Infrastructure

Himachal Pradesh’s Water Cess: A Regressive Tax ‘Innovation’

Ananth Krishna and Rohit Pathania

Apr 29, 2023, 04:51 PM | Updated May 01, 2023, 11:45 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Himachal Pradesh’s decision to impose a cess on the use of water for electricity generation through the Himachal Pradesh Water Cess on Hydro Power Generation Bill, 2023 has run into significant controversy.

Not only have the State Legislatures of Punjab and Haryana in response passed resolutions condemning the move, the Himachal Pradesh High Court is considering a challenge to the water cess.

The Power Ministry has already sent a communique to all states to scrap such tax levies on electricity generation, arguing that it is illegal and unconstitutional. Himachal’s move to impose a cess follows earlier moves by Uttarakhand and the then State of Jammu & Kashmir imposing similar water cess on electricity generation.

A Cess at the Cost of Other States

Firstly, Himachal Pradesh’s cess is on the water used for electricity generation and not for any other purpose. This tactfully avoids a legal prohibition on charging cess for the use of irrigation or domestic consumption and a constitutional prohibition on taxing electricity generated from an interstate river (Article 288).

The legal innovation lies in taxing the water used for generating the electricity rather than the electricity generated.

The legislation has been made applicable to users undertaking electricity generation from any water source. This charge is to be determined by the HP Government from time to time, and would have to be paid by every hydro-electric project operator.

This would mean the projects managed by the Bhakra-Beas Management Board (BBMB) would be liable to pay the water cess, setting off a political storm.

The BBMB, which was created through the Punjab Reorganisation Act, 1966, has representation from the successor states of the erstwhile state of Punjab (Haryana, Himachal Pradesh and Punjab) and Rajasthan along with representatives from the Central Government. As such, the organisation is funded as a statutory obligation by the successor states of erstwhile Punjab and Rajasthan.

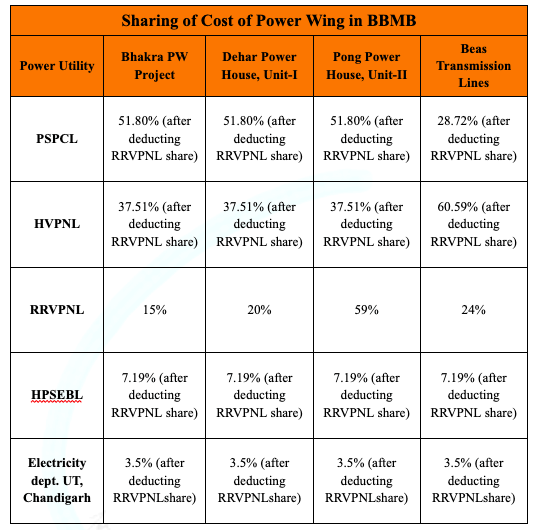

The new water cess means that BBMB’s additional expenditure will have to be met by the partner states, with Himachal Pradesh itself liable for 7.19% of the liability that is raised. Considering the proportion of liability, Punjab and Harayna will bear the greater responsibility for meeting the financial requirements raised through the cess (Refer below).

In effect, the Congress-led State Government in Himachal is raising resources at the cost of an AAP-led Punjab Government and BJP-led Haryana Government. The cess is likely to exacerbate the financial crisis in Punjab, at the benefit of Himachal deferring immediate financial pain.

Not A Novel Practice

Both Uttarakhand and the Union Territory of Jammu and Kashmir (J&K) impose a similar cess on the water used for electricity generation. J&K passed the Jammu and Kashmir Water Resources (Regulation & Management) Act, 2010 to impose the cess.

However, following a direction by the Standing Committee on Energy, the Government of India has persuaded J&K to defer the imposition of cess on three projects (Pakal Dul, Kiru and Ratle) for 10 years.

In Uttarakhand, the cess was imposed through the The Uttarakhand Water Tax on Electricity Generation Act, 2012. However, the legislation was stayed in 2016, but was upheld later on in 2021 by the Uttarakhand HC.

In this decision, Alakananda Hydro Power Co Ltd. & Ors. v. State of Uttarakhand & Ors. (2021), the High Court held that the tax imposed on the water used for generation of electricity is constitutional. A subsequent appeal by the NHPCL to a division bench of the Uttarakhand High Court is pending, and the bench has allowed the application of the cess meanwhile.

In fact, the legislation in Himachal Pradesh seems to be in fact a word-to-word copy of Uttarakhand legislation. The HP legislation also references the Uttarakhand legislation in its statement of objects and reasons, along with Jammu & Kashmir.

The Power Ministry has been opposing the imposition of such a cess, arguing that it is an indirect violation of Article 288 (which prohibits the Imposition of a cess on electricity generated from interstate rivers).

The Standing Committee on Energy too noted that such cesses would have a regressive movie that increase the cost of power generation.

Legally Tenable, But Regressive

As stated earlier, similar water cess to that of Himachal Pradesh was upheld by the Uttarakhand High Court. While the appeal remains pending, the reasoning for the HC decision is sound.

By not imposing a cess on the electricity generated but the water consumed, it circumvents the prohibition of taxing electricity generated from an inter-state river.

Further, the cess is not merely on the projects of the Central Government or BBMB but on all projects, including that of the state government.

However, it should be noted that the cess also breaches the conventional understanding of taxation. The tax is imposed not on the consumption of water, but generation of electricity using water, which does not change its nature in any way.

That being the case, there is no doubt that the move is a regressive decision policy wise. After taking the financially disastrous decision to implement the Old Pension System (OPS), the Himachal Pradesh Government is scrambling to avoid financial ruin.

Some might argue that this water cess can at best be described as an innovative financial tool by the hill state to raise fiscal resources. However, this ignores the consequences of such policy decisions in the hydroelectric power sector.

The National Hydro Power Policy, 2008 provides for 12+1 per cent of the power generated for free by Central-sponsored projects to the states in which the projects are based.

By squeezing additional fiscal resources from such projects, the states are subverting the basis of hydroelectric projects.

In the case of Himachal, the political landmines are dime a dozen, considering the importance of the BBMB project both in the power sector and in the agricultural sector.

The disproportionate impact of this move will be felt in Punjab, Haryana and Rajasthan than in Himachal. If replicated across states, it is likely to create multiple negative second-order effects.

This is what has prompted the Power Ministry to issue a tersely worded communique to all states.

Creating barriers to entry in the power sector will negatively affect the growth of the sector, especially when the Government is aiming to initiate further reforms to make the sector more open and competitive (à la Electricity Amendment Bill, 2022).

The practice, if replicated by upper riparian states can be compared to a form of price gouging.

With political tensions in federalism already palpable, these measures further worsen relations between States and between the State and Centre.

Critics may point to the limited fiscal independence and resources provided for states after the initiation of the Goods and Sales Tax (GST) regime. The water cess can arguably be categorised as an innovative tax measure, but it would ignore the state’s own lack of fiscal prudence.

The devolutions of the GST revenue and the rise in growth has not left states much to complain about. Prudent fiscal management is a necessary regimen for states, not an option. One cannot excuse regressive policy decisions on the basis of innovative taxation.

It would be ideal for the Central Government to step in and prevent the imposition of such irrational taxes that would deter investment and promotion of hydel power, and moreover is a disincentive that would negatively affect states, thus damaging cooperative federalism.

As hydroelectric energy remains a core component of India’s move towards reducing non-renewable energy sources, it is important to nip moves such as that of HP’s in the bud.

Financially beleaguered states, who have worsened their own position, should not be allowed to export their problems to other states and entire sectors of the economy.