Economy

The Paradox of IPR Regimes

Prashant Kulkarni

Oct 18, 2014, 08:30 AM | Updated Feb 24, 2016, 12:07 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

India must firmly resist the imposition of the single-fit US-based IP model down its throats. We have to evolve our own decentralized IP mechanism suiting Indian conditions. Markets should become battlegrounds for IP

Sooner or later, Prime Minister Narendra Modi’s economic diplomacy will have to confront pressures to suitably restructure the Intellectual Property Rights (IPRs) regime in India. Implied is the imposition of the American Intellectual Property (IP) regime. Given the possible movement towards India’s participation in Trans-Pacific Partnership (TPP), these pressures will intensify. However, as history reveals time and again, US IP models are anything but pro-market.

Firms protect and enhance market power through several means, including IP creation and development. Since knowledge creation involves high capital costs, IP producers and owners, by law, are vested with certain rights, resulting in a temporary monopoly as reward for innovation. Patents cover tangible inventions (current discourse covers intangible elements like concepts and mathematical models too), copyright protects the expression, trademarks and trade dress the identity, and trade secrets protect confidential information/recipe.

Prima facie, IPRs, a recipe to produce tangible goods, are sine qua non. Being non-rivalrous and non-excludable, absence of IP protection makes knowledge products susceptible to free riding. The consequent knowledge under production necessitates conversion into private goods through assignment of property rights. Therefore, the current use of knowledge becomes an object of a trade-off between its possible over-uses—an implied barrier to future creation of knowledge—against easing barriers for future knowledge creation—restricting its current usage.

The IP Environment

Contemporary discourse challenges the traditional notions of IP protection being subject to national sovereignty. Symbolizing this are twin US creations, Trade Related Intellectual Property Rights (TRIPS), an essence of perceived global regulatory capture, and Digital Millennium Copyright Act (DMCA), a legal instrument allegedly to control human creativity and intellect. TRIPS, in setting minimum standards in copyright, trademarks, geographical indications, industrial designs and layouts of integrated circuits, explicitly recognizes knowledge as a private good.

However, if, in principle, globalizing and standardizing the set of intellectual property principles aims to provide effective protection to digital technology and biotechnology, popular perception has it otherwise. The US investment of more than a trillion dollars a year in intangible assets besides being the largest net exporter of intellectual property, lends credence to the belief that major US corporations control TRIPS regime. Moreover, given the emphasis on scale and ownership of physical capital, more often than not the rights do not reside with the creator.

To IP protagonists, markets work best under stringent protection. Colonial hangovers, little or no development of drugs for tropical diseases like ebola, malaria, tuberculosis, ostensibly on grounds of lack of markets (patients cannot afford the drugs), Western response to AIDS or ebola in Africa reinforces the fears of IP as a tool of Western dominance. Add to that the imagery of omnipresent pharmaceutical firms controlling patents on all aspects of the compound, including the compound itself, dosage methods and processes of making it, and, post expiry of patent, seeking to evergreen it through incremental innovations, high prices, supernormal profits.

Further, creative and cultural industries, aided by the copyright regulators engaged in overenthusiastic enforcement of legislation and technological encryption, often drive amateur creativity, visible on social networks like YouTube, underground. Education, journalism, scholarship or criticism, all dependent on the fair use doctrine are often affected by unlimited copyrights. High profile trials like Stephanie Lentz , the Salinger case or the Jesse Jordan case resonate fast across communities augmenting the image of corporate extortion over market competition. Further, Western governments often lobby privately, and at times in public, in support of their corporations for market access overseas.

Discourses in Intellectual Property, grounded either in sociological or legal foundations rests on certain assumptions. Socially and juridicially, the system is sound, will work well in the future too, and independent of the specifics of time and place. But debate on IP effectiveness, relevance and alternatives often deteriorates into rhetoric and ideological dogma.

In the digital domain, absence of architectural tools to restrict and monitor access makes it possible to reproduce the goods immediately, infinitely and at zero marginal costs. Robust architectural controls restricting access end up in just delaying and not preventing ‘jail-breaking’. Resource access or exclusion through IP relies on state intervention or inherent product architecture rather than market or norms.

