Magazine

An Open Letter To The Hon’ble Union Finance Minister

Jaithirth Rao

May 14, 2015, 06:30 PM | Updated Feb 11, 2016, 09:34 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The reputation for whimsicality and high-handed arbitrariness that our IT Department has acquired needs to be addressed not only to encourage business, but for a significantly larger moral reason.

Dear Shri Jaitley,

As a taxpayer and as a businessman who has been involved in business in several countries, I am taking this opportunity to give you some suggestions as you go about the task of reforming our Income Tax Administration. I am confining myself to matters of administration rather than those involving legislation. It is frequently remarked that it is relatively easy to pass laws (although that too is a challenge in our country, which you are ably trying to address), but difficult to change the mindset and the operating style of the administrative apparatus, which at the end of the day is what interacts with the taxpayers. To make constructive changes, it is therefore necessary to address some matters in detail.

It is a truism that no one likes paying taxes and that the Income Tax Department in any country is not popular. The Department cannot and should not seek popularity. However, the reputation for whimsicality and high-handed arbitrariness that our Income Tax Department has acquired needs to be addressed not only in order to encourage business and entrepreneurship in the country, but quite frankly for a significantly larger political and moral reason. If taxpaying citizens (and I am deliberately excluding foreign investors in this argument) feel that they are being oppressed, then much more is at stake than FDI or FII flows.

Citizens lose faith in the State as a benign influence in their lives and indulge in acts of silent secession and revolt. Over years and decades, this erodes the credibility of the State itself. The anti- Roman revolts in provinces like Judaea in ancient times were directly related to the popular perception that Roman tax gatherers were tyrannical and rapacious. The Tax Department should aim not for popularity, but for a reputation of justice and fairness.

Here are some administrative items that you may wish to consider:

– Currently, the Department sets collection targets for each Income Tax Officer. This is plain immoral and wrong. The officer’s job is to implement the law fairly and impartially. He/ she is not a toothpaste salesman with sales targets. If one wishes to judge the performance of an officer, it should be by looking at the number of wins and losses when orders are appealed to a tribunal, with a greater positive weightage for wins and a lower negative one for losses. This will ensure that genuine long-term revenue collection happens.Currently, the perverse incentive in the system encourages officers to raise spurious tax demands which are later overturned—but which constitute an act of tyranny against citizens. One cannot blame officers, if their incentives are aberrant.

– Over the years, one of the Department’s priorities seems to be to change the rules, sometimes even the law, to reverse any legal battle that the department loses in the courts. This horrible pattern must be ended immediately. The Executive Branch of great, civilized, legitimate States are characterized by their willingness to accept defeats in judicial chambers gracefully. Every time a taxpayer wins a battle in courts, the government cannot and should not immediately change the law in order to “plug a loophole”—where the loophole is in the eyes of the beholder, in this case the powerful Tax Department.I am not referring only to the recent controversy on retroactive taxation. I am referring to hundreds of new provisions that have been introduced over the decades with the sole intent of hurting taxpayer interests to the benefit of the Department.

– Currently, the system gives each Income Tax Officer the right (some would say, in fact, there is an obligation required of him) to interpret the laws and rules, keeping in mind some technicality to keep going after taxes, even when the broad intent of the Government is to the contrary. I will give you an example from my old industry. The stated intent of the Government of India, in earlier times, was to encourage the IT Industry, if for no other reason than that, it was/ is one that has attained global competitive standards and has been a critical engine in our economy.

Our IT companies provide services to overseas customers both from offshore centres in India and from on-site client locations. The Government has repeatedly stated that both these revenues should be treated as exports and that tax exemption should be available to both streams. In fact, a predecessor of yours said so on the floor of the Parliament. It was/ is clear that there were no doubts in the ministerial intentions.Nevertheless, when the “official circular” was issued, a mischievous proviso was inserted, “provided the invoices and records are in order”. This allows, in fact obliges, the Income Tax Officer to go fishing for records and to assess revenue patently against the desires of all successive Governments to support Indian IT and BPO firms.The only beneficiaries of the circular and its aftermath have been our competitors in China and the Philippines.

