Business

MSME Financing: The Missing Link In India's Manufacturing Story

Anirudh Vijayan

Jul 18, 2025, 03:05 PM | Updated 03:09 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

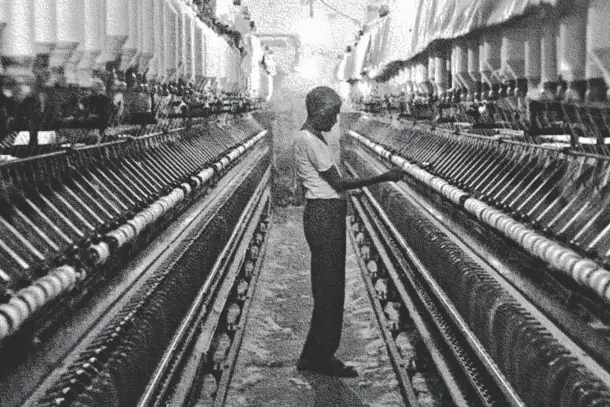

India’s aspiration to become a global manufacturing powerhouse hinges significantly on its Micro, Small, and Medium Enterprises (MSMEs). Contributing nearly 30% of GDP and employing over 110 million people, MSMEs are central to the vision of Atmanirbhar Bharat and Make in India.

Yet, a persistent credit gap continues to hamper the sector, posing serious challenges to industrial growth.

The Credit Puzzle: Despite their economic importance, only 11%–20% of MSMEs have access to formal credit. While schemes like the Production-Linked Incentive (PLI) support large-scale manufacturers, MSMEs often struggle to secure basic funding.

One key challenge is the structural mismatch between how banks operate and how MSMEs conduct business. Many small enterprises, especially in rural and semi-urban areas, are cash-driven, informally structured, and lack formal financial documents such as GST filings or audited balance sheets.

Loan application processes often mirror those designed for large companies, involving extensive paperwork and lengthy timelines, burdensome for both banks and borrowers.

Ground Realities: Take Ramesh, a small entrepreneur in Aurangabad. He needs a ₹3 lakh loan to buy a new machine. Without a GST number or formal records, his application becomes a protracted ordeal, with demands for collateral and guarantors, often leading to delays of months. For many like him, formal credit remains out of reach.

Why Banks Hesitate: Traditional banks face a difficult choice. Processing a ₹5 lakh loan involves similar overheads as a ₹50 lakh loan, but with far lower returns. This disincentivises banks from engaging with small-ticket borrowers.

As a result, even schemes like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), meant to offset lender risks, face limited uptake.

Informal, Yet Indispensable: India’s MSMEs are not non-compliant by choice. They operate in traditional formats: trust-based transactions, cash payments, and verbal contracts.

Though efforts like Udyam registration and GST onboarding are improving formalisation, over 70% of transactions remain cash-based. Many small units do not have access to reliable internet, making digital bookkeeping impractical.

The Credit History Conundrum: A significant barrier is the absence of a credit history. Without prior loans, many MSMEs are considered “high risk”. But without access to credit, they cannot build a history, creating a vicious cycle. Digital lenders, while faster, often charge unsustainable interest rates, and even co-lending models have not significantly bridged the gap.

Lack of Collateral: Most small businesses do not own assets such as land or buildings that can be pledged. This restricts their ability to access traditional loans, reinforcing the cycle of credit exclusion.

OCEN: A Vision in Transition: The Open Credit Enablement Network (OCEN), launched in 2020, was envisioned as a digital revolution for MSME lending. Backed by India’s Digital Public Infrastructure (DPI), OCEN aimed to provide easy, collateral-free loans using digital trails such as UPI, GST, and Aadhaar-linked data.

The Ambition: OCEN’s core goal was to enable small loans with minimal paperwork. The idea, as stated by its proponents, was simple: let a street vendor access ₹5,000 in the morning and repay it by evening, thereby building a credit footprint.

By leveraging India's digital public infrastructure, such as UPI, Aadhaar, and GST, OCEN aims to make credit accessible to even the smallest entrepreneurs, including street vendors.

