Economy

With Modinomics, India Finally Gets Industrialisation Right

- Domestic liberalisation, moderate protectionism, hard/soft infrastructure, and financial innovation – Modinomics represents the right mix of free markets and swadeshi, a pragmatic ‘Indian system’ of economics that delivers.

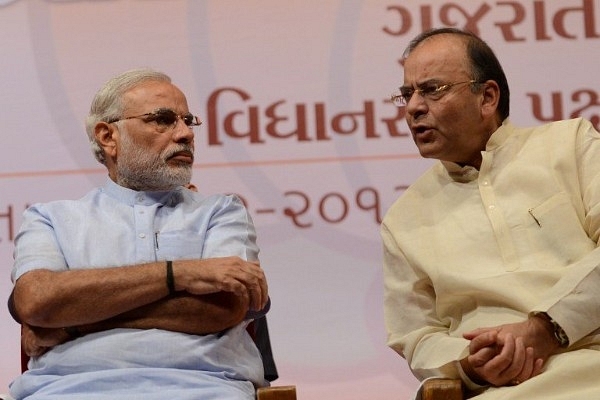

Narendra Modi And Arun Jaitley

India's last millennium has not been a very productive one. My best estimates for relative incomes in England and India based on the available research (Broadberry/Gupta, Madison, etc.) is shown below - moreover, the inequality in medieval India by some measures was probably worse than, say, contemporary England or Japan, hence median as opposed to mean incomes might paint an even worse picture. While the comparative fall has been terrible for the Indian economy, even in absolute terms, there was hardly any sustained improvement in per-capita incomes till about the mid-19th century. However, India has now started converging with the West and Japan, and recently with China too.

Moreover, almost every new addition to the Indian labour force will be literate, irrespective of gender (In 2021, women in the 15-24 age bracket are likely to have 96% literacy and even higher for girls below the age of 15). Moreover, the female labour force participation rate has bottomed out around the low 30s in percentage terms for the 25-65 age group. Just like demographics is a secular tail wind for India in the coming decades, so is technology - as I explained in my last article.

However, there is no scope for complacency, and good policy-making matters. India clearly has surplus labour (even if increasingly literate labour), in the sense that there is disguised unemployment in the agricultural sector - we can produce the same food with 20x fewer farmers; the technology is already there.

Now, China has reached or is about to reach its "Lewis turning point" by employing hundreds of millions of men and women in manufacturing exports, construction, infrastructure and urban services sectors. India unfortunately is way behind - partially because we messed up our industrialisation. Initially, when we went for protectionism, we also killed domestic economic freedom. Then in the 90s, when we started to corrected the latter, we over-compensated on the former as well. Thankfully, such debates are hardly new.

In 1790, the first US President, George Washington, noted that free peoples must "promote such manufactories as tend to render them independent of others for essential, particularly military, supplies” while still supporting general trade. His treasury secretary, Alexander Hamilton, came up with his "report on manufactures" the next year. He acknowledged the partial validity of concepts such as 'free trade' and 'comparative advantage', though he did not use those terms.

However, Hamilton, worried about the "strong influence of habit and the spirit of imitation" i.e. if industrialisation is not kick-started, and foreign trade is unfettered, then industry could concentrate in other countries even as there is de-industrialisation at home - which is exactly what happened with India under British colonialism. Today, we might use terms such as "path-dependent outcomes" or "structural traps" or "coordination problems" for these scenarios.

Hamilton recommended various tariffs and "bounties" including internal improvements / infrastructure, domestic commerce, and moderate tariffs against foreign goods. He never endorsed tariffs so large so as to make imports absolutely non-competitive. Indeed, the local industry eventually went over to the side of much more protectionist leaders such as Jefferson and Madison.

Yet, Hamilton, who was shot dead in a duel later, had the most dazzling economic legacy as his programme was by and large followed throughout the 19th century and in the first half of the 20th. Leaders such as Henry Clay, Abraham Lincoln and German-American intellectuals such as Friedrich List fine-tuned this "American system", in contrast to the 'free trade' colonial "British system". Later, Germany and now East Asia has also largely followed the American catch-up model.

Scholars such as economic historian Robert Allen have summarised the "standard" (now heterodox) model of catch-up. I have paraphrased the "formula" below, along with adding what Modi's government has implemented along that axis, as well as linking relevant articles:

- "Have no internal tariffs and build good transportation infrastructure" (The GST finally created one Indian market; moreover, highways, expressways and other logistics' cost reducing infrastructure is being prioritised again)

- "Have moderate external tariffs, especially on manufacturers" (From smartphones to textiles and more, India has raised tariffs to give marginal protections to domestic manufacturing, while liberalising investments by foreign companies to increase competition and transfer best practices)

- "Make the financial system efficiently allocate savings to businesses" (From the new bankruptcy code to listed infra/real estate trusts to inflation targeting, many such measures have caused short term pain but will lead to faster growth in the coming years)

- "Invest in basic human capital" (While education has not been a priority so far, literacy is already almost universal amongst the 25 or less age group; "Modicare" if implemented well and the deworming campaigns will further strengthen human capital)

There are at least two twists to keep in mind with respect to this 19th century formula for the early 21st century. One, the average minimum efficient size of factories across sectors has increased multi-fold so, having a large domestic market or partially asymmetric access to global markets is important - India, which will soon have the world's largest population, and is increasingly closer to America and Japan geo-politically, meets this criterion.

Second, the need for a "big push"; since the poorest countries are now almost two orders of magnitude worse off in per capita income terms compared to the richest ones, even after adjusting for cost of living - convergence ambitions have to be more ambitious. A domestically statist catch-up can work but seems to inevitably hit a ceiling as a more complex economy cannot ignore the power of incentives (call it the 'middle income trap' if you will), so having at least domestically free markets makes a lot of sense. The Indian private sector is already very sophisticated, and there is no permission required as such for new capacity etc., the way it was required earlier during the licence raj.

The orthodox, Western recommendations for faster growth today are of course about factor market reforms - land, labour, capital - and privatisation etc. There is clearly some overlap here with the heterodox approach - especially on capital market reforms, on making sure domestically labour is mobile, on perhaps public-private partnership approaches to health/education, and so on. Indeed, the Modi government has reformed contract labour hiring even as he proceeds with disinvestment but not privatisation yet.

Nonetheless, what is clearly missing in the orthodox free market approach is a focus on two crucial issues - infrastructure and strategic trade policy. This is of course a result of American dominance towards the end of the twentieth century (when the USSR had fallen, and "Communist" China had not yet risen) - free trade after all was not just an economic concept but also a geopolitical one, and secondly a lot of good infrastructure had already been built in the West/Japan.

India must pragmatically choose the economic policies that suit its national interests, and not blindly follow any dogma no matter how well-credentialed the divine behind it is. With Chinese manufacturing being 10x India's size right now and Donald Trump rewriting rules of global trade, we must think for ourselves. There is nothing to be afraid of - even regarding the West, we have given their "FAANG" tech stars more or less full access to our domestic market unlike China. There will be a lot of deal-making and technological innovations in the coming decades alongside fast growth; what we need is a dynamic Indian school of economic thought that combines the best of free markets and "Swadeshi".

This piece was first published on the writer’s LinkedIn page and has been republished here with permission.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest