World

India Batting Strong, Even As Central Banks Elsewhere Struggle

- At the end of 2021, the interest rate was 4 per cent in India, 0.25 per cent in the UK, and 0.07 per cent in the US.

- As per forecasts, at the end of 2022, the interest rate would be 6.25 per cent in India, 3 per cent in the UK, and 4.08 per cent in the US.

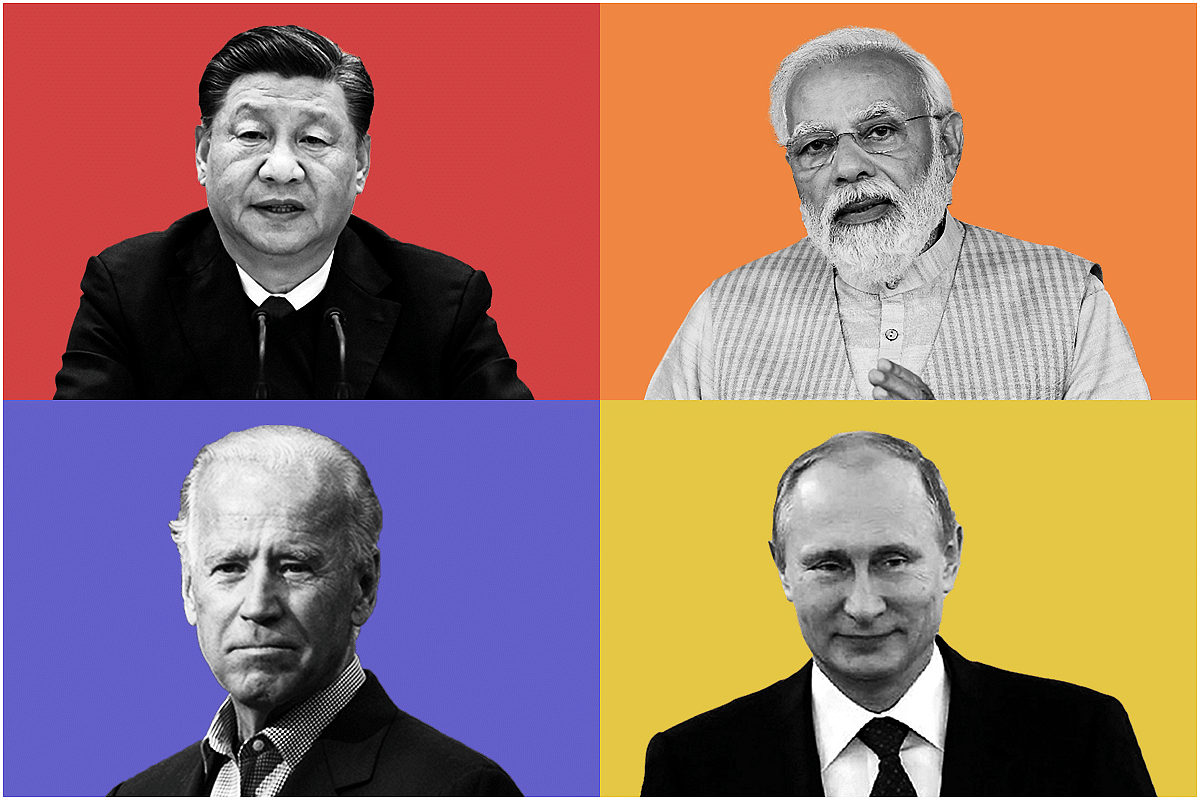

Chinese President Xi Jinping, Indian PM Narendra Modi, US President Joe Biden and Russian President Vladimir Putin

In simpler times, the Reserve Bank of India downgrading the growth forecast to 7 per cent from 7.2 per cent would have invited harsh commentary. Not anymore.

Even the increase in the repo rate by 50 basis points (at 5.9 per cent now), as a pursuit of the central bank to get the inflation mark below the upper tolerance of 6 per cent, is not alarming.

The macroeconomic fundamentals look good, the inflation is not as harsh as in the West, the demand is not dented, and the markets, for now, are cruising well enough through the global economic storm.