An apparent state-corporate nexus with roots in rent seeking behaviour resulted in the American model of IP governance and enforcement, degenerating into state-supported turf retention and expansion strategy conflicting with market outcomes. It is erroneous to assert that pro-corporate is pro-market. A sharp distinction exists between the two, though used interchangeably. Markets express themselves in a constant see-saw battle, tug of war between buyers and sellers, and the balance of power continuously shifting across the buyer-seller terrain. Corporates, once established, aim to perpetuate their market dominance. Markets unsettle such establishments restoring the producer-consumer balance. In seeking market avoidance, corporates do not hesitate to use state interventions.

Current IP Models result in Tragedy of Anti-Commons

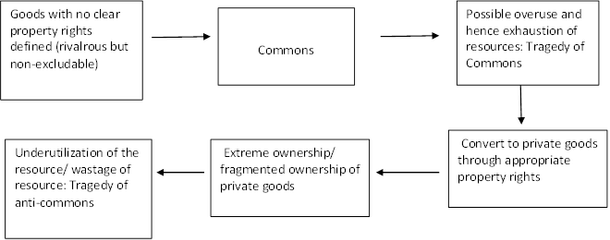

Like the tragedy of commons, extreme/fragmented ownership too generates a similar outcome. If free riding and overexploitation cause the former, hold-outs result in the latter. (Figure I)

Figure I: Tragedy of Anti-Commons

`Developed by the author based on Michael Heller’s exposition of the same in The Gridlock Economy: How too much Ownership Wrecks Markets, Stops Innovations and Costs Lives”, Basic Books, 2008

A case in point is James Watt’s hold-out on rail engine patents derailing the growth of British railways or American aircraft industry coming to standstill pre-World War I. Commercializing drugs depends on the related patents that might be in possession of several biotech firms. Any patent holder might refuse to part with its discovery or price it higher than the buyer’s reservation price. Anecdotal evidence points to several cases where possible higher private benefits outweighing potential social loss manifested in missing drugs. With handycams around, amateur entertainment production might cost just few hundred dollars but copyright clearances and post-production editing costs more than few hundred thousand dollars.

Moreover, lure of ‘attractive returns’ through IP ownership spawned the business of non-practicing IP entities popularly termed trolls. Their business model revolves around building IP portfolio through purchases and later suing firms for alleged violations. With giants like Google, Microsoft, Samsung and IBM not immune to trolling, these non-practicing entities apparently pose bigger threat to new product development than IP itself (Fig II).

Figure II: Prisoner’s Dilemma Representation of Hold Ups/ Trolls

| IP holders | New product development | ||

| Royalty/monetary payments | Non-monetary attributions /donations/royalty affordability issues | ||

| Co-operate | New product development; commercial cultural production | Open source discovery models / copyright alternatives / non market cultural production | |

| Hold out | High product costs; cost structure predominated by clearance costs; demand shifts from formal to grey markets ; demand-side state interventions | Lawsuits force abandonment of products; IP trolling; likely shift of product/service supply from formal to underground; supply-side state interventions | |

Source: Developed by the author; this representation is variation and adaptation from Prashant Kulkarni, “Towards Locating Market Failure as an Outcome of Intellectual Property Regime: Mapping the IPR-Market-Society Interfaces”, Proceedings of the 1st Intl. Conference on Management of Intellectual Property & Strategy, Feb 2012

There is no ‘Single Fit’ IP Regime

Despite uniform IP law across sectors, appropriation and enforcement practices are not homogenous across and within industries (see an interesting book ). In the fashion industry, firms go to great lengths to protect their trademarks, yet demonstrate remarkable diffidence towards imitation or derivative reworking of designs. Derivate reworking is not uncommon and its impact on revenues seems insignificant. With technological improvements absent, fashion industry economics thrives on the ‘diminishing marginal utility’ with consumers seeking something novel every season. Imitations help in ‘induced obsolescence’ compelling new designs every season.

