Economy

ARC Or No ARC, There’s No Quick-Fix For PSU Banks; Finance Minister Should Plan For Long Haul

R Jagannathan

Jun 11, 2018, 01:07 PM | Updated 01:06 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

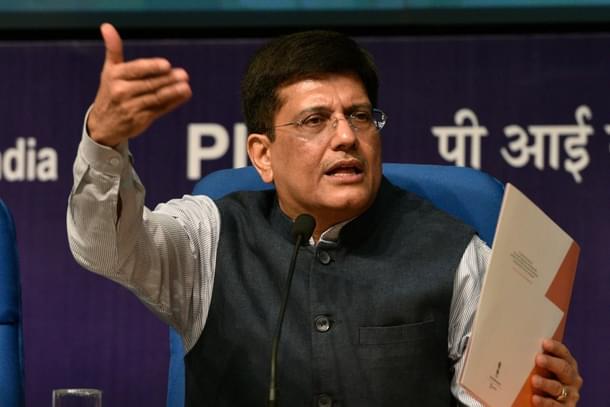

There seems to be some degree of desperation in the government’s approach to fixing India’s public sector banks in order to revive credit growth. Last week, a proposal was floated to merge four loss-making banks into one; on 8 June, stand-in Finance Minister Piyush Goyal announced the setting up of a committee to suggest a faster way forward on bad loans, including the possibility of creating an asset reconstruction or management company (ARC/AMC).

Both ideas are non-starters at this stage in the economic and political cycle. Merging four weak banks is, as we have argued, not the right way to create one strong bank. Four drunks propping each other up cannot expect to avoid a fall. And setting up an ARC is not going to solve the problems of bad loans in the foreseeable future, when a general election looms less than one year away. Neither mergers nor ARCs are going to get credit growth up fast enough to deliver visible growth or jobs before the elections.

There are several reasons for this pessimism.

One, there are already nine or 10 ARCs in business, and banks are wary of giving their bad loans to them. So what purpose will the creation of one more ARC serve? The reason why banks are reluctant to hand over bad loans to ARCs is that the minute they do that, they have to provide for the losses. If, say, an ARC buys a bad loan at 40 per cent of its face value, the bank will have to provide for a loss on the balance 60 per cent.

Two, setting up an ARC is no different from asking a bank to focus on chasing bad loans all by itself. The ARC will not know more about the probability of how much of the loan can be recovered than the lending bank itself.

Third, the ARC process will be slow, and recoveries will not happen for another year in most cases – something that is not any faster than the IBC (Insolvency and Bankruptcy Code) process adopted to settle big bad loans.

Fourth, setting up a new ARC will take months, including incorporating the company, announcing its key manpower, etc. There is nothing a new ARC can do that a bank’s own asset recovery cell cannot do faster if it wants to.

The government needs to give up the illusion that there is any faster way of reviving lending than by painstakingly cleaning up the balance-sheet, one loan at a time.

This means it should do the right things, even if does not mean early nirvana before the elections.

And there are more problems coming its way. The Reserve Bank of India is said to be considering shifting six more public sector banks to “prompt corrective action (PCA)” mode, which means they will not be able to grow their balance-sheets without getting adequate capital from government or recovering more of their bad loans. Since there are 11 banks already in the intensive care unit, adding six more means two-thirds of the public banking system is under water.

Against this backdrop, here’s what government could do immediately.

#1: Identify four or five existing PCA cases and designate them as bad banks, which will focus only on recovery. They will sell their good assets and liabilities (deposits) to other banks at a small premium, and buy other banks’ bad loans at a discount. The government will provide capital for, say, three years, while this process is seen through to the end.

#2: Banks outside the PCA mode should be encouraged to sell most bad loans, except those they are confident they handle themselves, at a 50 per cent discount. Since most banks would have provided around 50 per cent for bad loans, this may not involve huge further losses, but their shares would revive if their gross bad loans show a sharp fall.

#3: The good banks and the bad ones can have a deal whereby if the recovery is higher than the rate at which the loans were sold, they will share the spoils 50:50. So there is an upside here.

#4: Government will have to guarantee the liabilities – ie, deposits – of the bad banks till they transition to the good banks, or till the bad banks themselves become good after solid performance on recoveries and once they move out of PCA status.

#5: Generous voluntary retirement schemes for public sector bank staff should be offered, especially for staff in bad banks.

The point of these changes is simple: it is too late in the day to create new ARCs or entities to address the problem of bad loans. It is best to use structures that can be activated within weeks rather than months. It is best to use banks currently in the PCA mode as bad banks to do the dirty work.

And yes, it would help if the government were to offer another equity infusion of close to Rs 1 lakh crore, over and above the Rs 2.11 lakh crore package offered some time ago. It has to bite the bullet on this even at the cost of busting its fiscal math.

Jagannathan is former Editorial Director, Swarajya. He tweets at @TheJaggi.