Business

RBI Hikes Repo Rate By 50 Basis Points To 5.9 Per Cent; Revises Down FY23 GDP Growth Forecast To 7 Per Cent

Swarajya Staff

Sep 30, 2022, 10:35 AM | Updated 10:44 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Reserve Bank of India (RBI) on Friday (30 September) hiked the benchmark lending rate by another 50 basis points to 5.9 per cent.

The hike is part of RBI's efforts to check inflation, which has remained above the central bank's tolerance level for the past 8 months.

With the latest hike, the repo rate or the short term lending rate at which banks borrow from the central bank is now close to 6 per cent.

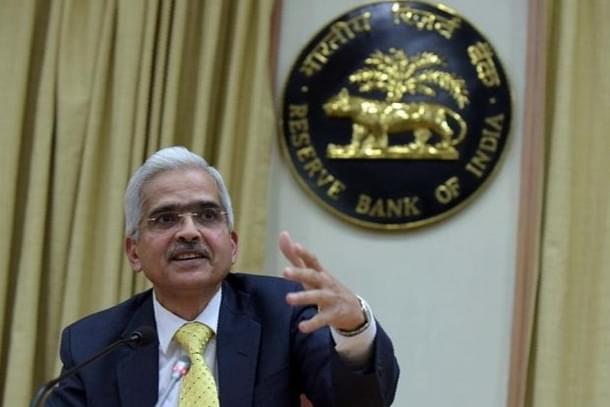

The decision by the six-member Monetary Policy Committee (MPC) was announced by RBI governor Shaktikanta Das.

This is the fourth consecutive rate hike after a 40 basis points increase in May and 50 basis points hike each in June and August. In all, RBI has raised benchmark rate by 1.90 per cent since May this year.

The RBI also lowered its economic growth projection for FY23 to 7 per cent from earlier estimate of 7.2 per cent.

The central bank retained the inflation projection at 6.7 per cent for the current fiscal.

The Consumer Price Index (CPI) based inflation, which RBI factors in while fixing its benchmark rate, stood at 7 per cent in August. Retail inflation has been ruling above the RBI's comfort level of 6 per cent since January this year.

Das said that the recent correction in global commodity prices if sustained may ease cost pressures in coming months.

(With inputs from PTI)