Other instances include investment banking (trade secrets and constant innovation to avoid prisoners dilemma traps), sports (competitive advantage in the immediate run, execution), magicians and stand-up comedians (norms-based appropriation, short shelf life), cuisine (preparation, difficulties in proving no prior art), and dance (execution, then theoretical appropriation). Despite advocating stringent IP laws, the film industry itself has thrived on derivative reworking of original plots including Walt Disney’s Snow White (he tapped Brothers Grimm’s version which was in the public domain). Ironically, Disney allegedly lobbied to retain the copyright over Mickey Mouse, Goofy etc, thus causing the shrinking of the public domain. Formula films and music have long been the staple diet not only in the Indian film and film music industry but across their international counterparts also.

Current IP Regime is incompatible with Digital Economy

Shrinking shelf space, fast emerging substitutes, rising production costs all underscore the difficulties for a firm in sustaining the dominant position. The Industrial Revolution onwards, the production and exchange of information, knowledge and culture was subject to the command and control-centric industrial economy. However, digital technologies resulted in a structural shift in the way information is produced, organized and exchanged. These shifts permeating through society reframe the balance of control of information and knowledge from complex organizations in the hands of citizens, consumers and autonomous individuals of cultural, social and political groups.

Proprietary production is gradually but significantly giving way towards non-market and non-proprietary production models. The shift, driven both by individual and cooperative efforts in a wide array of loosely or tightly woven collaborations, is reported from diverse areas as software development and investigative reporting, avant-garde video, encyclopedias, music sharing and multiplayer online games.

The destabilization is in part accounted for by the ease with which digital content can be downloaded, created, modified and distributed at zero to low marginal costs. Firms from Wikipedia to Linux to outright rebels like Napster, Aero and host of peer to peer (P2P) file sharing networks, for good or for bad, struck at the established order. Threatened by the emergence of non-market, non-proprietary production models and inefficacy in re-gearing their business models, IP becomes the byword for turf protection and continued cartelization. Further, modern IPR law, incompatible with digital goods, shifts the battlegrounds to the courts of law rather than markets.

Piracy and online grey markets are outcomes of market imperfections generated by IP Law

To assert piracy is wrong is stating the obvious. Piracy, in an orthodox view, deprives the economic incentives to the original creator. Yet it did not emerge in a vacuum. Online piracy is the digital equivalent of tax arbitrage-driven socialist-era grey markets. Amateur non-market creation targeted by lawsuits is the digital equivalent of socialist-era regulatory terrorism. Amusingly, industry itself and even artists have been known to hobnob with pirates to popularize their creations. Amateur creativity-driven Schumpeterian entities are creatively destructing the industrial era-driven cartelized business models. An alibi to perpetuate cartels is a resort to IP legislations to prevent the ‘unauthorized’ production of expression thus tainting a diverse range of informal, non-criminal creative activities.

Without doubt, parasites free ride digital content. Yet, assuming everybody is a parasite, thus criminalizing piracy, might be a gross simplification. Amateur creativity going underground is the collateral damage in the battles of attrition between corporations and P2P sites. Every site shut down results in multiple offsprings, causing what game theory terms as ‘Nash equilibrium’.

Users of file sharing sites, legal or illegal, have diverse motivations. A few want to mock at corporations while some sample content before buying. A large user base downloads content since they either cannot afford or the original content is unavailable. Economics 1.0 theorizes the price mechanism takes care of shortage and surplus. However, this does not imply absence of latent demand, to which these pirate or grey markets cater to. At any price point, agents of supply and demand exist. The goods, though poor substitutes, nevertheless fulfill user needs. Online grey markets aided by unique digital configuration enable reframing the terms of interactions with the incumbents.

Interestingly, T-Series, currently a proponent of strong copyright, was an early beneficiary of an opening in the copyright laws to push version recording, newbie artists singing tunes sung by popular singers. The remix phenomenon, a new media culture mixing the legal and non-legal was the end product. T-Series transformed the distribution system, moving into neighbourhoods, shops, grocery shops, paan wallahs, and tea shops literally commoditizing the cassette. Spillovers reflected in mushrooming of Palika Bazaar in Central Delhi for video, Nehru Place for software and hardware, and Lajpat Rai Market in the Old City for music as well as cable industry hardware.

