World

The Worst May Be Over For Pakistan For Now

- Pakistan has used geopolitics in its favour for a long time, and it would once again ensure a lifeline to the economy.

- However, its politics will take a long time to overcome challenges.

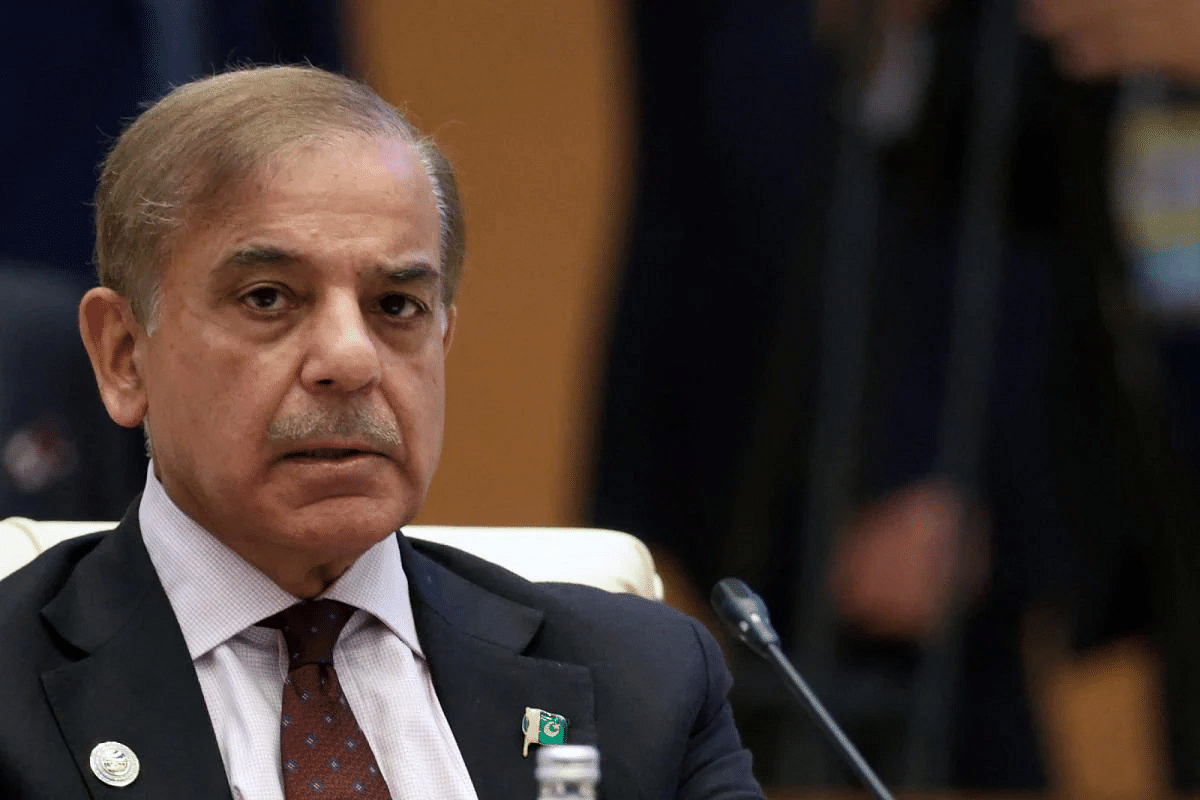

Pakistan Prime Minister Shehbaz Sharif. (Representative Image)

A bad neighbour can be worse, if he has nothing to lose. From that perspective, the collapse of the 23-crore people strong Pakistani economy, or whatever is left of it, has never been a welcome proposition to India and the region.

As it appears, Islamabad might avoid further worsening of its economic woes, at least for another six months till election, riding on IMF (International Monetary Fund) bailout.

Release of a $1.1 billion tranche, that was due in November, might take place any time soon, partly because Pakistan undertook due policy adjustments and largely due to geopolitical considerations.

Geopolitics has been key to Pakistan’s unenviable record of managing one IMF bailout in every three years. However, this time the fund has been stricter and forced Pakistan to swallow some of the bitter restructuring pills — like sharp energy price revision.

Such changes might and should create a case for Pakistan to resume trade with India that it had stopped in 2019. However, a decision in this regard might have to wait till election in Pakistan, if not till the 2024 general election in India.

Poor Economics

According to United States Institute of Peace (USIP), Pakistan has to repay $4.5 billion external loans in this quarter and a total of $77 billion between April 2023 and June 2026.

This is equivalent to roughly 22 per cent of Pakistan’s GDP (gross domestic product) of $348 billion, at current prices, in 2022.

For a country that has been witnessing wild volatility in foreign exchange reserve for a decade; repayment of this order is impossible without fresh loan support.

Covid years apart, Pakistan’s exports remained stagnant for last 10 years. A rising trend in remittances is the only silver lining to the economy.

Pakistan Export, Import, Trade Gap And Remittance Earning (USD Billion)

Notably, similar to its estranged sibling Bangladesh, Pakistan banks heavily on textiles for export earnings. It is the fifth largest producer of cotton. Together, garments and raw cotton contribute nearly 60 per cent of Pakistani exports.

For Bangladesh, garments contribute 85 per cent of the export revenue. They don’t have cotton and is dependent on imports for raw material. Yet, Dhaka is miles ahead in exports and surpassed Pakistan’s GDP in 2018-19.

Clearly, Pakistani economy suffers from serious competitiveness hurdles and, that is despite having access to bigger finance, which is crucial to build necessary infrastructure.

According to World Bank Debt Statistics 2022, during 2010 and 2020, Pakistan’s external debt stock increased by 71 per cent from $63 billion to $108 billion. Bangladesh’s external debt reached $67.7 billion in 2020.

Geopolitics Is Key

To sum up, money was showered on Pakistan for all these years. Islamabad didn’t make a productive use of it and ended up in a debt trap.

Ideally, the economy should undergo a painful restructuring process. There is little case for IMF to lend it more money. However, geopolitical realities should force the Western block to loosen its purse strings.

According to an IMF report in September 2022, 30 per cent of Islamabad’s total external borrowing is from China. The tally increased from 27 per cent at the beginning of the year.

It means, if IMF chokes finance, Pakistan will take refuge in China. The all-powerful Pakistani army is culturally more attuned to the West and they do not want the country to be an official Chinese colony.

Meanwhile, China is rapidly increasing its influence in the Middle East, so much so that Beijing had recently brought permanent enemies — Iran and Saudi Arabia — together.

Both Riyadh and Tehran announced normalisation of relation last month, after high level meetings with the Chinese president Xi Jinping. This had practically ended the US monopoly over Saudi Arabia.

Riyadh was giving signals to revisit its foreign policy for some time. There had been toxic exchanges between Saudi and the US last year, over crude oil production and pricing issues. The recent developments formalised the shift.

Importantly, after China, Saudi Arabia is a large lender to Pakistan. It means the US-led block has little option but extending fresh finance and ensuring a degree of control over Pakistan. The IMF lending is, therefore, a foregone conclusion.

The IMF lending might not stop with the current package that will keep Islamabad afloat till election. The new government has to seek more funds to avoid a default and, they might get it too.

Trade To Resume

Pakistan has used geopolitics in its favour for a long time, it would once again ensure a lifeline to the economy. However, topsy-turvy over the last few years, has had a few positive takeaways.

First, IMF forced the weak Shehbaz Sharif government to take some tough decisions, which will push the country to restructuring.

For decades, Pakistan followed a peculiar policy of high import duty on automobiles but one of the lowest auto-fuel prices outside the oil-producing nations. The policy helped the rich.

Similarly, 40 per cent electricity was generated from costly gas (27 per cent) and fuel oil (13 per cent). But electricity was distributed at a subsidised rate. Only 15 per cent electricity is generated from the cheapest fossil fuel, coal.

Sharp upward revision in energy prices created new tax opportunities for the government and reduced the potential subsidy. But more importantly, it would push Pakistan to be cost-competitive.

Meanwhile, the hyper-inflation (35 per cent in March) created wide awareness in Pakistan about the importance of bilateral trade. Delhi’s rising economic and political muscle has become a part of the political discourse.

The setting is perfect to resume trade, it's now a matter of timing. For ages, Pakistani politics thrived on anti-India stance, it is difficult for them to shift gear now, at least not before the election with Narendra Modi in power in Delhi.

In fact, it is a million-dollar question, if they would dare to resume trade before the 2024 general election in India, with opposition parties banking on minority votes.

Resumption of trade does not mean end of notoriety either. Pakistan made it a practice to thrive on geopolitical rent. The paradigm is now challenged but not over. Their politics will take a long time to come out of it.

Till then, India's aim should be to keep the enemy weak and engaged.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest