Context

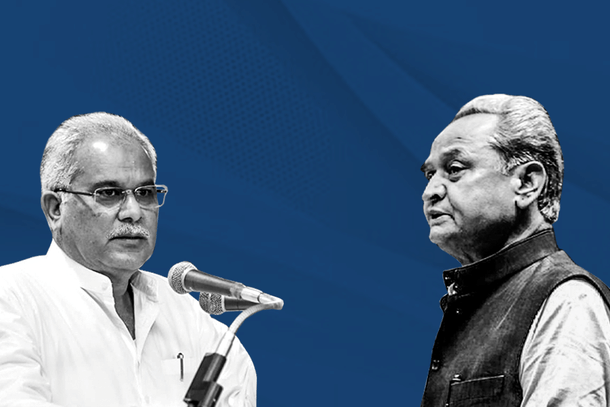

Have Rajasthan And Chhattisgarh Opened A Pandora’s Box By Going Back To Old Pension Scheme?

Swarajya Staff

May 03, 2022, 05:31 PM | Updated 05:40 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

In recent decisions, Congress-ruled Rajasthan and Chhattisgarh reintroduced the old (defined benefit) pension scheme with retrospective effect from 2004, the year when the new (defined contribution-based) pension scheme (NPS) was launched.

With the election season in Gujarat and Himachal getting nearer, the same demand is likely to be made there.

The majority of India’s 2.5 crore government employees always felt for the old pension scheme as well.

What will be the short term impact? Rajasthan and Chhattisgarh already pay 56 per cent and 41 per cent respectively of their revenues to pay the salaries of their employees and retirees.

The removal of fiscal commitment (14 per cent of employee salary) to NPS, helps the government reach the fiscal deficit mitigation targets in the immediate term making the next generation shoulder the repayment.

State government employees whose salaries increased 10 per cent, with NPS in mind, will have spare cash to burn.

The state will have less fiscal space for development expenditure, which is crucial for sustainable growth.

What are the bigger problems that their steps can lead to?

The rate of return from NPS will suffer with states switching to old policy.

BJP-ruled states may also be forced to switch to remain competitive. This will be the end of pension reforms.

The pension — linked with pay commission awards and dearness allowances — will keep rising with time and the state economies will face a heavier fiscal burden.

India government bureaucracy is already understaffed, and fiscal stress will come in the way of the government to increase capacity.

Many states have resorted to solving this by recruiting low-salaried contractual staff (who are outside this pension debate) already.

With the income source (oil and coal) possibly starting to dry up, the states will have less fiscal space for development expenditure.

The bottom line is clear: Switching to the old pension scheme is a serious blow to long-term fiscal stability of the nation and its capacity-building initiatives.

Read in-depth: Rajasthan And Chhattisgarh Undo Pension Reforms; Why It Can Lead To A Bigger Fiscal Mess For The Country