Economics

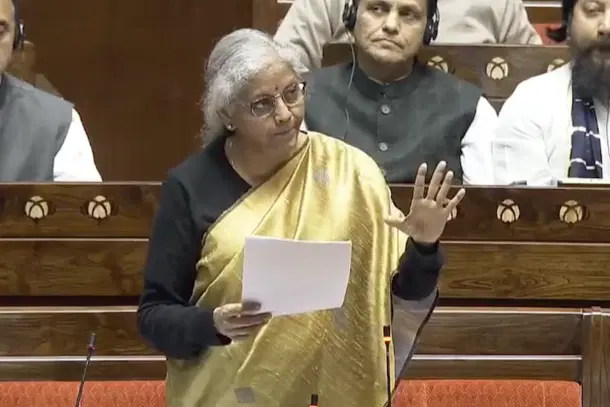

Don't Look Only At Location Of Direct Tax Collection, Money Comes From All Over India: FM Nirmala Sitharaman In Rajya Sabha

Swarajya Staff

Dec 08, 2023, 09:36 AM | Updated Dec 14, 2023, 05:06 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Union Finance Minister Nirmala Sitharaman has emphasised that the principle of basing tax sharing on the location of direct tax collection might not be equitable, as taxes are paid where companies are registered, despite revenues coming from across India.

In response to a question in the Rajya Sabha, the Finance Minister said that the states receive 100 per cent of State GST (SGST) collected in that state, approximately 50 per cent of IGST collected in the state, and a portion of CGST is also devolved to the states based on the Finance Commission's recommendations.

She said that industrialised states like Tamil Nadu have several companies with pan-India operations and concurrent tax payments.

"For example, Tamil Nadu is one of the leading automobile manufacturing states in the country. Manufacturers make a profit because these automobiles are sold across the country. Similarly, plantations from Kerala make profits by selling across India," Sitharaman said.

"This explains why the location of direct tax collection may not be a fair and equitable principle for the sharing of tax because although the money comes from everywhere across India, tax is paid in the state where the companies are registered," she added.

"So, if automobile companies selling across India are registered in Sriperumbudur in Tamil Nadu and they pay their taxes from there, it's not just Tamil Nadu's tax money that is there," the Finance Minister said.