World

China's Belt And Road Initiative Is Running Into Huge Losses, Over $78 Billion In Loans Re-Negotiated

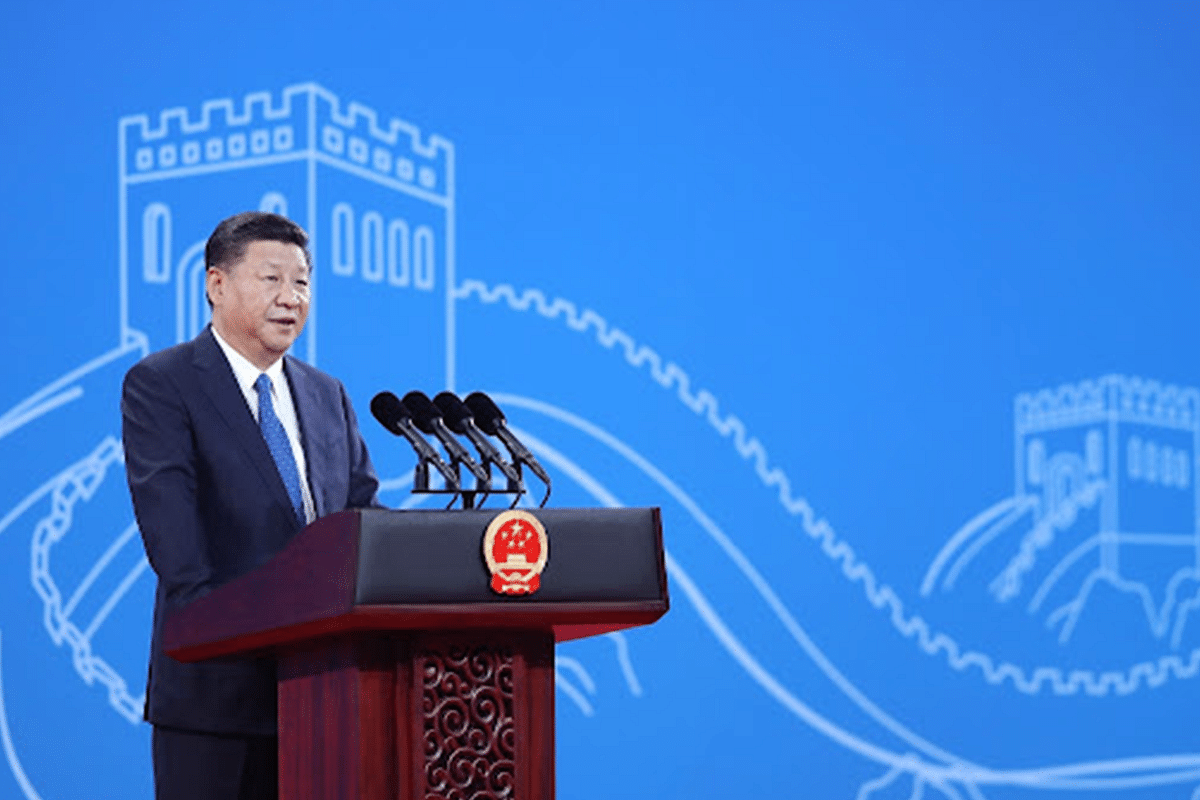

Beijing has provided significant "rescue loans" to over 150 countries participating in the BRI. (Representative image).

Bad loans worth over $78 billion have hit China's $1 trillion Belt and Road Initiative (BRI) infrastructure finance programme in the past three years.

China's scheme had turned it into the top bilateral creditor, but it seems to have now become a financial burden for Beijing and its largest banks.

Chinese institutions re-negotiated or wrote off about $78.5 billion in loans for infrastructure projects such as roads, railways, ports, and airports globally between 2020 and March 2021, says the research organisation, Rhodium Group.

Rhodium recorded $17 billion in re-negotiations and write-offs in 2017-2019, which is now surpassed as companies' re-negotiated debts worth over $70 billion.

The total scale of BRI lending over the past decade is not officially known. However, AidData's Brad Parks estimates it at around $1 trillion.

Beijing has provided significant "rescue loans" to over 150 countries participating in the BRI, to prevent large borrowers from experiencing sovereign defaults.

A recent study by AidData, World Bank, Harvard Kennedy School, and Kiel Institute for the World Economy has revealed that sovereign bailouts to developing countries amounted to $104 billion between 2019 and end of 2021. For the longer timeframe between 2000 and 2021, the total stands at $240 billion.

BRI borrower countries are facing insolvency due to global growth slowdown, rising interest rates, and high debt levels. China has been accused of blocking debt restructuring negotiations by western creditors of these struggling countries.

BRI re-negotiations and write-offs reduced in 2022 after a surge in 2020-2021 due to the pandemic. Experts, however, suggest that this doesn't imply any enhancement in China's loan book's inherent quality.

The signs were visible early on, as early as 2019, but back then, no one was able to factor in the pandemic and the economic crisis in the small economies, due to the Russia-Ukraine war.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest