Business

Credit Inquiries Touched A Record High During Festive Season: TransUnion CIBIL Report

Sourav Datta

Nov 18, 2021, 04:57 PM | Updated 05:00 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

According to TransUnion CIBIL’s Credit Market Indicator (CMI), India’s credit market has been resilient despite the pandemic. TransUnion CIBIL is one of the four credit bureaus operating in India. In a recently released report, the credit bureau analysed the retail credit market trends in India.

The report concluded that credit demand and supply have seen resurgence, and it expects credit growth to continue. The CMI takes into account four primary factors – demand, supply, consumer behaviour, and various performance metrics.

How Has The CMI Fared In The Past?

Between 2016 and the first half of 2017, the CMI saw a sharp decline as credit growth rates moderated. In addition, delinquencies saw a slight increase during the period. But between the second half of 2017 and the beginning of 2018, the CMI witnessed an upward trend as non-banking financial services and financial technology companies helped create demand and eased supply in the markets.

Fin-tech companies have made access to credit easier for users with various lending products. The advent of fin-tech has allowed financial institutions to grow their loan books quickly as partners with fin-tech companies.

However, India witnessed the IL&FS Crisis in 2018, which had a ripple effect over the economy. Financial institutions such as non-banking financial companies (NBFCs) that had been on a lending spree, saw asset quality deteriorate and credit costs increase, further putting pressure on the CMI. As the economy slowed, demand for credit suffered as well.

Pandemic Woes Over?

The CMI remained on a minor downtrend, further aggravated by the pandemic that struck in 2020. The CMI Value declined from 100 to a low of 78 till around November 2021. However, CMI almost immediately saw an exponential rise as the economy opened up with demand returning. Currently, the CMI Value stands at 87 in contrast to the previous year’s 78, indicating a return in both the demand and supply of credit.

The festive demand spurred credit growth as well, with credit inquiries reaching a record high during the first week of November. According to the report, inquiries jumped up by 54 per cent between February and August 2021.

In comparison, it had seen a decline of 12 per cent the previous year over the same period. Fin-tech firms’ Buy-Now-Pay-Later (BNPL) schemes were quite successful, with several platforms recording more than 100 per cent disbursal growth. Reserve Bank data appears to be backing these claims as well, with India seeing a 6.8 per cent non-food credit growth in September 2021, as compared to 5.1 per cent growth in September 2020.

The increase in demand has been led by consumption-driven loans. Between February and August, the demand for consumption related loans increased by 29 per cent as compared to a decline of 42 per cent during the same period in the previous year.

According to a BusinessLine report, banks lent out Rs 127,742 crore during the fortnight ended 5 November, during the festive season. The amount was four times the money lent in the previous year’s fortnight.

However, credit performance has been impacted due to relatively weak financial health of consumers. There has been an increase in delinquencies across key products. But, home loans have witnessed the lowest deterioration rates.

Who Is Leading Credit Growth?

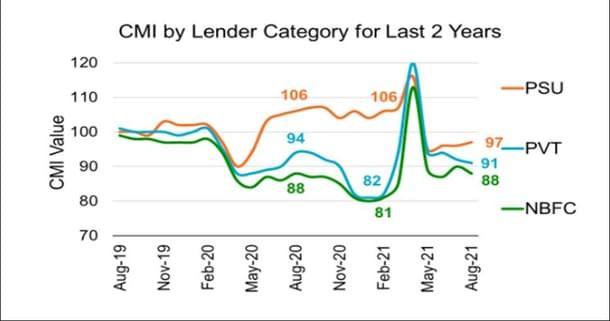

Public sector banks felt a less negative impact as compared to private banks and NBFCs, because these banks had resumed lending post the initial lockdown.

However, as the pandemic declined, NBFCs and private banks have seen their CMI supply increase, according to the report. CMI demand however, saw an almost uniform increase for the three lending groups. NBFCs saw a lower recovery as delinquencies increased and liquidity was constrained.

While loan originations have increased, lenders appear to be becoming cautious as approval rates declined by 4 per cent between August 2020 and August 2021. Further, the share of new credit users in loan originations has fallen from 18 per cent in August 2020 to 15 per cent in August 2021.

Further, states that recovered from Covid did much better than states that suffered from Covid related issues. Maharashtra showed the strongest increase of four points in CMI, whereas Kerala saw a CMI decline of 12 points. Possibly with lockdowns, both credit growth and demand had been affected in some states.