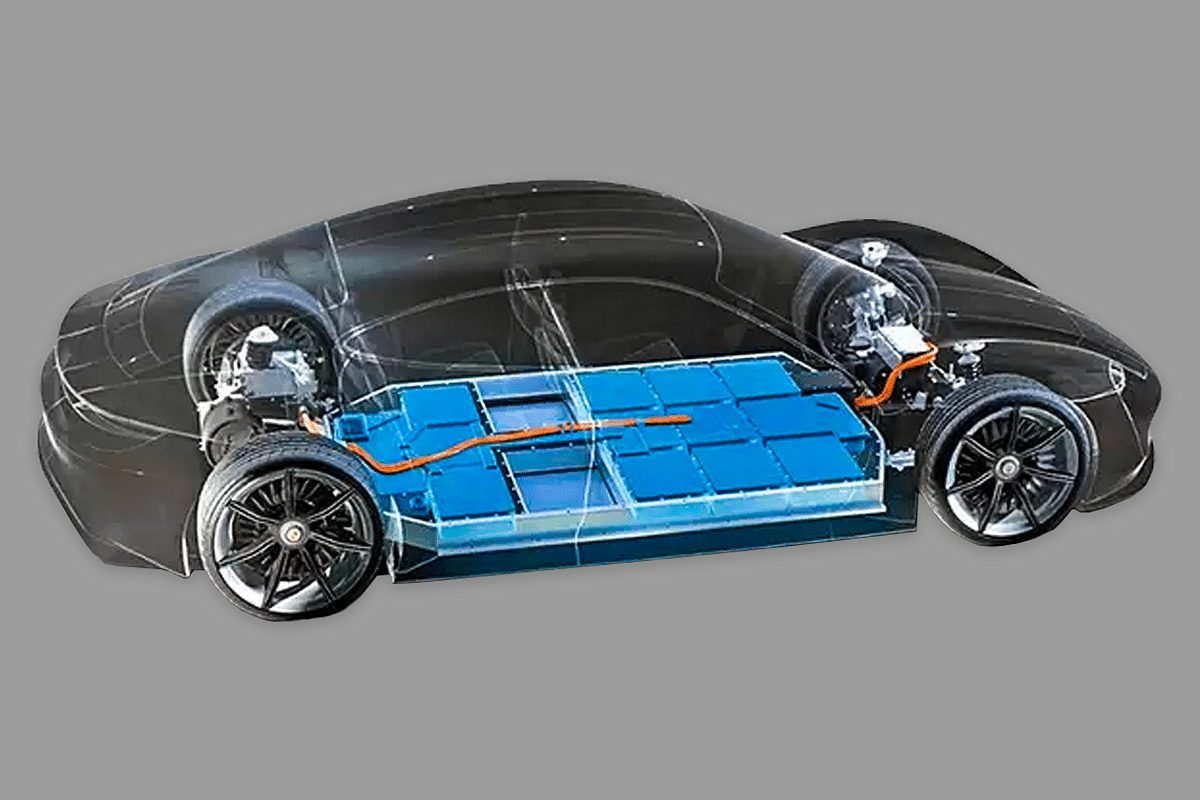

EV Battery (Representative image)

The price of Nickel, a critical component in the production of electric vehicle (EV) batteries, has hit a decade high. On the London Metal Exchange (LME), the three-month nickel contract jumped as much as 4.4 per cent to $22,745 a tonne on 12 January 2022, the highest since August 2011. The rise reflects a broader boom in the commodity market due to falling stockpiles of critical metals and a production increase of EV’s from car manufacturers.

With battery raw material prices soaring, the price sustainability of EV is under stress and has the potential to disrupt the transition to electric mobility which is a promising global strategy for decarbonising the transport sector. India is among a handful of countries that support the global EV30@30 campaign, which targets to have at least 30 per cent of new vehicle sales be electric by 2030.

What is an Electric Vehicle (EV)?

An EV is propelled by an electric motor, powered by rechargeable battery packs. The electric vehicle operates on the principle of converting electricity to kinetic energy to drive motor(s), which in turn rotates the wheels of the vehicle.

This is in contrast to conventional fuel technologies such as petrol and diesel vehicles. They are based on Internal Combustion Engine (ICE) with a fuel tank and provide mechanical power to the transmission enabling the vehicle to move.

Unlike conventional technologies, there are no tail-pipe emissions from electric vehicles. EVs thus have emerged as a promising alternative that could help in mitigating the adverse environmental impacts caused by conventional vehicles.

Battery technologies

Battery plays a vital role in overall development of EV ecosystem. The battery technology for EVs has evolved substantially over the last two-three decades. Lead acid was the first battery technology to hit the EV market many decades back, and subsequently Nickel metal hydride (NiMH) batteries marked their entry in the automotive space.

However, Lead acid units over the years lost out on popularity owing to its carcinogenic nature and other deficiencies. This heralded the arrival of lithium-ion batteries in the market in the late nineties for use in automobiles.

