Commentary

Munaafaa – The Missing Link of Businesses Today

Praveen Patil

Oct 02, 2014, 06:56 PM | Updated Apr 29, 2016, 12:41 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Recently Rajshri Productions celebrated 20 years of ‘Hum Aapke Hain Kaun..!‘, which is undoubtedly one of the landmark Hindi films to completely revolutionize the business of movie-making in India. The economics of this film was way ahead of its time as it was the first Indian movie to breach the 100 Cr mark some 14 years before it became an industry norm (Aamir Khan’s Gajini was the first post-modern film of the 21st century to enter the 100 Cr club in 2008). Made at a total cost of a paltry 4.5 Cr rupees, this film went on to collect 133 Cr rupees in India alone, which was further enhanced to about 150 Cr in the worldwide market. When we add the audio sale revenues of more than 20 Cr, home video, TV and satellite revenues along with other merchandise, the total comes close to a whopping 200 Cr rupees!

For every rupee invested, Rajshris earned an incredible 30 rupees in return (after reducing theatre rents and other distribution costs)! Now that is what the Marwaris and Gujaratis term as “Chauka Munaafaa“. Not surprisingly, the Barjatyas, who own Rajshri Productions, belong to the Marwari community and really understand the value of each rupee. A little bit of background information and the impact of HAHK on the Indian movie industry is needed to understand why it was such a pioneering effort in terms of movie-economy of India, more than just earning a mind-boggling profit for its makers.

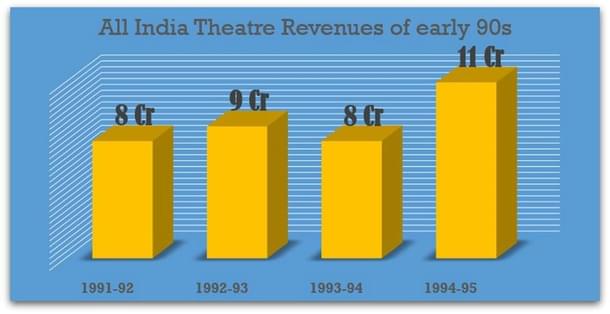

1.Before HAHK was released in August 1994, the film industry in India was going through an unprecedented recession due to the onslaught of satellite TV and video piracy as families simply refused to venture into movie theatres.

2.The situation was so calamitous that many production houses purely depended on audio sale revenues and had simply foregone theatrical revenues (for Ex: T-Series produced movies like Lal Dupatta Mal Mal ka, Jeena Teri GaliMein which made huge profits by just selling audio tapes without even seeing a proper theatrical release. Mahesh Bhatt, one of the leading film makers of that era, made an exclusive TV movie for ZEE TV, Phir Teri Kahaani Yaad Aayi, because he was so sure of earning revenues by purely audio sales alone.)

3.It was in such adverse conditions that HAHK was released and created history. For instance, before HAHK, any movie that made 10 Cr rupees in the all India circuit was considered as a ‘blockbuster’, but HAHK made 12 times more money which suddenly doubled the blockbuster barometer to 20 Cr rupees all India collections.

4.As per trade analysts of that era, weekly all India theatre revenues jumped by a whopping 40% in 1994-95 to 11 Cr rupees from 8 Cr rupees in 1993-94, courtesy the families revisiting theatres due to HAHK

5.The overall immediate impact of HAHK on the Indian movie business was that it singlehandedly expanded the market by more than 60%. But its long-term impact is even more dramatic as it is said to have created a whole new market for family dramas with women as the primary target audience which gave rise to an entire television industry of saas-bahu

Recently, another interesting bit of news caught our attention, the 1 billion dollar fund raising by Flipkart, possibly India’s top e-commerce portal, which has raised more questions than answers. It is the way they are going to utilize those 6000 Cr rupees that raises these questions, for the intention is never to make money by making a smart investment, instead most of that money would be used to lose more money!

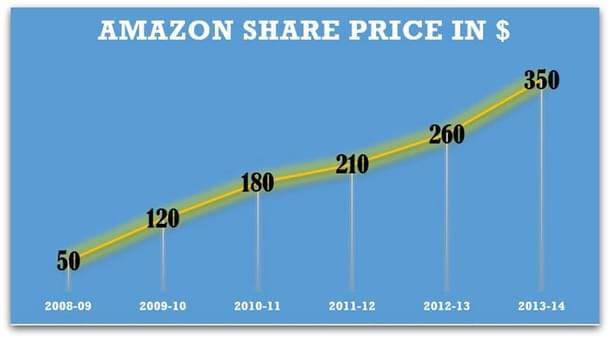

Flipkart is not alone in this endeavour, mind you, it is only following in the footsteps of its bigger global cousin, Amazon, which has defied all odds of financial gravity by growing impossibly beyond all expectations. That growth of Amazon has again come on the back of losing more money. In the last 8 years, the stock price has gone up a whopping 800% from 60$ to 400$ and it reported 126 million $ losses this quarter, which has been a continuing saga and not just an aberration. Quarter after quarter, Amazon keeps making losses while its stock price keeps rising and, by the way, after Flipkart raised those 1 billion dollars, Amazon announced its own plans to invest 2 billion dollars in its India operations. This will only lead to more pricing wars, more technological and logistic investments and more losses for both the players. The only thing missing in both these e-commerce companies is a profitable balance-sheet. In fact, Amazon’s P/E ratios are as high as a mammoth 500 times!

