Business

Ukraine Crisis Poses A Challenge For Semi-Conductor Supply And Auto Industry Revival

- India Ratings and Research (Ind-Ra) has revised its outlook for the auto sector for FY23 to neutral from improving, primarily on account of supply-side constraints and a muted rural demand.

- Ind-Ra expects auto domestic sales volumes to grow 5-9 per cent year-on-year in FY23, after three consecutive years of decline.

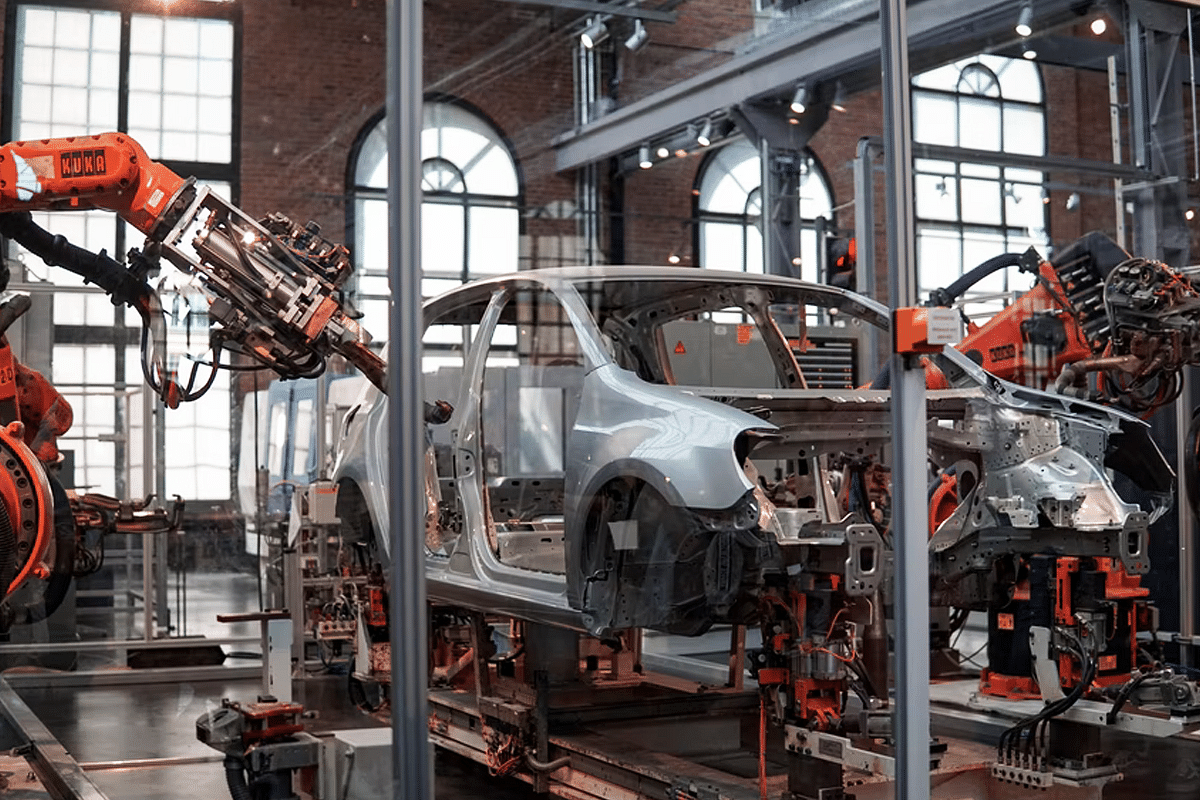

Representative Image (Unsplash)

The near-term outlook for the Indian auto industry remains woven in challenges as supply crunch with ongoing geopolitical tensions sparked off by Russia-Ukraine situation could spike commodity prices and crude oil prices and exacerbate supply chain issues.

Furthermore, a slower recovery in rural sales and further price hikes by original equipment manufacturers could act as possible headwinds for the sector, according to several analysts and industry bodies. Precious metals and neon gas which comes from the war-hit zone will further slow the supply of semi-conductors, thus making waiting periods longer for passenger vehicles (PV).

