Infrastructure

India Emerges As Top Beneficiary Of 'China + 1' Strategy Amidst Global Supply Chain Shift, Reports Nomura

Swarajya Staff

May 29, 2024, 02:09 PM | Updated 02:17 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

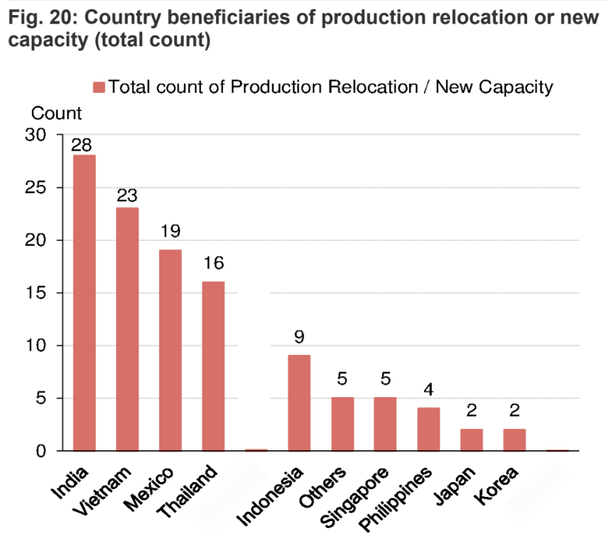

India and Vietnam are likely to be the two biggest Asian beneficiaries of the China + 1 strategy, as firms seek to set up or expand production facilities amidst great reshuffle in global supply chains, Nomura said in a report on Tuesday.

'Decoupling' or 'China + 1' refers to the strategy of reducing reliance on China by diversifying business operations and supply chains into other countries.

"Our results show that Asia is still the main beneficiary of shifting supply chains. India has received the most interest from firms (28 out of 130 firms) regarding setting up or expanding production facilities, followed by Vietnam, Mexico, Thailand, and Indonesia," the Japanese financial firm said.

"These results differ slightly from our 2019 survey. During that phase, when relocation out of China was in its initial phases, our sample showed Vietnam as the biggest beneficiary," the Nomura economists wrote in a research note.

According to Nomura, the shift in supply chains away from China has triggered what economist Kaname Akamatsu described as the ‘wild-geese-flying pattern’ of economic growth, where production moves from the lead goose (an advanced nation) to the next flock of geese (developing nations).

India's large domestic consumer market has significantly enhanced its attractiveness, drawing interest from firms in electronics, apparel and toys, automobiles and components, capital goods, and semiconductor manufacturing.

.jpg?w=610&q=75&compress=true&format=auto)

"We believe the low production linked incentive (PLI) disbursements are not a good reflection of India's potential on global value chain integration. Its large market size, faster growth, lower labour cost and political and economic stability make it an attractive investment destination for consumer goods production to both cater to domestic demand and also for exports," Nomura stated, anticipating India's share of global trade to rise to 2.8 per cent by 2030.

Sector-wise, electronics remains the most favoured industry for manufacturing in India, particularly in smartphone production (refer to the attached image).

According to Nomura’s estimates, this trend of shifting supply chains is expected to boost India's exports from $431 billion in 2023 to $835 billion by 2030, representing an annual growth rate of 10 percent.

The majority of investments in India are coming from US-based companies, particularly in the electronics sector. Japan and Korea are also investing in India's automotive, consumer durables, and electronics sectors, leveraging the growing domestic demand and using India as a manufacturing base," noted the global brokerage.

“Equity opportunities are several across countries and sectors, but we are most excited about India. Investors need to be patient in the short term, but we expect a larger impact on fundamentals and more opportunities over time,” Nomura said.