The last decade has witnessed critical innovations in the field of battery technology and Lithium-ion batteries have emerged as predominant battery chemistry currently used in EVs.

Lithium-ion batteries offer higher number of cycle life as compared to traditional lead-acid batteries, however, the main reason for their high adoption in EVs is their high energy density characteristic. High energy density allows lithium-ion batteries to store more energy in less weight/volume which is an ideal requirement for e-mobility applications.

Battery technology is currently evolving at a rapid pace with new battery chemistries gaining popularity. Along with lithium-ion batteries, there have been advancements in other battery technologies such as metal-air, solid-state, lithium-sulfur batteries etc., however, these are still under research. No new technologies are on the horizon for immediate commercial usage.

What is a Li-ion battery?

A lithium-ion battery or Li-ion battery (abbreviated as LIB) is a type of rechargeable battery that uses lithium ions as a key component of its electrochemistry.

These batteries are chiefly made up of lithium, cobalt, nickel, iron, copper and aluminium. The minimum expected lifespan for Lithium-ion batteries is around five years or at least 2,000 charging cycles which can extend upto 3,000 cycles with proper care and under optimum working conditions.

LIB batteries used in various vehicle segments - from two-wheelers to commercial vehicles and public transport buses - are largely the same. Their composition and size change from vehicle to vehicle, depending on the power required to run them. Batteries are stacked together in cells and modules to make a battery pack.

How does a lithium-ion battery work?

Li-ion batteries come in different shapes and sizes, but most have three key elements: Electrodes - the negative (anode) and positive (cathode); a separator between the two electrodes; and an electrolyte that fills the remaining space of the battery. The anode and cathode are capable of storing lithium ions. Energy is stored and released as lithium ions travel between these electrodes through the electrolyte.

Li-ion batteries can use a number of different materials as electrodes. Materials that are used in LIB cathode include Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminium Oxide (NCA) and Lithium Titanate Oxide (LTO).

The anode is generally made from carbon (Graphite) and the electrolyte varies from one type of battery to another. Li-ion batteries typically use ether (a class of organic compounds) as an electrolyte.

Among these chemistries of Li-ion battery, LFP, NMC, LMO, and NCA are four commonly used types and this can be attributed to their substantial production scale-up over other chemistries over the past decade. All Tesla’s electric vehicles have NCA batteries; BYD uses LFP batteries, and Chevy Volt, BMW uses NMC batteries in their respective EV models.

It is estimated that in the next five years, use of LFP and LMO batteries will reduce due to their low energy density, and chemistries such as NMC532, NMC622 and NMC811 will experience an increase in adoption.

Material Challenges

Rechargeable LIBs are projected to meet future electric mobility, electric aviation, and stationary grid energy storage targets by 2030.

EV batteries rely on a host of rare materials – from Lithium and Nickel, to Cobalt. With growth in EV industry, use of these rare elements are expected to increase, and therefore could lead to supply chain issues in future as availability of these rare elements is concentrated in few countries only.

According to an estimate by International monetary fund (IMF), a typical electric vehicle battery pack may need around 8 kilograms (18 pounds) of lithium, 35 kilograms of nickel, 20 kilograms of manganese and 14 kilograms of cobalt, while charging stations require substantial amounts of copper.

While the global electric vehicle (EV) market is on the cusp of exponential growth in the wake of a big push to transport decarbonisation, auto makers may encounter bumpy roads ahead, as they face challenges to secure supplies of raw materials used for battery production according to a report by independent research organisation A.T. Kearney Energy Transition Institute.

Failure to obtain adequate supplies of lithium, nickel, manganese or cobalt could slow the shift to EVs, make those vehicles more expensive and threaten carmakers' profit margins.

The challenging natural resource shortage is further exacerbated by a lack of viable and cost-effective reuse and recycling options for electric car batteries. “By 2025, the economics of recycling is likely to improve as used batteries become more commonplace and second-hand batteries take root,” the report said.

Cobalt Market

The global Cobalt sector has received a shot in the arm from the global shift to the green economy as the ferromagnetic blue metal is a key component of rechargeable batteries and valued for its stability, hardness, anti-corrosion and high-temperature resistance characteristics.

Besides EV batteries, Cobalt is used in manufacturing alloys, aircraft, machinery tools and portable electronics, including smartphones and laptops which account for the largest share of 36.3 per cent of the global off-take. Automotive applications account for 23 per cent in Cobalt consumption.

According to an EU Joint Research Centre Science for Policy Report, “Cobalt: demand-supply balances in the transition to electric mobility”, between 5.5 kg and 11 kg of Cobalt is required in EV batteries.

Although Cobalt is mined as a by-product from Copper and Nickel, it also mined, primarily in, the Democratic Republic of the Congo, or DRC and Australia. Congo accounted for 67 per cent of global supply last year and it will continue over the next few decades. There are, however, growing concerns about the reliability of future supply, as Congo is perceived to be unstable with a corrupt political and business environment and growing concerns about child labour issues.