IP is just one new weapon for Knowledge Cartels in their quest for Elixir of life

The history of information empires in the US unambiguously points at today’s IP battles being a continuum of a long war between incumbency inertia and Schumpeterian disruptors. From Theodore Vail to David Sarnoff to Jack Valenti to Steve Jobs to Jeff Bezos, the centralized corporation as benevolent monopoly protecting information-illiterate consumers from the after-effects of destructive market-based competition is the foundation of strategy. To varying degrees, this holds true across global economies cutting across ideologies.

Western Union (local telephones services vs long distance telegraph services), American Film Trust (patent cartel on movie products), RCI (control on radio broadcasting, suppressing FM radio, stifled innovation in television) are just a few examples. ‘Outlaws’ like Adolph Zukor, Carl Laemmle (film production in Californian backyards to escape IP laws), Ted Turner (cable television challenging entrenched television broadcasting), Steve Jobs (iPod upsetting music industry models), Jeff Bezos (Kindle challenging the publishing industry) successfully dislodged the entrenched to varying degrees.

Personalities changed, yet the strategic foundations remain unchanged. Closed systems encourage cartels, and control and appropriate innovations. A few independent ‘rebels’ challenge the mainstream; turf wars follow. At times, the entrenched are unseated; the victors become the new entrenched. The script between the Schumpeterian disruptors and incumbents repeats, with just the engagement turned global from local.

Regulatory Arbitrage has Determined Course of Economic History

The need to eliminate regulatory differentials across countries dominates global IP negotiations both at bilateral and multilateral levels. These differentials supposedly enable ‘anti market’ practitioners to relocate production in countries with weak IP laws, export into other markets virtually free riding on the original creators.

History, however, reveals these precise differentials explain the industrial development of the Western world since Industrial Revolution. Industrial espionage enabled the US to displace Britain as the leader in the textile industry. Offshore relocation and IT outsourcing are byproducts of differentials in labour laws and minimum wages. Countries including Switzerland, Italy, and Japan had relatively liberal IP laws for a long period. The Indian pharmaceutical industry would not have prospered without the Patents Act 1970. The British chemical industry remained outside patent purview during the war years to combat alleged German superiority in chemical warfare. China’s weak IP enforcement policy did not threaten its position as a manufacturing hub. Given the western history of appropriating protectionist mechanisms, it might be a good weapon for emerging economies in competing with developed economies.

State-Driven Solutions need to be Redefined

Advocates of state intervention do have a persuasive case. Compulsory licensing sustains radio and television content growth and development. Patent pooling stimulated the off-ground US aircraft industry around World War I. US and Canada themselves compulsorily licensed the -anthrax drugs after the post-9/11 scare. US pressure on stringent IP laws made Brazil adopt free software unhindered by copyright laws, and projects like Points of Culture (Pontos de Cultura) to increase cultural supply, with reasonable success

For many tropical diseases like ebola, sleeping sickness, malaria, kala-a-azar, little drug development has taken place in recent times, given that the firms are reluctant to invest in these ‘non-market’ goods. In the absence of the good, reverse engineering might become hypothetical. To ensure public health security, the state might buy bulk drugs from pharmaceutical companies through bargaining for low prices followed by creation of distribution mechanisms.

IP is Linked to Business Models; Develop and Sustain IP Markets

Estimates suggest commercial exploitation of IP anywhere between 5-25%. Given that unmarked terrains necessitate an unfamiliar configuration of assets, resources and positioning, firms favour ideas that fit with known patterns. High development costs and valuation difficulties perhaps account for technology dormancy and under-utilization. Xerox Paulo Alto Research Centre (PARC), despite pioneering numerous technological innovations from the laser printer to the graphical user interface (GUI) to the Ethernet, failed to commercialize them. Open innovation and consequent open business models, use-driven innovation etc. overcome some of these innovation market inefficiencies. Development of genuine and robust IP markets must be the end objective of harmonization of cross-country IP laws.