Though demand for PV has remained strong, customers refrained from making purchases which led to retail sales of two-wheelers and PVs falling by 4 per cent and 5 per cent, respectively, on a year-on-year basis in March 2022, according to the Federation of Automobile Dealers Associations (FADA).

Commercial vehicles continue to record double-digit growth when compared to last year, even though the ride to pre-covid levels is still an uphill task. While for the total fiscal 2022, total vehicle retail increased by 7 per cent year-on-year, it fell by 25 per cent when compared to FY20, which was largely a pre-covid year.

Tractors and two-wheelers with low single-digit growth, which largely represents rural India, underperformed, thus giving signals of stress which continues to prevail in that specific market. Rising international crude prices, which crossed $100 mark for the first time since 2014, have also resulted in petrol/diesel prices skyrocketing and have connived with increase in raw material costs and consequent rise in prices of vehicles to negatively impact consumer confidence.

In terms of wholesales, March also shows a continued impact on auto production in the country due to shortage of electronic components. Manufacturers such as Maruti Suzuki and Hyundai Motors posted a decline in wholesales with Maruti Suzuki selling 8 per cent fewer units at 137,658 last month in the domestic market compared with a year earlier.

The shortage of electronic components had some impact on the production of vehicles in FY 2021-22 and since the supply situation of electronic components continues to be unpredictable, it might have some impact on the production volume in FY 2022-23 as well, the company has said.

Hyundai Motor India sold 44,600 units in the domestic market, while exporting 10,687 units in March 2022. For the full fiscal, the company posted a growth of 2 per cent in domestic sales to 471,535 units.

While Mahindra & Mahindra’s passenger vehicle wholesales grew 65 per cent in March to 27,603 units, and 44 per cent to 225,895 for the full fiscal, automotive division CEO Veejay Nakra said the company remained ‘watchful of the global supply chain’. Meanwhile, Honda Cars recorded annual sales growth of 4.3 per cent to 85,609 units in FY22. Domestic sales for March were lower at 6,589 units compared with 7,103 units a year earlier.

Not surprisingly, India Ratings and Research (Ind-Ra) has revised its outlook for the auto sector for FY23 to neutral from improving, primarily on account of supply-side constraints and a muted rural demand. Ind-Ra expects auto domestic sales volumes to grow 5-9 per cent year-on-year in FY23, after three consecutive years of decline (likely 5-8 per cent decline in FY22).

Passenger vehicle volume could grow 5-9 per cent year-on-year in FY23, driven by an intermittent improvement in consumer sentiments and continued preference for personal mobility, although supply chain issues could limit the growth. Semi-conductor chip shortages could also persist for the next few quarters while improving gradually.

However, increased cost of ownership, a slower revival in the purchasing power of lower-end consumers and a muted rural demand could limit two-wheelers growth at 5-8 per cent year-on-year for FY23 but commercial vehicles (CV) volumes are likely to grow in high double digits of 16-22 per cent year-on-year in FY23 mainly supported by medium and heavy CVs, aided by an uptick in economic activities and increased infrastructure spending.

Ind-Ra expects industry revenues to increase 13-15 per cent year-on-year during FY23, after likely growth of 14-17 per cent year-on-year in FY22, largely driven by price hikes undertaken by OEMs and increased mix of CVs which have higher realisation. The industry could also see incremental Production Linked Incentive (PLI) scheme related capex in FY23. However, refinancing risk is low for the industry and there is adequate rating headroom, says Ind-Ra.

While FADA remains extremely cautious in terms of any recovery in sight until the Russia-Ukraine conflict and China lockdown come to an end, the government’s thrust on capital expenditure in 2022-23 can, however, be the gamechanger this time around by enhancing productive capacity, crowding in private investment and strengthening aggregate demand amidst the conducive financial conditions engendered by the Reserve Bank of India (RBI), and improving business and consumer confidence.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest