Infrastructure

NITI Aayog Proposes Fiscal Incentives, PLI Extension To Boost LNG Adoption As Transportation Fuel

Amit Mishra

Feb 08, 2024, 03:08 PM | Updated 03:08 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

NITI Aayog, the apex policy think tank of the Union government, has proposed a host of fiscal and non-fiscal incentives to encourage use of LNG in medium and heavy commercial vehicles.

The report titled "LNG as a Transportation Fuel in Medium & Heavy Commercial Vehicle Segment", notes that India's rapidly expanding trucking market, which is expected to more than quadruple from 4 million trucks in 2022 to roughly 17 million by 2050, offers immense scope for lowering emissions and encouraging investments for growth.

According to the report, the use of LNG as a transportation fuel will lower carbon dioxide emissions as well as contribute towards increasing the natural gas share in the primary energy mix to 15 per cent by 2030.

Studies have shown that the heavy-duty vehicle (HDV) segment is the most significant contributor to air pollution and the largest consumer of fossil fuels.

The report, prepared in partnership with the government of the Netherlands, calls for reducing the value added tax on the sale of LNG to heavy duty vehicles to 5 per cent (from 10 per cent now) and bringing retail LNG price under the ambit of the 5 per cent GST bracket.

Among non-fiscal initiatives, the report calls for preferential right of, priority lane access, free parking and extension of life by 5 years for LNG trucks.

One of the key policy ask in the report involves setting up a demand aggregator company for buying LNG trucks, similar to Energy Efficiency Services Limited — the state-owned agency has acted as a demand aggregator for electric vehicles leading to larger order volumes and cost optimisation.

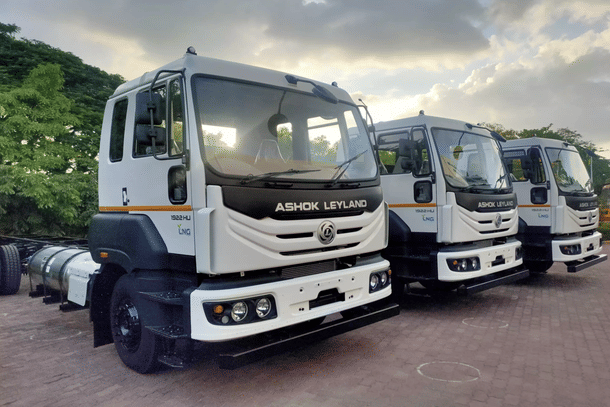

The report also recommends including the LNG-fuelled vehicles in the list of AAT (advanced automotive technology) vehicles eligible for PLI Scheme, thereby providing a major boost to OEMs to manufacture and produce additional LNG vehicles.

Under the automotive PLI scheme, incentives are applicable for determined sales of advanced automotive technology products (vehicles and components) manufactured in India from 1 April 2022 onwards for a period of five consecutive years.