Physical innovation markets face barriers in search, negotiating and enforcement costs. Digital interfaces ease the transaction costs, facilitating the development of IP markets. IP per se has latent economic value but without realization is worthless. Thus technology, creativity or any knowledge product might not have any independent value and is business-dependent. These markets, through licensing, lending, leasing, renting, selling and buying of IP products, probably transform IP development and usage through inclusive monetization rather than funnel-centric exclusive closed innovation pipelines. Examples from Procter and Gamble, Air Products, IBM leveraging knowledge emerging from outside suggest such a movement despite being anchored in firm-centric and not market-centric models.

IP Registration and Adverse Possession

Copyrights get conferred automatically unlike patents, trademarks and trade secrets which need registration. Unless registered, the default status for copyrights must be public domain. This will minimize litigation. Orphan works, whose owners remain untraceable for a certain period of time, should be deemed to lapse into the public domain.

Unless defensive, if IP remains unutilized for a certain time period, it can be transferred to the public domain, forcing IP owners to seek markets for commercialization. In simple economics, non-utilization signals little utility and resources being scarce, be transferred to those who gain higher utility from product possession and usage. Adapting the principle of adverse possession, and suing alleged violators might be subjected to limitations. For non-practicing entities, the onus on proving violations should rest with accusers and not the accused.

Cost Decentralization through IP Funds

Industries like pharmaceuticals, biotechnology, medical electronics, software, entertainment, and music face demand and supply uncertainties. High capital costs demand high volumes, yet reproduction costs are low and approach zero for digital products. Reverse engineering, derivative reworking and emergence of substitute products keep markets constantly in flux. Scarce funds are to be balanced between new product development (implied demand uncertainty) and marketing (faster diminishing novelty). All these factors influence the firm in seeking refuge under IP laws.

With capital costs concentrated within the firm, diffusion of costs is critical. Contract research organizations (CROs) enable conversion of capital expenditure to operational expenditure in industries like pharmaceuticals and biotechnology. IT networks permit societal distribution of high capital costs. Upstream research in basic sciences like gene sequencing and mapping, protein mapping, computational biology, IT services, software development, hardware design, product design, mine prospecting, basic physical and chemical sciences are tapping this phenomenon. Goldcorp (mining), Novartis (Type 2 diabetes drug), @proteinfold (mapping proteins), SETI (search for extra-terrestrial intelligence), Local Motors (car micro-factories) illustrate the above.

IP funds might be a solution. Like other investment funds, these can be specific for R&D and cultural creation. Further investment objectives might be linked to appropriation mechanisms. Funds channeled into R&D or cultural supply being linked to shorter IP protection or curtailing of some IP rights or adoption of IP alternatives might help in addressing cost-linked longer IP protection. A few might exist investing only in funds where all rights are appropriated. Securitization, if taken care of for downsides, shifts risks to a wider base.

Uses, Not Product, Matters

Copyright laws apply not to underlying ideas but expression of the idea. Yet, the obsession with mere copy rather than uses of the copy distorts market models since the latter is connected to economic incentives of copyrights. Substantial extent of derivated reworking lies in the non-commercial space hardly affecting the revenues of IP owners. Co-existence of mainstream Japanese manga market with the Dōjinshi ‘underground’ market illustrates the above. Contrary to perception, free download does not mean lost sale. Many consumers would never be in the mainstream market in the first place. Possible free riding can be circumvented through business models seeking to compensate the original creators.

Explore New Revenue Models; Make Piracy Redundant

Digital goods are non-rivalrous, infinitely expansible, discrete, aspatial and recombinant. With zero marginal costs to create a perfect copy, they invert economic theories. Zero marginal costs imply zero prices, precisely the outcome of the file sharing movement. Therefore, file sharing, which is shaking up the music, entertainment and publishing industries should be made redundant and not banned.

Analogous to pricing models like ‘Freemium’, revenue has to be linked not to costs but consumer utility or satisfaction. Since each unit of the same product consumed yields different levels of satisfaction to different consumers, this can be the basis for price discrimination. Instances from free anti-virus software, P2P music, online games, and email services demonstrate the possibility of offering basic goods free yet make a profit. Implied is linking price discrimination models like revenue management, self-selection, segmentation, windowing, versioning etc. to marginal utility.