Practical Challenges

Limited Adoption: A significant share of MSMEs lack the digital footprint required, such as GST filings or formal bank records, to benefit from OCEN.

Digital Literacy Gap: Many small business owners are not fluent in using apps or online platforms. Surveys found that over two-thirds of micro-entrepreneurs in tier-3 towns were unaware of OCEN.

Lender Reluctance: Banks fear margin pressures and operational challenges. They cite high costs and lack of reliable data as deterrents. Banks worry that if borrowing becomes a matter of plugging into an API network, their returns on these loans will shrink.

Without clear incentives (such as relaxed regulation or guaranteed support), most banks prefer to continue with traditional business or internal fintech partners. Indeed, only “five public and private lenders” were reported as actively using OCEN by late 2024.

Moving Forward

OCEN’s architects, including Nandan Nilekani, have acknowledged these challenges and are working on solutions such as simplified KYC, lender incentives, and partnerships with NGOs for digital education.

Still, critics argue that while the tech framework is solid, execution requires stronger policy support and on-ground outreach.

CGTMSE: Growing in Numbers, But Falling Short?

The CGTMSE scheme, launched to offer credit guarantees on MSME loans, has seen impressive numbers. Guarantee approvals rose from ₹1 lakh crore in FY23 to ₹2 lakh crore in FY24. The average loan size also increased, but challenges remain.

Issues on the Ground

Partial Coverage: Most guarantees cover only 75–85% of the loan, leaving residual risk with banks.

Delayed Settlements: Claims that should close in 30 days often take months, discouraging banks from lending more under the scheme.

Complex Compliance: Extensive documentation and procedural checks limit its reach, especially for new and first-time entrepreneurs.

Despite the uptick in sanctioned loans, many are small and driven by priority sector lending (PSL) targets rather than genuine credit expansion. Some banks reportedly use CGTMSE loans to meet quotas rather than actively support MSME growth.

CGTMSE’s own CEO acknowledged that priority sector targets largely drove MSME credit growth: “credit flow to this segment has been mainly thanks to the priority sector lending targets… despite the low NPA percentage and higher margins for the lenders”.

The Larger Context And Way Forward

While large manufacturers benefit from headline-grabbing schemes like PLI, with subsidies, tax breaks, and easy credit, MSMEs struggle with basic financing. This disparity risks creating a two-speed industrial economy: large firms racing ahead, while small businesses remain stuck.

The cost of this gap is visible. In FY2023, over 13,000 MSMEs shut down — many due to a lack of timely finance. These closures represent more than just lost businesses; they mean lost jobs, output, and innovation.

For India to achieve true industrial self-reliance, MSMEs must be empowered with accessible and timely credit. Here are five key steps to consider:

- Formalisation-first approach: Expanding Udyam registration and mandating digital onboarding as a prerequisite for government benefits and building the data trails OCEN needs to work with would help in further reaching out about the cause.

- Mandate and incentivise OCEN: Treating OCEN-enabled loans like PSL, offering higher risk weight relaxations, and linking them to credit guarantee cover would help in increasing the credit involvement of various institutions under the initiative.

- Revamp CGTMSE: Making claim disbursement time-bound and automated, especially for smaller loans. Consider 100% guarantee coverage for loans of up to ₹5 lakh. This would help in maintaining cash flow for MSMEs when they sell on credit or are in need to expand.

Making CGTMSE a direct product of public sector banks rather than an insurable product would also help in serving the true purpose of the scheme by distributing credit to reach the right consumers.

- Bridge both initiatives: Merging CGTMSE and OCEN would help in greater reach to better support the cause of MSME financing. Using CGTMSE as the fund source and OCEN Network as the distribution channel.

- Enhanced Monitoring and Grievance Redressal: Strengthen oversight of fraud (inspections, audits) to maintain confidence, but also provide a transparent grievance mechanism for banks facing unjust claim denials.

No MSME, No Make in India

India’s manufacturing dream cannot rest solely on the shoulders of large corporations. MSMEs form the foundation of economic resilience, employment, and grassroots innovation.

By addressing their credit needs through thoughtful reforms in schemes like OCEN and CGTMSE, India can ensure that Make in India is not just a slogan.