On the other hand, Cobalt refining is concentrated in China, which accounts for 66 per cent of global refined cobalt, and Chinese monopoly is expected to continue over the years to come. Finland is a distant second in the output making up 10 per cent. The top refiners both depend on Congo for their feedstock and thus are vulnerable to upstream supply shocks.

Then there’s the harsh economics: Cobalt is also one of the most expensive metals in EV batteries, costing between $33,000 and $35,000 per tonne. Currently, Cobalt is quoted at $70,500 a tonne with the metal gaining 119 per cent since the start of 2021.

One solution could be finding an alternative to Cobalt in EV batteries. One major Chinese manufacturer, Contemporary Amperex Technology (CATL), already produces batteries that use phosphate instead of nickel-cobalt-aluminium (NCA) or nickel-cobalt-manganese (NCM) combinations. That's attracted the attention of one of the largest EV producers, US-based Tesla Inc, with reports suggesting the company is seeking to move to a Cobalt-free battery without specifying any time frame.

Nickel Market

Nickel, traditionally used to make stainless steel, is taking center stage in the mining industry’s push into the booming battery metal space. Stainless steel accounts for about two-thirds of global nickel consumption estimated at around three million tonnes this year. Nickel demand for use in lithium-ion batteries could grow as much as to command 20 per cent share in consumption by 2025.

Nickel is a key component in LIB, used in electric vehicles. It packs more energy into batteries and allows producers to reduce use of Cobalt, which is more expensive and has a less transparent supply chain.

The potential impact of electric vehicle demand on the nickel market is substantial. Nickel price surged to $22,745 a tonne, the highest in a decade in January 2022. The lingering question is where all this Nickel will come from. Supplies will be tight for the next three years, and there could be a significant deficit as early as 2023 as demand picks up, according to a Bloomberg report. While timelines differ, experts agree that a Nickel shortage is likely on the horizon, especially given the fact that the battery industry requires a higher grade of Nickel than the stainless steel industry.

Tesla CEO Elon Musk has previously voiced concern about future Nickel shortages -- which could put a brake on the efficiency and storage capacity of batteries, as well as making them more costly to produce.

Indonesia holds the world’s largest Nickel reserves and leverages those reserves to attract investment in the battery supply chain. Australia holds around a quarter of the world's nickel supply. As such the big EV makers are securing supplies to meet soaring worldwide demand for EVs. Anglo-Australian mining firm BHP had signed a deal to provide Tesla with supplies of Nickel in July 2021. Tesla reached a similar supply deal with the Goro Nickel mine in New Caledonia.

With the supplies of the metal starting to ramp up, it is expected that the historical rally in Nickel prices would recede. New supplies of Nickel that can be used to make the chemicals for batteries will come from projects to convert Nickel pig iron into matte and high-pressure acid leach projects in top producer Indonesia.

Graphite Market

Within the LIB battery, graphite is the major material used for the anode. Graphite is used across all common battery chemistries at greater mass per kWh than cathode raw materials such as lithium, cobalt or nickel.

LIB use graphite anodes because they cope well with the flow of lithium ions during charging and discharging. Driven by growth in electric vehicle and energy storage markets, demand for graphite for batteries is set to grow by 19 per cent per year through 2029.

The battery industry has faced a short supply of graphite in recent months.

China currently accounts for 79 per cent of the production of Lithium-ion cells, and 80 per cent of the chemicals used in Lithium-ion batteries. It holds a 55 to 60 per cent volume share in the global graphite market in 2019.

In a bid to reduce dependence on China for critical raw materials for its LIB, US electric vehicle maker Tesla has signed an agreement with Australia’s Syrah Resources to supply natural graphite.

Syrah will supply Active Anode Material (AAM) from its vertically integrated AAM production facility in Vidalia, Louisiana. Syrah will source material from Balama in Mozambique, where the firm operates one of the world’s largest graphite mines.

Spread over 110 sq.km, the US$200 million mining project is set to be the largest graphite producing mine in the world when it reaches nameplate capacity. With a life-of-mine total graphite content (TGC) of about 19 per cent, the quality of graphite extracted here is said to nearly double the grade of ‘typical’ graphite deposits in China and Brazil. Syrah commenced commercial production in 2019.

Tesla plans to buy up 80 per cent of what the plant produces — 8,000 tons of graphite per year — starting in 2025, according to the agreement. Tesla also has retained an option to offtake additional volume from Vidalia production facility subject to Syrah expanding its capacity beyond 10,000 tons per annum of AAM.

Way ahead

The shift to EVs needs batteries. Currently, we are unable to match the demand for EVs, but with supply chain reversal for key raw materials, we won't be able to even make enough EV batteries in near future. The supply needs to be secured with investment in raw-material extraction, recycling and development of alternative technologies.

Countries need to have a long-term strategy to counter against supply chain restrictions in the face of rising geo-political tempers.

We can reinvent the battery chemistry, improve the recycling quotient, or massively expand the mining of key materials but until the stakeholders don’t sort the issue fast, the shift to EV mobility would remain a sordid reality.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest