Economy

Bottled Ambitions: Can India’s Specialty Chemicals Live Up To Hype?

Amit Mishra

Jun 05, 2025, 05:35 PM | Updated Aug 03, 2025, 09:42 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

There’s a new buzzword echoing through India’s manufacturing corridors, and it’s not IT, textiles, or even automobiles. Say hello to specialty chemicals, the dark horse of Indian industry that's galloping into the global spotlight.

In 2019, the specialty chemicals sector was already worth a solid USD 32 billion, accounting for about 18 per cent of the total chemical industry in the country. Fast-forward to 2023, and the numbers tell a striking story: the sector now accounts for 22 per cent of India’s expanding USD 220 billion chemical market.

So the big question is: does the sector finally have the pieces in place to break out? Or is it another story where the promise is strong, but the execution needs to catch up?

The Alchemy Behind Modern Life

Often unglamorous but utterly indispensable, the chemical industry is the bedrock of global industrialisation.

It sits at the very heart of the global economy, orchestrating a complex transformation: turning raw materials like oil, natural gas, minerals, and metals into products that are extensively used in all facets of daily life like agriculture, health, personal care, automotive, electronics, water, etc.

In 2019, the global chemicals market swelled to a colossal USD 4 trillion, a figure that underlines the industry’s scale and pervasiveness. But within this vast ocean of molecules and materials lies a tale of two chemistries, basic vs. specialty.

Chemicals used in bulk quantities (high-volume) but with lower value are considered bulk or commodity chemicals. These include plastics, synthetic fibres, films, certain paints and pigments, explosives, and petrochemicals.

They significantly cater to the downstream industries. There is limited product differentiation within the sector; products are sold for their composition.

On the other hand, specialty chemicals are used in low quantities (not bulk) but have a higher value. These low-volume, high-value products are sold on the basis of their quality or utility, rather than composition and also greatly influence the performance of the end-product.

For instance, a specialty chemical might be something that helps a shampoo foam up, or makes a T-shirt wrinkle-free, or helps crops absorb pesticides better. This market is a lot less commodity-like: here, performance matters.

Because specialty chemicals are designed to solve specific problems or enhance particular qualities, they are almost exclusively sold business-to-business (B2B).

Globally, commodity chemicals make up about 80 per cent of the chemical industry's output. The remaining 20 per cent—the specialty segment—is where margins are higher, capital intensity is lower, and long-term client stickiness is the norm.

But that intimacy comes with expectations. The demands are high. Clients expect exacting quality, regulatory compliance, environmental safety, and on-time delivery. Many insist on joint development and pilot-scale validation before scaling up. Entry barriers are steep, especially for companies targeting developed markets like the EU, US, or Japan, where the regulatory bar is unforgiving.

Yet for those who can navigate the gauntlet, the rewards are significant.

The India Stan

Peek beneath the surface of India’s specialty chemicals boom and you’ll find a kaleidoscope of thriving sub-segments, like dyes and pigments, agrochemicals, and textile chemicals among others, based on end-use industry application.

Take dyes and pigments, for instance. India commands a 16–18 per cent share of global dyestuff exports, supplying over 90 countries. In FY 2023–24 alone, pigment emulsions and dyes contributed over Rs 10,000 crore in exports.

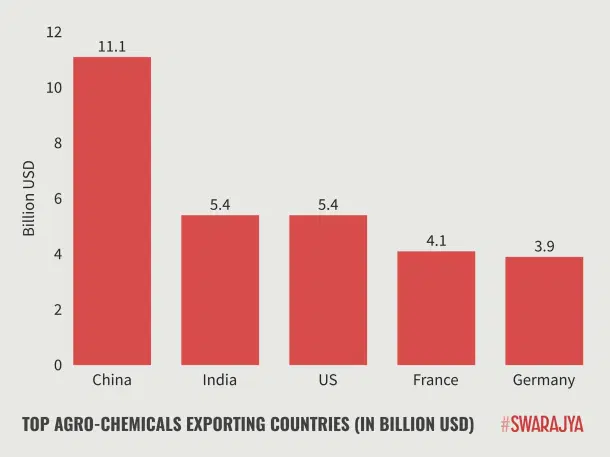

Then there’s agrochemicals—a cornerstone of India's specialty chemicals success. Not only is the country the world’s second-largest exporter in this space, but it also exports nearly half its total agrochemical production.

Zoom in further, and you'll find Indian excellence in less headline-grabbing but highly strategic niches. In the flavours and fragrances (F&F) segment, India is a key global player in natural ingredients, especially spice oleoresins and mint extracts.

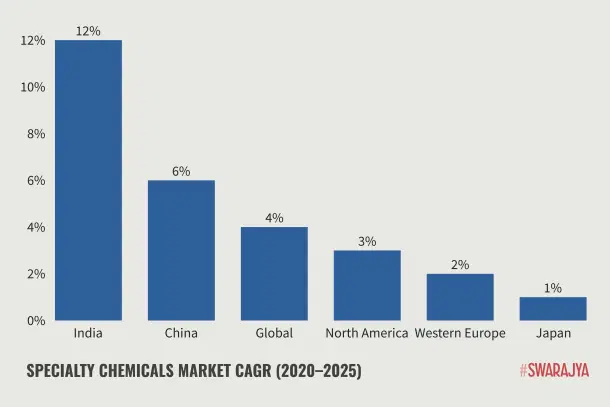

When it comes to global market share, India’s specialty chemicals industry currently holds a modest 4 per cent, dwarfed by China’s commanding 26 per cent. Yet, the winds are shifting.

According to a KPMG report, India is poised to outpace not only China but also Japan and the rest of the world in percentage growth terms. If current trends hold, India’s share is expected to rise to 6 per cent by 2026, marking a sharp upward trajectory for a sector that’s long flown under the radar.

The Boom... and the Backstory

But the story isn’t without its shadows.

For all the celebration around export growth and rising market share, there are structural fragilities that continue to gnaw at the sector’s long-term prospects. Beneath the bullish headlines lies a sobering reality, one flagged not just by economists, but by policymakers and industry veterans alike.

Multiple government reports have flagged three critical fault lines that could undermine the sector’s long-term sustainability.

Raw Material Dependence

Behind India’s chemical surge lies an inconvenient truth, an ever-deepening import of key raw materials, especially petrochemical intermediates, which affects the prices of specialty chemicals.

With raw materials accounting for anywhere between 40 per cent and 60 per cent of the total cost of production, Indian specialty chemical makers often find themselves with little room to manoeuvre. Price volatility in international markets translates almost directly into margin pressure at home, leaving even the most sophisticated players exposed.

Consider the case of Fine Organics, a global leader in specialty additives, those invisible but vital ingredients that help enhance the performance of everything from plastics to cosmetics to animal feed. Even as sales volumes held steady, the company’s earnings told a different story.

The pressure point? Input costs.

Midway through FY25, prices for Fine’s key raw materials, natural oils like palm, sunflower, and castor, began to climb sharply. They stayed elevated well into the second half of the year.

While the company had no control over this volatility, it also had limited ability to pass on the added cost to its customers, especially those locked into long-term contracts.

“Wherever there were no long-term contracts, we passed on. But wherever there were, we had to bear that additional cost," explained CFO Sonali Bhadani.

The result: a classic margin squeeze. While Fine could adjust pricing for spot-market buyers and smaller accounts, it wasn’t nearly enough to offset the financial strain from its larger, contracted clientele.

This vulnerability isn’t unique. Indian manufacturers, in general, lack the kind of backward integration that shields many of their counterparts in emerging economies. Developed economies like the US and countries in the EU benefit from plentiful natural resources, long-term agreements and local sourcing, helping them avoid major impacts from global price fluctuations.

But not all is bleak.

Take Privi Speciality, one of the biggest players in India when it comes to making these base aroma chemicals. Privi has built a resilient business around chemicals derived from pine-based raw materials like crude sulphate turpentine (CST) and gum turpentine oil (GTO).

These materials are notoriously challenging to source in bulk, as they are derived from pulping processes or forest-based resources, making large-scale industrial production both complex and constrained.

Unlike many of its peers, Privi is backward integrated. It has secured long-term access to its raw material base and gone a step further by developing circular production loops. In essence, it reuses by-products from its primary processes to craft new, high-margin specialty compounds.

Still, Privi’s example is the exception, not the norm.

India’s broader challenge remains unresolved: a chronic shortfall in domestic production of essential feedstocks such as methanol (C1), ethylene (C2), propylene (C3), and toluene (C7). Current capacities fall far short of downstream demand, forcing manufacturers to rely on imports, not only for base chemicals, but also for intermediates and final compounds derived from them.

To make matters worse, the global pricing cycles for many of these inputs have grown increasingly erratic, changing not quarterly, but monthly or even weekly. For producers, this creates a minefield of fluctuating costs and unpredictable margins, undermining both stability and scalability.

The Talent Conundrum: A Chemical Imbalance

The specialty chemicals sector demands deep technical expertise, and India has to contend with a scarcity of skilled research and development professionals.

Despite being a sunrise sector, the pipeline of chemical engineering talent is worryingly thin. A limited number of chemical engineers graduate annually from the nation's premier institutions, with many pursuing further education or changing fields, resulting in a dearth of specialized PhDs.

The numbers say it all: just 13,937 students appeared for the GATE 2024 Chemical Engineering paper, compared to a whopping 1.23 lakh for Computer Science, a nearly 10:1 disparity that signals a sharp decline in interest toward core sciences among India’s youth.

