Insta

Budget 2021: Retired Senior Citizens Exempted From Income Tax Filing, Big Relief For All In Assessment Reopening

Swarajya Staff

Feb 01, 2021, 12:56 PM | Updated 12:55 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

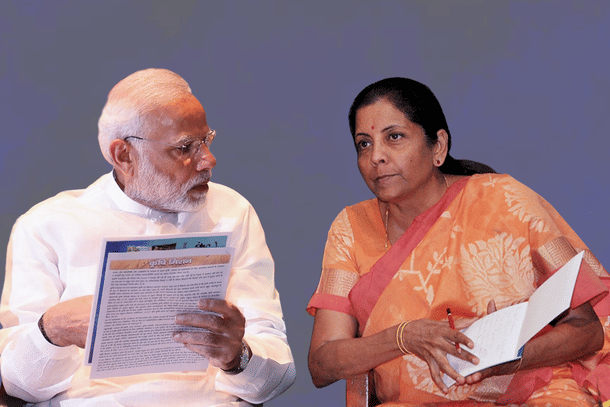

Finance Minister Nirmala Sitharaman during her budget speech on Monday (1 February) announced that senior citizens aged 75 years and above, will no longer need to file their Income Tax returns if they only have pension or interest income.

Sitharaman during the announcement offered her Pranaam to senior citizens, many of whom have strive to build India despite their personal sacrifices.

Sitharaman also said that the paying bank will directly deduct the necessary taxes from their pension or interest income if applicable.

The Finance Minister also announced that the reopening of assessment in tax evasion cases will be slashed from the present six years to three years.

Additionally, only in case of income concealment exceeding Rs 50 lakh or more in a given year would reassessment be opened for 10 years. This assessment reopening will only be permitted after the approval of Principal Chief Commissioner.

In more reforms, TDS deduction for Invits and REIT have been exempted and audit threshold has been hiked from the present amount of Rs 5 crore to Rs 10 crore. This new audit measure will be applicable for those whose 95 per cent transactions are digital.