Business

What The 11-year Low In Oil Prices Means For Geopolitics And Economics

Swarajya Staff

Jan 07, 2016, 09:58 PM | Updated Feb 12, 2016, 05:29 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

How will geopolitics and geo-economics be impacted now that oil has hit the skids again?

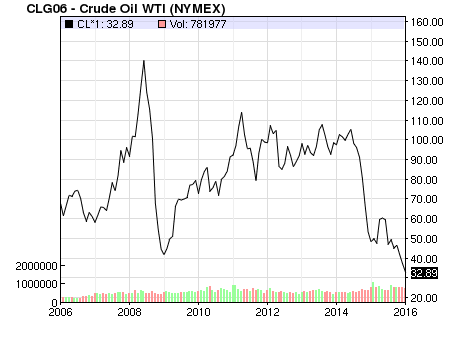

Now that oil has hit the skids again – Brent crude hit a 11-year low on 6 January, falling below $35 – it is worth looking at its potential implications, both for geopolitics and geo-economics.

The first impact will obviously be on the producers themselves, most of them unstable regimes in West Asia. While oil will be profitable even at this price, the problem is that for many countries oil is not about seling profitably, but about bankrolling their government budgets.

The IMF and Deutsche Bank did indicative studies to figure out what level of oil price is vital for them to finance their spending programmes. Apparently, Libya can’t get by even with oil at $180 a barrel; Qatar needs $80, Russia and Saudi Arabia around $105 and Iran at $130.

Since oil is nowhere near those levels, it is a safe bet that these countries – in fact, the whole Islamic world – will not be able to keep their own populations happy through subsidies and welfare. So the Islamic world, already at war with itself and with the rest of the world, could become more unstable and violent.

Unstable governments will thus try to distract public opinion by rousing passions against external enemies. The recent Saudi-Iran spat over the execution of a Shia cleric in Saudi Arabia which ended with the latter snapping diplomatic ties with Iran, is a pointer to what lies ahead.

Side-effect: If oil stays this low, some of the Gulf countries that employ lakhs of Indians, could start downsizing their ambitions and send some of the Indians home.

The case of the US is interesting. As the world’s biggest energy consumer, falling energy prices will come as a great boon to consumers and businesses. But the US had also become the world’s biggest oil and gas producer with the rise of shale oil and gas production, which helped bringing manufacturing back to the country after moving offshore for many years.

The oil price crash has changed things around, with shale oil and gas becoming more and more unviable ($50 is said to be a viable price for shale on an average). So, at the cost of a huge drop in output and employment in shale, the rest of US industry stands to benefit – just like India.

An aside: The Saudis are said to be keen to keep oil prices low both to gain market share and to put shale competition out of business. But far from achieving this, the Saudis may actually end up benefiting the US in some way, even while Islamic violence spikes in its neighbourhood, from Syria to Iraq to Yemen.

The US is happy to receive cheap oil from any source, including the Gulf. If not, shale will do, thank you. Shale has changed the bargaining power of Opec vis-a-vis the US. There is, in fact, talk of the Saudis and Iran not pumping more oil out, the former to keep Iran down, and the latter as sanctions come to an end.

Oil politics and economics will continue to stay in a state of boil in 2016.

The sharp drop in oil, by destroying revenues of the oil producers, adds a new recessionary element to the prospects of global growth.

2016 starts with the US possibly heading into recession, Japan and Europe struggling to stay afloat, and China slowing down. The sharp drop in oil will reduce demand from the entire oil producing zone in West Asia, lowering global growth further.

When oil and commodity prices fall, economic power shifts to consumers from producers.

This is why India is a net beneficiary of a global fall in commodity prices, especially oil. As an importer of 80 percent of our oil requirements, the fall in Brent prices brings our imports down faster than exports.

While commodity exporters (iron ore, and steel) suffer, commodity importers gain. The suffering will be high in the mining and metals sector, And the entire manufacturing sector will see lower costs in fuel, raw materials and taxes (as most commodity taxes are ad valorem), but there will be more than commensurate gains in bottom lines and corporate health.

2016 will not see a major revival in growth in India as the export engine will not fire too well, but it will signal a turnaround in fortunes that will begin to show up from the second half of 2016-17.

The world’s fortunes, though, is another story. We have to worry about the prospects of more terrorism and a slow slide into chaos in large parts of the Islamic world, with some negative consequences for us and the world.