Analysis

As Countries Pour Billions To Onshore Chip Manufacturing, TSMC Founder Morris Chang Calls Shift Towards 'Semiconductor Self-Sufficiency' As Costly Mistake

- Morris Chang, the founder of Taiwanese chip manufacturing behemoth TSMC, has expressed concern over the concerted efforts by nations to bring chip production onshore in a bid to achieve self-sufficiency in semiconductors.

- While acknowledging that it was prudent for countries to have a chip-making capability for national security applications, Chang said that for the much larger civilian market, a supply chain substantially based on free trade system is by far the best approach.

- U.S, Japan and European Union have unveiled plans for new wave of investment to keep chip manufacturing within their borders.

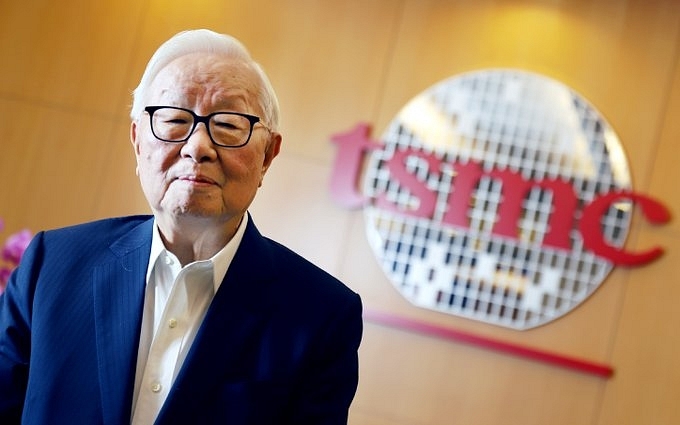

Morris Chang, TSMC

Morris Chang, the founder of Taiwanese chip manufacturing behemoth TSMC, has expressed concern over the concerted efforts by nations to bring chip production onshore in a bid to achieve self-sufficiency in semiconductors, Nikkei reported.

90-year old Chang, a protégé of K T Li, the Taiwanese godfather of technology, is widely credited with scripting the TSMC'S meteoric rise as chip manufacturing giant. TSMC is currently the world's biggest contract chipmaker with more than 50% of market share, supplying major chip developers from Apple, Qualcomm, Nvidia, NXP to Sony and hundreds of others.

Chang said that the move could backfire and will fail to achieve self-sufficiency despite billion of investments that is likely to be poured in to chip manufacturing.

Semiconductor manufacturers worldwide are set to commence construction on at least 19 new high-volume fabs by the end of this year and break ground on another 10 in 2022 , according to a quarterly World Fab Forecast report by SEMI, an industry association comprising companies involved in the electronics design and manufacturing supply chain.

"Recently, we note with concern the tendency to want self-sufficiency or ‘on-shoring’ of semiconductor chips,” Chang told the APEC trade group, “it would be highly impractical to try to turn back the clock. If it is tried, cost will go up and technology advance may slow.”

“What may happen is that, after hundreds of billions and many years have been spent, the result will still be a not-quite-self-sufficient, and high-cost, supply chain,” Chang added.

While acknowledging that it was prudent for countries to have a chip-making capability for national security applications, Chang added a cautionary note on need to onshore chip manufacturing for commercial applications.

“For the much larger civilian market, a supply chain substantially based on free trade system is by far the best approach.” Chang said.

Chang added that over the past several decades, free trade has powered the advancement of semiconductor technology. "In turn, the ever greater complexity of the technology has caused the supply chain to go offshore."

"It would be highly impractical to try to turn back the clock. If it is tried, costs will go up and technology advancement may slow," citing his own speech at the APEC leaders' virtual meeting.

Much of the world is currently dependent on Taiwan and its dominant chip manufacturing giant, TSMC, to supply chips. But the island nation faces supply chain shocks and growing geopolitical concerns about China's expansionist designs — concerns that have accelerated U.S. plans to get TSMC and competitors to set up shop on U.S. soil too.

The U.S. Senate recently passed a bipartisan bill worth $52 billion to support the domestic chip industry. In February, President Joe Biden signed an executive order mandating a review of supply chains of critical goods, products and services to reduce dependence on China and other rivals.

Europe too is planning to reshore part of the manufacturing, including in a cutting-edge factory, or "fab," on the Continent.

If Europe wants to build a mega, cutting-edge factory, or "fab," it needs to attract at least one of the world's top three manufacturers — TSMC, the U.S.'s Intel or South Korea's Samsung — to invest roughly €20 billion in a new foundry.

EU Commissioner Thierry Breton is putting together a multibillion-euro plan for the semiconductor industry.

Breton has an expansive vision that aims to catapult Europe to 'technological sovereignty' in semiconductor domain by creating capability to manufacture ultra-sophisticated chips for smartphones, cloud computing and artificial intelligence.

"Europe must have this ambition," Bretton said, referring to plans to produce 2-nanometer chips — the industry's most advanced target — by 2030.

European Union aims to double the production of chips on its territory in order to increase its global share to 20%.

In April, Bretton met Intel’s Chief Executive Officer Pat Gelsinger to discuss the idea.

EU wants to mobilise a public-private funding to tune of €20 billion-30 billion to operationalise its semiconductor manufacturing ambitions

Gelsinger recently met French president Emmanuel Macron and Italian prime minister Mario Draghi to discuss the impact of global chip shortage.

Intel is reportedly seeking at least $9.7 billion in public subsidies towards building a semiconductor factory in Europe.

Erstwhile chipmaking champion Japan is also plotting a plan to regain lost glory in Semiconductor world.

Japan is hoping to invest at least ¥1 trillion ($9 billion) toward chip development this fiscal year and trillions more after that, if it is to have any hope of reviving its national industry, according to Tetsuro Higash, the government’s lead adviser on semiconductor strategy.

Japan is currently pursuing an all-out strategy to lure overseas semiconductor companies, including designing generous financial incentives.

"Japan will swiftly match efforts by other countries to attract cutting-edge chipmaking facilities so it can build a secure supply chain at home," a recent note presented to a Cabinet Office stated.

Japan lags behind South Korea and Taiwan in advanced chip manufacturing. It imports more than 60% of its semiconductors, much of them from Taiwan and China.

Also Read:

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest