Business

India’s Big Push For Small Chips: Why Government Looks Serious To Ensure That Country Turns Producer Of Semiconductors

Arun Mampazhy

Jun 05, 2020, 07:12 PM | Updated 07:12 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

And the initiative has been taken by the Union government.

A technology village in Thoothukudi in early 2000s, a fab city project in Hyderabad in 2006, two consortiums involving half a dozen companies declaring their intent in 2014, talks on an Analog fab named similar to India's popular game around 2015 - this forms the list, may be not exhaustive, of the attempts at realising a commercial semiconductor fab or foundries in India.

Unfortunately none of them took off.

In recent years, India made giant strides in many other areas connected to electronics, especially related to mobile phones.

Well known brands set up assembly, testing, marking or packaging (commonly known as ATMP) units in India and they are expected to continue their growth.

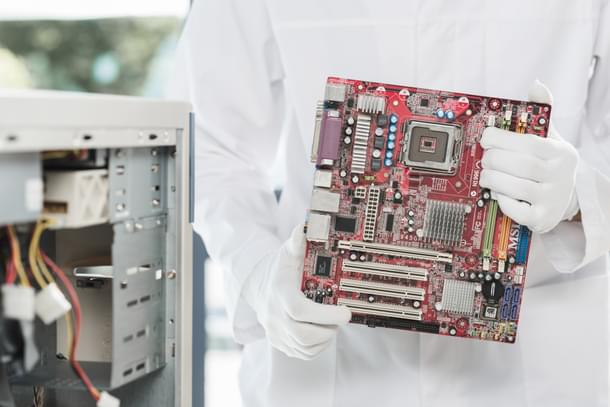

However, a semiconductor fabrication plant (fab) that mass produces the Monolithic Integrated Circuit (commonly known as an IC or simply, a chip) remained elusive. This, despite the very second agenda item in the National Policy on Electronics formulated in 2011 being "Set up semiconductor wafer fabrication facilities".

There is the ISRO-owned Semi Conductor Lab (SCL) in Chandigarh with a 200mm size silicon wafer handling capability and 180nm technology node, which, though for analog (RF) chips, is not really outdated. From what one can understand, the SCL has limited production and perhaps it is geared mostly towards ISRO's needs.

Moreover, for digital chips, technology has scaled into the 10nm range faster.

Clearly, lack of a commercial semiconductor fab in India, an aspect in which we are lagging nearly two decades behind China and Malaysia, and many more behind countries like Taiwan, Singapore, US and many European nations, must be reason enough for a government, like the present, who wants to push ‘Make in India’, to do something.

There are perhaps two common factors in the (failure of) previous attempts at realising a fab in India.

One, quite likely, the cart was put before the horse.

Second, apart from the likelihood of incentives in the form of tax exemptions and other infrastructure related support, there was no solid cash offered.

It is in this background that the announcement of three schemes on 2 June 2020, by Union Minister Ravi Shankar Prasad and NITI Aayog (India's policy think tank) CEO Amitabh Kant, seemingly stands apart.

Swarajya has covered the details of all three schemes here and so this article will look at the schemes through the prism of a possible $1.5-2$billion investment semiconductor fab finally taking off in India.

Not only has the government tried to better define and quantify the peripheral sops in the forms of infrastructural support (through the scheme named EMC2.0), it has actually offered up to 25 per cent reimbursement on capital expenditure (capex) via a scheme called SPECS .

The third scheme announced on the same day - Production Linked Incentives or PLI, with an overlay of 40,951 crore INR ( USD 5.5 billion), may not directly benefit a pure-play foundry setting shop in India for the first time as the scheme takes the production or investment of the year 2019-20 as its base.

The 'Integrated Device Manufacturers', which have both fabs and products, could perhaps benefit. Details of PLI are here.

Those with ATPM units and small component manufacturers are likely to benefit. This article, however, will limit its analysis to semiconductor chips (or wafers) fabrication facilities.

An already existing 'Electronic Manufacturing Clusters' (EMC) scheme has now been modified as EMC2.0 , details of which are available here.

Financial assistance is offered to 'EMC project' as well as 'Common Facility Centers'.

For CFC there should be at least 5 electronics manufacturing units identified as users of the facility.

Given that a fab is a huge investment (minimum of Rs 12,000 crore or $1.5bn, newer the technology node, higher the cost in general), the CFC may actually be the way forward if five big players in the field want to come together, identify a "common minimum program", or in other words a "sweet spot" in terms of technology node or equipments that could be common to all of them.

In a world of cut-throat competition and struggle for profit even after big investments, one may say that is easier said than done, but in the semiconductor world, such collaborations are not too uncommon even among 'rivals'.

Financial assistance to the EMC project itself seems to be an attractive 50 per cent with a ceiling of Rs 70 crore for every 100-acre land. For the bigger areas, there is a pro-rata ceiling wherein the assistance cannot exceed Rs 350 crore per project.

Not surprisingly, the scheme has called upon state governments for PSUs for 'further assistance' - in the spirit of encouraging healthy competition among states of India. More importantly, we are talking about land and other forms of support, which typically fall under the state governments’ ambit.

Out of the three schemes, the word ‘semiconductors’ is present in the third one, Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors or SPECS, details of which are available here.

Annexure -1 has a list of goods, where ‘Category F’ lists semiconductor wafers as the base or the 'raw' material on which the ICs (listed in category G) are built.

Most foundries buy their wafers, but clearly the government seems to have gone with the thought that, let the absence of the latter in India not discourage the possibility of the former, in line with the ‘Make in India for the world’ thought process.

It may encourage some with a futuristic outlook to think beyond silicon, and into other materials or variations of silicon also.

Premier engineering institutes of India have strong material science departments, though understanding industrial needs for not-so-well established materials is often tough, predicting the same is even tougher.

For all the categories, 25 per cent reimbursement on capex is the big news, and capex includes plant, machinery, equipment, associated utilities, R&D and transfer of technology.

Most equipment in the fab cost hundreds of millions of dollars. fabs will need a good amount of investment for R&D. And technology transfer from an existing fab elsewhere is a must.

This will cost quite a bit too given that a difference in specification of even one out of hundreds of equipment compared to what is an existing fab, will need thorough re-qualification of technology. This, in turn, will involve cost in manpower as well as a lot of test wafers will be processed and checked for yield and reliability.

The government in general and the committee in particular must be complimented for including these.

However, the clause about "only 20% refurbished equipment will be considered eligible" may end up as a discouraging factor for some.

Section 4.2.4 states that the refurbished equipment should have a minimum residual life of five years as per ‘Hazardous and other wastes’ rules - quite likely the government is trying to ensure that India does not become a dumping ground for such equipment.

However, in the semiconductor world, refurbished equipments with further life of 20 or even 30 years is not uncommon.

In fact, it is quite likely that some foundries who have moved most of their production to advanced technology nodes, will find the scheme much more attractive if that clause were more flexible, or negotiable, for equipment involved in the manufacturing of category F and G goods, or at least for specific equipment whose brand new version costs above a certain threshold amount, as decided by the project management authority (PMA).

It is also not clear how the Rs 3,285 crores overlay will be distributed; for example, if there is a rush of interested parties, each looking for reimbursements in the order of thousands of crores. But that "problem of plenty", most likely, is something that the government will be happy to deal with as opposed to the possibility of no one coming forward for a full fledged fab.

The need for uninterrupted and non-fluctuating power, waste management plants, a good supply chain of chemicals, spare parts, availability of parts and knowhow for both reactive and preventive maintenance and so on should be seen as opportunity rather than challenge. May be, a good business model will be to have independent units for those facilities under the CFC, which can be profit-generating on its own.

Robotics is another field which could fit into the bigger puzzle as fabs need high degree of automation. The wafers are typically moved from one equipment to another through an overhead system of conveyors.

Indeed, take that one step ahead—currently 'hot' areas like machine learning and artificial intelligence too have immense scope in fabs.

To quote an example, equipment often needs to be tuned in real time while the line is running because even a small variation in the performance of an equipment used for one of the thousands of complex steps in the process, can render the final chip completely useless. For this, indeed software and automation skills will also be needed, which India has in plenty.

In fact, some of the fabs around the world already have a presence of their supporting teams in India.

So, the fab in itself may not open up huge job opportunities, but with all the peripherals needed for its support, there will be plenty.

Above all, it will create an ecosystem for future expansion also, and though it may sound laughable, a world class facility, if done in the right way, may even attract the domestic, 'industrial learning', kind of tourism

What is the net then?

The good news is that the government of India has finally offered to do something concrete.

The bad news may be that, for a long time to come, this may be the best - albeit with some possible tweaks - that this government or any future government can offer, given the changing and challenging economic scenarios.

India has rich investors, so also there are thousands of Indians associated with the semiconductor fabs directly or indirectly, in India or abroad.

It may be a matter of some of them stepping forward, helping to join the dots and changing India's electronic map forever.

Arun Mampazhy has a BTech from IITM and MS from University of Maryland in semiconductor fabrication and over a decade of industry experience. His dreams of seeing a commercial fab takeoff in India has changed from black and white to colour over two decades. He can be reached via email nanoarun(at)gmail(dot)com or @nano_arun on twitter. Views expressed are personal.