Economy

Managing Cash: How RBI’s Structural Weakness Left It Clueless

Subhomoy Bhattacharjee

Dec 21, 2016, 09:11 PM | Updated 09:11 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The one institution which has clearly come out much weaker from the demonetisation exercise is the Reserve Bank of India (RBI). This has disturbing implications, given the massive rise in stakes, for all Indians, in the financial sector, post the exercise.

Why did this happen? There are several reasons for this but all of them go back to the place that the mechanism of currency issuance — the department of currency management – occupies in the pecking order within RBI.

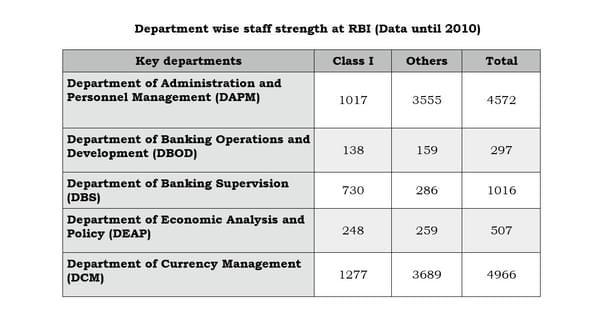

This department is the largest among the 26 departments in the central bank. The following chart of comparative staff strength among all the departments shows it clearly. To put it in perspective, every fourth employee of RBI has something to do with the department of currency management. Though the absolute number of people has shrunk, the relative size has not changed.

But through the year, most of the work of this department is routine. At the beginning of each financial year, RBI’s central board sets the rate at which cash will be printed in the printing presses. The rate is in turn, determined by the nominal rate of growth of GDP. Once this piece of economic analysis is parsed through by the RBI Governor and his deputies, the rest of the work on handling of currency is quite predictable. For instance, based on the aggregate issuance, the denominations in which the currency notes will be issued is set thereafter. In most years, it is more or less a fraction above what has obtained in last fiscal.

Let us examine some further aspects of the currency operations of RBI. The RBI annual report is a carefully written document. That is not surprising, given its stature among the leading central banks of the world. The report makes a detailed analysis of the state of monetary management in India as it obtained in the past financial year. Going ahead, it makes an equally careful analysis of the expected monetary developments in India in the year ahead.

Till recently, however, the only exception to the painstaking work in the report was the chapter on management of currency. There were years like this and this where the annual reports almost reproduced verbatim the chapters on currency. It is only in the annual report of 2013 that this thread of predictability was altered when it began a discussion on the curious rise in the percentage of high value denomination notes in the economy, far ahead of what the economy needed. Essentially the brick and mortar of actual issuance of currency notes gets short shrift within RBI.

Also, unlike the other major departments like the department of banking supervision and the department of economic analysis, few of the currency officials sit on Mint Road, the headquarters of RBI. So they are rarely able to apprise the Governor and his team first hand about the details about the state of operations on the ground. Hence the feedback loop is thin. In the RBI hierarchy of jobs, the top billing has always gone to the department of economic analysis and the department of banking supervision. Among the deputy governors, these two departments have been the most coveted. Currency management has usually been considered the equivalent of a dog house posting.

So as the cash first dried up post demonetisation and was then released in a thin stream, the RBI top brass were in difficulties. They have rarely got onto this turf. In an exercise of this scale where the configurations of the challenge are altering daily, lack of daily feedback is often fatal. It is like fighting a battle where the commanding officers give orders over long distance, without ever getting to see the state of operations.

This is also reflected in another piece of data. Over the years, the RBI has distinguished itself with a series of studies and working papers written by its staff and invited economists on a range of monetary topics. There have also been reports galore on all aspects of the economy that have made their mark. Management of cash economy has been conspicuously absent from this list. The omnibus-like periodic reports on currency and finance have plenty of details on the role of cash, but they too do not dwell on the practical bread and butter business of transporting cash from one point to another or offer a disaggregated picture of the demand for cash in the economy. Where it refers to cash management, it means how central government manages its requirement for cash as a subset of liquidity management.

So here is the scale of the problem—there was just nobody in the RBI who knew how cash moves. This is not unlike the lack of knowledge on this topic among other central banks too. But then none of them has faced demonetisation. And this explains why RBI has been left scrambling and forced to issue orders almost daily in the course of this six weeks in order to regularise the flow of notes.

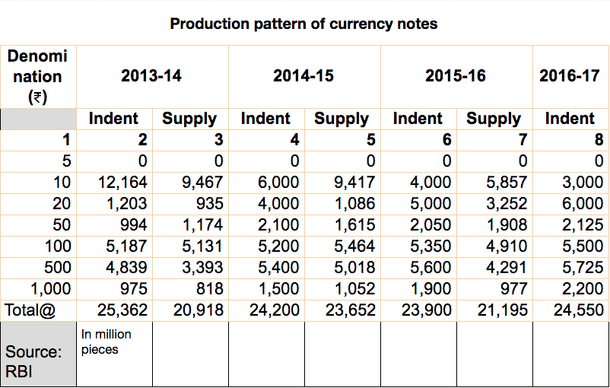

This is the reason why RBI bosses despite the data on printing capacity of their own mills, were led to believe that normalcy could be restored by end-December. Check out the data on orders (in volume and not value) placed for Rs 500 and Rs 1000 pieces of note. Notice that it takes the same time to print a smaller or larger denomination note. The table makes it clear that nearly 60 per cent of the old notes had already got printed by the date of demonetisation. Post November 8, that 60 per cent has to be printed again. Will it be possible to compress the print run in the remaining five months of this fiscal year?

The Twitter smirks about the number of notifications which the RBI has had to issue since November 8, including Monday’s now withdrawn tighter rules for depositing old Rs 500 and Rs 1000 notes in banks, are correct. Though anyone who thought the central bank could sit pretty while the world’s largest currency swap was in progress has little idea of the humungous role of cash management, it turns out RBI too was unaware of the scale of the changes it needed to bring in to implement the orders from Prime Minister Narendra Modi.