News Brief

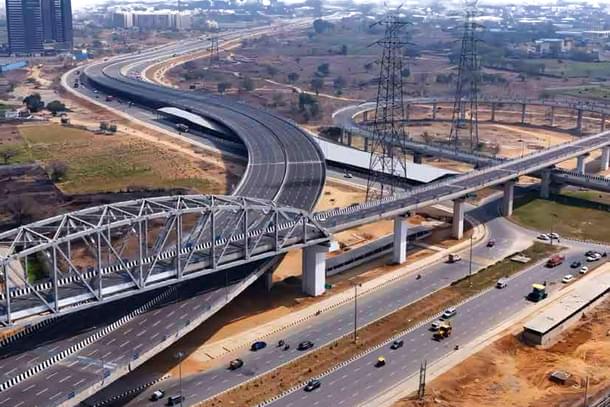

Retail Investors To Soon Get Access To Highway Assets As NHAI Plans Public InvIT

Arjun Brij

Jun 10, 2025, 04:45 PM | Updated 04:45 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The National Highways Authority of India (NHAI) is set to allow retail investors to become equity holders in its highway assets for the first time.

The authority plans to launch a public Infrastructure Investment Trust (InvIT), running parallel to its existing private InvIT — the National Highways Infra Trust (NHIT) which has so far been restricted to institutional investors such as Canadian pension funds Ontario Teachers' and CPP Investments, mutual funds, and the EPFO.

This shift marks a significant diversification of the investor base and reflects the government’s intensified focus on asset monetisation through the PM GatiShakti framework.

“To attract high quality institutional investors and investors with expertise in infrastructure management, NHAI will develop targeted outreach programs across geographic locations and investor profiles,” states the authority’s strategy document.

Through its private InvIT, NHAI has raised Rs 43,638 crore over four rounds by monetising 2,345 km of highways. The introduction of a public InvIT will enable two monetisation rounds annually, compared to just one at present, offering a more dynamic and inclusive funding model.

In tandem, NHAI is overhauling the Toll Operate Transfer (ToT) mechanism. The new approach will see the offer of three asset bundles each quarter, tailored to attract a wider range of investors: a small bundle targeting Rs 2,000 crore, a medium one at Rs 5,000 crore, and a large bundle projected to raise Rs 9,000 crore.

Till date, 11 bundles totalling 2,689 km have been monetised through ToT, yielding Rs 49,000 crore.

In addition, securitisation of toll revenues, particularly from high-traffic corridors like Delhi–Mumbai, has raised Rs 40,000 crore.

In total, Rs 1.4 lakh crore has been raised via NHAI’s monetisation efforts, which are now being reinvested into new highway projects, reducing reliance on government funding.

“Additionally, private sector participation will bring in advanced technologies and management practices, enhancing the quality and longevity of our road assets and enhancing road user experience,” NHAI Chairman Santosh Kumar Yadav remarked.

This strategy also aligns with the upcoming second National Monetisation Pipeline (NIP), which targets Rs 10 lakh crore in the next five years, with the road sector expected to contribute Rs 3.5 lakh crore.

Arjun Brij is an Editorial Associate at Swarajya. He tweets at @arjun_brij