The story outside India is that of desperation, however. To put things in perspective, the central banks in the west, led by the Federal Reserve, have been going through sleepless nights to tame inflation, mainly driven by the sharp increase in food and energy prices, post-February 2022.

The annual per cent change in consumer price index, as of July 2022, is 10.1 per cent in the United Kingdom, 8.5 per cent in the United States, 7.5 per cent in Germany, 6.1 per cent in France, 7.9 per cent in Italy, and 7.6 per cent in Canada.

In an Indian context, these increases may not appear as sharp, but to put things in perspective, the US inflation rate was 4.9 per cent the month Lehman Brothers collapsed, and for the decade that followed, hovered mostly below 2 per cent.

The Western economies, by virtue of their policies, are not equipped when it comes to handling inflation of this magnitude.

Germany, for instance, in the last fifteen months, has witnessed a surge in annual inflation from 2 per cent to 10 per cent. For almost fourteen years after 2008, inflation was around 2 per cent in Germany.

Another point to be noted is that the inflation is not conventional, for it is being driven by two commodities; energy and food.

For July 2022, the annual per cent change in consumer price index for energy was 36 per cent in Germany, 28 per cent in Canada, 28.65 per cent in France, 42.96 per cent in Italy, and 57.7 per cent in the UK.

For food items, the inflation rate was of around 10-12 per cent for the above countries and the items outside the food and energy category were registering inflation of around 3 to 6 per cent. Thus, a supply-side energy crisis.

Discarding the monetary spoils normalised after the Great Recession of 2008 and during the pandemic, central banks around the world have embarked on rate-cutting measures.

As per a tracker in the Financial Times, the number of rate increases is the highest in two decades. For the longest period between 2008 and 2021, the cuts were on the lowered side, fueling a bubble in the markers, as per some experts.

As soon as the rate increases kicked in, many bubbles were deflated, including those of cryptocurrencies and other non-fungible tokens, the most recent fad.

It is also important to put in perspective the volatility in the interest rates in the West compared to India. At the end of 2020, the interest rate was 4 per cent in India, minus 0.5 per cent in the Eurozone, 0.1 per cent in the UK, and 0.09 per cent in the US.

At the end of 2021, the interest rate was 4 per cent in India, minus 0.5 per cent in the Eurozone, 0.25 per cent in the UK, and 0.07 per cent in the US. Now, post the inflation storm, triggered by the Russia-Ukraine war, the forecasts for 2022 and 2023 have thrown the central bank tools for a toss.

As per forecasts, at the end of 2022, the interest rate would be 6.25 per cent in India, 2 per cent in the Eurozone, 3 per cent in the UK, and 4.08 per cent in the US.

At the end of 2023, the forecasts project the interest rate in India to be around 6.25 per cent, 2.25 per cent in the Eurozone, 3.25 per cent in the UK, and 3.33 per cent in United States, clearly factoring in the relief in the crude and natural gas prices and for the war in Ukraine to cease.

However, what are the central banks outside India trying to achieve with such sharp hikes?

The aim is to engineer what most central bank heads call a ‘soft landing’, that is a moderate slowdown in growth to ensure inflation back to normal levels but without hurting the businesses.

What is worrying the observers is a repeat of the mistakes post the oil crisis in 1979 that led to high inflation (more than 12 per cent) resulting in the Fed having to take the interest rates as high as 19 per cent in 1981.

Two years later, inflation had fallen to 5 per cent, but at the cost of severe unemployment and an unprecedented recession. That is what most observers fear today; a central bank ushered recession.

The question that remains is how efficient would the central banks, led by the Federal Reserve, be in tackling inflation that is not originating from the demand side but supply side.

The citizens are not paying through their nose because they CAN but because they have no other option, and also because every stakeholder in the Russia-Ukraine war overplayed their hand.

Theoretically, interest rate hike would tame inflation ensuring stable demand, but a dented demand here means many European citizens without heaters in winters.

In retrospect, it cost India its banking sector to get out of the 2008 crisis, under the Manmohan Singh regime. Under Narendra Modi, even as the music slows down elsewhere including China, the fundamentals look good, and the sentiment looks strong.

India's decade in the making, perhaps?

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest