Insta

Now Invest In Govt Bonds Easily As RBI Offers Hassle-Free Trading For Retail Investors

Swarajya Staff

Jul 13, 2021, 12:34 PM | Updated 12:34 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

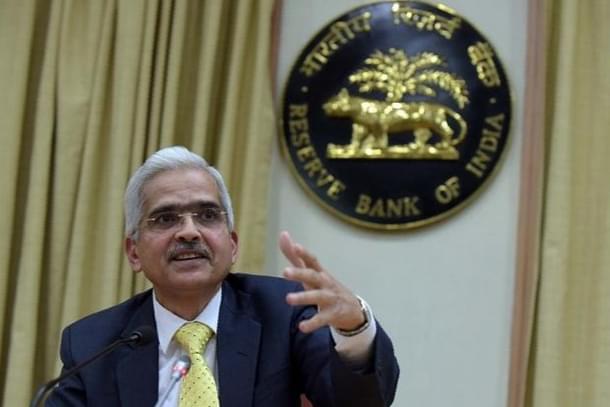

The Reserve Bank of India (RBI) is set to further simplify the process for retail investors to begin trading in government bonds. The retail investors can now open an account with the central bank and start trading in government securities, stated a press release by RBI.

They will be given access to an online portal that is already available for institutional investors, however, the starting date of this ‘retail direct gilt’ (RDG) account hasn’t been disclosed yet.

Retail investors will be accordingly permitted to get registered under the scheme and subsequently maintain a RDG account with the basic know your customer (KYC) formalities.

The account can be registered by filling up an online form and authenticating it with a one-time password (OTP). Thereafter, the account will be validated for the purpose of bidding at primary auctions and also secondary market trading at the Negotiated Dealing System -- Order Matching (NDS-OM).

One bid for each security will be allowed in primary auctions and the payments for the same can be made through net banking, UPI, payment aggregators etc.

On the other hand, investors will have to transfer the funds to their designated Clearing Corporation of NDS-OM (CCIL) account ahead of trading hours or amid the day for secondary market deals.

They will then be allotted a funding (buying) limit to put their ‘buy’ orders on the basis of the success on the actual transfer.

Moreover, securities that have been purchased will be credited to the RDG account on the day of the settlement itself, Business Standard reports.