The Government must immediately withdraw this right (obligation?) of tax officers to open up technicalities which are against the spirit, if not the letter of the Government’s intentions. In the absence of such a measure, all reassurances that the regime will be taxpayer-friendly are received by the public with a level of cynicism that bodes ill for the country at large.

– Of late, we have noticed that the Indian Income Tax Department frequently comes up with the argument that they are only following so-called international standards. This is a completely fatuous argument. India does not follow international standards on literally hundreds of counts. If we did, then we would not be considered a dismal place to do business in. To pick and choose selectively only those items that are unfriendly to taxpayers and invoke the halo of international standards is laughable.

The recent changes in the Companies Act have been inspired by the American Sarbanes-Oxley Act.Instead of choosing the good points of the US, we had to choose one of their worst and silliest laws to imitate. The only beneficiaries of Sarbanes-Oxley are law firms and accounting firms and the US has lost out as a capital market where foreigners will list on account of this law, which represents a hysterical overreaction to corporate fraud. To blithely bring to India some of the most counterproductive practices of the US Inland Revenue Service, which seems to be the aim of our Income Tax Department, would mean condemning Indian citizens to the worst of all worlds. Let us desist from this silliness.

So far, I have kept the discussion focused on Indian citizens. But I would like to end with a word regarding the sheer anguish of well-meaning foreigners who have tried to do business in India, and who might be regretting it now.

As Indians, we can say whatever we want. The fact remains that one of the few foreign companies that actually invested in manufacturing cellphones in India and which employed tens of thousands of young women has shut down operations largely because of exponentially rising tax demands from our Income Tax Department. Is it not high time that we sat down and calmly analyzed what went wrong and how such gridlocks can be avoided in future? Do we not owe this much at least to those hardworking young women who are currently seeking unattractive jobs elsewhere?

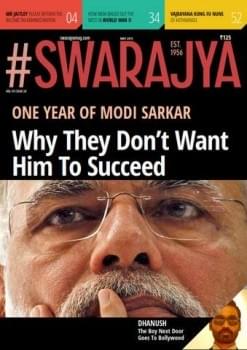

This piece originally appeared in the May 2015 issue of Swarajya. For ₹1500 you can get 12 issues of our magazine, access to Swarajya digital, archives and events. Click here to buy your subscription now!

Another foreign company should, in other circumstances, have been hailed as a success story of oil exploration in India and of the accelerated development of the Barmer region. But it too is embroiled in one dispute after another. The actual technicalities hardly matter. The lack of capacity in the Indian State to bring matters to a constructive closure, the endless sanctimonious posturing, the numerous inter-departmental wrangles within the Government, the inevitable recourse to a legal gridlock which has no respect for the time value of money—all of these end up reflecting on our country as not being serious about economic growth. We know that you and the Prime Minister are keen to change the situation.

Making this change happen on the ground will involve not just legislative action but also a measure of grappling with a great deal of messy detail and taking hard intrusive decisions so that actual administration in the country changes.

Trust me, these changes will be met with immense resistance —casual unfounded allegations of pro-rich crony capitalism and hundreds of attempts to sabotage good intentions with mischievous circulars, obstructive decisions and a general attempt to maintain the traffic jam into which our country has gotten into.

If we are to make sure that more cellphone factories are set up and more oilfields are explored, there is a lot of difficult work ahead for you.

Wishing you lots of luck, because you will need loads of it.

I remain

Sincerely Yours

The author is the former CEO of MphasiS, and was head of Citibank’s Global Technology Division. He is currently the Executive Chairman of Value and Budget Housing Corporation (VBHC), an affordable housing venture. Rao is a member of the Editorial Advisory Board of Swarajya.

The author is the former CEO of MphasiS, and was head of Citibank’s Global Technology Division. He is currently the Chairman of Value and Budget Housing Corporation (VBHC), an affordable housing venture.