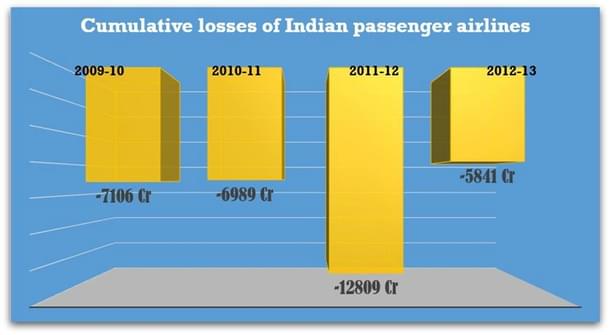

This is not a disease unique to e-commerce, but seems to be infecting every new business of our times. Every TV news channel in India is bleeding, every internet media organization is a white elephant that is forever hungry, every airline company is suffering losses every day… the list is endless and in every known new sector. The whole business model of making profits out of an investment has been turned upside down, instead a new business model of continuously investing has been instituted and nobody really knows when profits will start accruing, if ever.

Why have we come to this state? This new digital era where the whole world is connected should have ideally made more profits for all kinds of businesses, instead the internet seems to be a giant black-hole where all the money simply gets sucked up. We advertise more, we sell more, we have wider geographies to cater to, we have a much larger audience, our distribution and publishing costs have come down drastically and yet we make huge losses every day. All of this defies our classical business logic, doesn’t it?

The answer probably lies with the Brajatyas and ‘Hum Aapke Hain Kaun..!‘, which may sound as a frivolous pop-economics theory, yet let us try and understand the HAHK phenomenon. 20 years ago the Barjatyas released the movie in just 26 screens, mostly in the Bombay circuit instead of having a big all India release. Market was not flooded with promos, trailers, news and scandals, instead the entire marketing campaign was very low key and discerning. The movie was only released in upgraded theatres with better sound quality and better seating, which meant an increase in ticket prices of anywhere between 15 to 25% (in an extremely price conscious market like India this was considered to be a daylight suicide by trade analysts).

The product itself (HAHK) contradicted every known conventional saleable factor of that era, it had no violence, no sensuality and not even emotional highs and lows as it was a one-track story of a large joint family with never-ending weddings and 14 songs, many of them in the Bhajan format. Yet, an MTV generation of Indians flocked to theatres week after week, month after month, again and again to defy all logic or assimilated acumen. What started with just 26 prints went on to screen in an incredible 3500+ theatres!

The problem with most businesses of today is that they are blindly following the only model that is perceived to be viable in this digital era; to over market, over sell and under-price – the Amazon-Flipkart pathway – ,whereas the lessons that HAHK teaches us are something unique. To not flood the market and create a unique demand-supply paradigm of retaining the mystique of a product or a service and to expand in a phased manner by staying within the parameters of profitability to eventually reach out to the widest possible target audience. Such a business model has three distinct advantages;

- In this era of fast shifting loyalties, it creates a unique exemplar that slowly grows on you, which helps a product or service to last longer than a quick bombardment can afford (ex: quick shifting loyalties in the social media world from MySpace to Facebook to Whatsapp to Hike etc. as compared to being slowly overwhelmed by a Google or a Gmail etc. where “less” is celebrated).

- Phased expansion renders a unique ability to tweak the model at each level to adjust to changing requirements of the target audience (for instance, HAHK was tweaked after the initial response from the audience by deleting two songs and reducing the length of the movie because it had initially seen only limited release, whereas movies of today are released so widely to begin with, that tweaking along the line is an impossibly expensive affair).

- A sustained profitable venture: due to non-commitment of large unwarranted funds at the very beginning and instead going for phased capital expansion parallel to profitability.

Finally, ‘word of mouth’ is a unique marketing phenomenon that has never really been either fully understood or practically executed with a reasonable amount of success (Ponzi schemes of the MLM variety belong to the shadier side of this paradigm). In this era of an increasingly connected global world order, the power of word-of-mouth has only increased exponentially and can also travel at extremely fast time-frames. If utilized and executed positively in an uncluttered manner, this can revolutionize businesses in hitherto unimaginable ways… all we need to do is rediscover the mystique of fully clothing a product as opposed to in-your-face nakedness.

Analyst of Indian electoral politics and associated economics with a right-of-centre perspective.