Economy

Three Years Growth In Just Seven Months, Demonetisation Has Put India Firmly On Cashless Path

Swarajya Staff

Jul 14, 2017, 03:56 PM | Updated 03:56 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

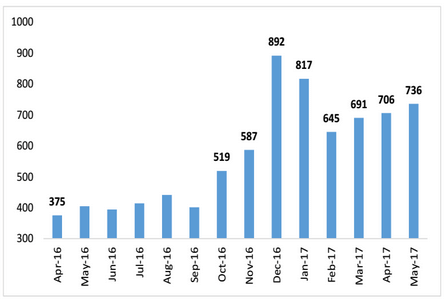

As a result of demonetisation and initiatives taken by the government to boost cashless transactions in the 2017-18 Union Budget, credit and debit card transactions on point of sale (POS) terminal have ‘increased stupendously,’ latest Ecoflash report released by the State Bank Of India (SBI) has said.

According to the report, “transaction value is quite large and approximately double of what it had been in the corresponding period of last year even after seven months post demonetisation". The report says demonetisation has pushed the country at least three years ahead in the realm of digital payments in just seven months.

“In other words, if demonetisation had not happened, it would have taken 3-years more for credit + debit cards transactions on POS terminals to reach the current level of Rs 700 billion. We believe that increasing number of POS terminals and ease of doing digital transaction will increase this level further. Clearly, India has leapfrogged 3 years of digitization in just 7 months,” the report reads.

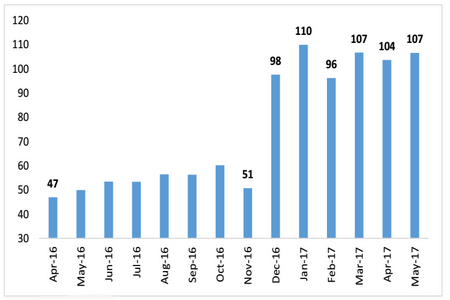

The report also states that usage of pre-paid instruments has also witnessed a sharp growth with transactions value worth Rs 107 billion in May 2017 compared to Rs 51 billion in November 2016.

The bank also states that digitisation will result in lower inflation. An increase in Rs 100 billion transaction by credit and debit cards at POS terminals will lead to around 1.1 per cent decline in Consumer Price Index inflation, the bank says.

“This augurs well for a lower inflation regime going forward. We also believe that combined with a structural change in food inflation regime that we are witnessing. India is well poised for a favourable growth-inflation mix in the coming years,” the report reads.