Economics

RBI Keeps Key Lending Rate Unchanged At 6.5 Per Cent For Fifth Consecutive Time

Swarajya Staff

Dec 08, 2023, 10:40 AM | Updated Dec 14, 2023, 05:07 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

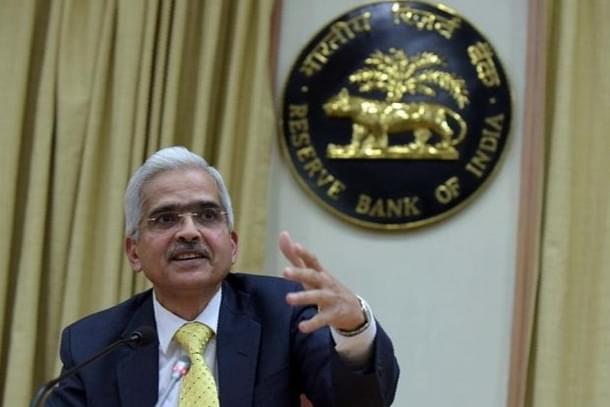

The Reserve Bank of India's (RBI) Monetary Policy Committee unanimously decided to keep the repo rate- key lending rate- unchanged at 6.5 per cent for fifth time in a row, RBI Governor Shaktikanta Das announced on Friday (8 December).

“Monetary policy will remain actively disinflationary,” Das said announcing the monetary policy statement of the central bank.

The monetary policy committee took the decision with inflation control remaining a major focus amid expectations of a spike in food prices in coming months and better than expected economic growth.

The RBI Governor said the global economy is showing signs of economy and said while the headline inflation receded from last year, it remains above target in many countries and core inflation continues to remain sticky.

Indian economy presents picture of resilience and momentum, Das said, emphasising that Q2 GDP exceeded all forecasts and fiscal consolidation is on course.

India’s economy grew 7.6 per cent in the July-September quarter, much faster than the polled median of 6.8 per cent and RBI’s estimate of 6.5 per cent, helped by government spending and manufacturing, raising bets that Asia’s third-largest economy will outperform its own estimates for the full year.

The RBI also maintained its policy stance of “withdrawal of accommodation” to ensure inflation progressively aligns with the committee’s target while remaining supportive of economic growth.