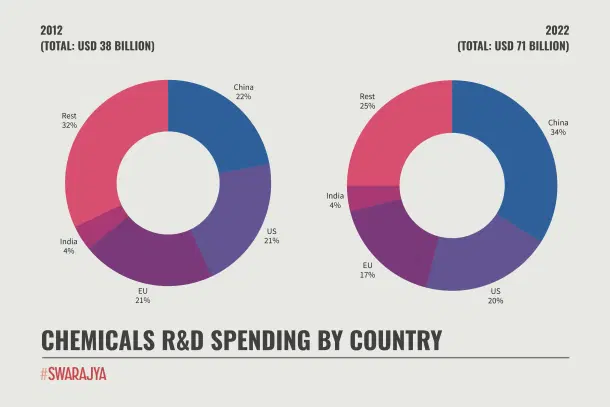

Consequently, India relies on international expertise to meet its chemical R&D requirements.

Indian chemical companies typically allocate less than 3 per cent of their revenues to R&D, far below the 6 per cent to 10 per cent range seen among global peers. In fact, between FY2015 and FY2022, the average R&D spend across 21 major Indian chemical firms was a mere 0.6 per cent of annual revenue.

However, it is the skills gap that is arguably the industry’s Achilles' heel. According to the National Skill Development Corporation, as of 2022, a mere 4.69 per cent of India’s workforce received formal skill training.

For an industry that thrives on close customer collaboration, quick formulation tweaks, and constant innovation, this skills mismatch is more than a bottleneck. It’s a billion-dollar blind spot.

Thankfully, some initiatives are laying the groundwork for change.

Institutes like the Institute of Pesticide Formulation Technology (IPFT) offer training in formulation analysis, safety, and operations. The Rubber Chemical and Petrochemical Skill Development Council (RCPSDC) is addressing talent gaps in the allied rubber and petrochemical industries.

But while these programs are encouraging, they remain scattered and small in scale. What India needs is a nationwide, integrated up-skilling effort that blends formulation chemistry, sustainability science, and global regulatory literacy into mainstream engineering education.

And there is no need to reinvent the wheel.

A European model, named European Chemical Regions Network (ECRN) cited in a recent PwC-Assocham report, offers a compelling blueprint: consortium-based upskilling. In this approach, regional clusters of chemical companies, local universities, and government bodies jointly establish training hubs focused on real-world problems and skill gaps.

Regulatory Friction

India’s environmental compliance process remains complex and unpredictable, often causing significant delays for chemical manufacturers.

Unlike the streamlined and harmonised frameworks found in global chemical hubs, such as the European Union’s REACH regulation, which mandates substance-level registration, risk assessments, and safety protocols, India’s regulatory landscape lacks consistency and clarity.

Most Indian manufacturers do not have in-house toxicological testing facilities, making them reliant on expensive third-party certifications.

Even within designated chemical zones, companies frequently encounter inconsistent timelines in securing critical approvals such as Consent to Establish (CTE) and Consent to Operate (CTO).

For specialty chemical producers, especially those focused on generic agrochemicals and pharmaceutical intermediates, speed to market is crucial. Delays in obtaining Environmental Clearances can result in missed opportunities to launch products globally, undermining their competitiveness.

In a significant policy shift, India has launched ChemIndia, its first digital platform under the proposed Chemical Management and Safety Rules (CMSR), aimed at tracking the production, use, and import of chemicals. While this is a step forward, the country still lacks a centralised, REACH-like database with pre-registration protocols, limiting transparency and confidence among global buyers.

Behind The Wheels

Most Indian chemical companies, including the industry’s biggest names, are well aware of the sector’s structural challenges. They’ve weathered regulatory fog, talent shortages, and supply chain strains. But one shadow looms persistently across the industry: overcapacity.

Consider Aarti Industries, a heavyweight in the production of benzene and toluene derivatives. These may sound esoteric, but in reality, they are the molecular backbones that fuel entire industries, from dyes and pigments to pesticides, pharmaceuticals, and fuel additives.

However, many of the end-use sectors Aarti caters to, such as agrochemicals and polymers, have recently experienced demand slowdowns.

Compounding the issue, global prices for many of these chemicals have come under pressure, driven in part by a flood of cheaper exports from China. Although Aarti has seen some recovery in volumes, margins remain under strain.

The core problem? They're moving more product, but can’t command premium prices. As Aarti’s management put it in a recent earnings call: “We are seeing volume recovery for sure, but given the amount of over capacity that exists in China, that incremental volume growth is also served by marginal pricing, and that's where we are not seeing uptick on pricing/margins at this stage.”

Despite these short-term pressures, the long-term outlook for specialty chemicals remains robust. The sector is projected to grow at a double-digit through 2026, fuelled by rising demand across industries like construction, pharmaceuticals, and energy storage.

The growth story feels almost certain, but it won’t happen by itself.

To really catch this wave, companies can’t just focus on producing more. Macroeconomic shifts, evolving regulatory standards, and customer sophistication are raising the bar, and only the agile will ascend.