Motivations Differ, Preferences Differ; Why Should IP be Uniform?

IP mechanisms ignore motivation and preference differentials that exist among users and producers. Different producers of similar products exhibit different motivations. IP law design and structure assumes uniformity and convergence of motivations and preferences. Patent models, practices and requirements might vary across industries from pharmaceutical to industrial equipment to commodities to chemicals to biotechnology to IT hardware to electronics. Similarly, copyright laws and uses vary substantially across music, entertainment, film, art, publishing, and commercial producers, amateur producers, community generated output etc. Customized software development, free CD distribution by music bands, presence of professional associations to diffuse knowledge, reflect life outside the IP domain.

These differentials manifest in divergent practices like free revealing, positive feedback loops, self-actualization, sheer passion, cognitive surplus, reputation building etc. Examples comprise extreme sports (user-driven innovation), industrial equipment (user-driven, local adaptation), adoption of best managerial practices (agglomeration economies), software products (avoiding lock in), cultural products (heritage preservation and enrichment), and localized products (non-availability in mainstream). Exclusive rights-based production comprises a tiny fraction of the total global information production.

Originality is rare, freakish. Derivative adaptations and imitations are more common, thus necessitating a more rigorous definition of novelty. Many goods which technically are minor improvisations get IP protection. Terms of IP protection and extent of originality need to be created.

The increasing pervasiveness of the digital space presents an opportunity for the state to codify various IP alternatives. Current alternatives from GPL to GNU to Creative Commons are community or volunteer-driven. Unbundling IP premised on preference and motivation differentials, sanctioned and codified by the state can be a way forward.

Open Source Models/ Non-Market Models are an Outcome of Motivation and Preference Differentials; Also Help Avoid Lock-In

Open source models, no longer peripheral, command significant market shares in products like servers, operating systems etc. cultural products licensed under Creative Commons, Novartis (increasing role of sharing in pharmaceutical industries), open hardware platforms like Aurdino (manufacturing), and open source biology. This signifies that exclusive IP is not universally appealing. By design or default, IP often creates customer and vendor lock-in. Open source is a manifestation of the countervailing forces desiring to escape lock-in.

Reasons notwithstanding, sufficient space exists for alternative models. Many inventions, discoveries, and cultural creations, ranging from the theory of relativity to the periodic table to Bunsen burners to chloroform to stethoscopes to enzymes to aspirin to oral contraceptives to mythological adaptations to cultural practices all are an outcome of non-market non-proprietary mechanisms. IP appropriation should be linked to the creators’ preferences and not ‘one design fits all’.

IP Fundamentalists

American IP models promote cartelization, monopolization and lock-in of the resource, and are thus the antithesis of market competition. ‘IP fundamentalists’ with an aversion for openness, favour an outcome resulting in benefits for concentrated interests against deep losses by a diffused set of consumers. Markets cannot be straitjacketed and come in shades of grey. Any debate must recognize the complexity of tradeoffs – producer rights retaining access control as against the consumer rights of trading in cultural expression priced in experiential and social values. India must firmly resist imposition of the single-fit US-based IP model down its throats. We have to evolve our own decentralized IP mechanism suiting Indian conditions. Markets should become battlegrounds for IP contestations and not courts of law.

Historically speaking, IP wars parallel the Thirty Years War (1618-1648) leading to the emergence of modern nation state—a battle between rearguard action of an imperial system of economic governance against the emergence of democratic, grassroot-driven citizen empowerment in economic interactions. The way this debate shapes up will in turn shape the terms of exchange and creation of knowledge, information and culture. Indian IP policy should ensure that cultural vitality, knowledge openness and information diffusion remain pillars to human progress and not sacrificial goats at the altar of concentrated interests.

Prashant Kulkarni teaches economics, a digital economy and globalization at a leading B-School. His area of interest lies in dissecting resource contestations and human behavior at the intersections of digitization, urbanization and globalization.