Economy

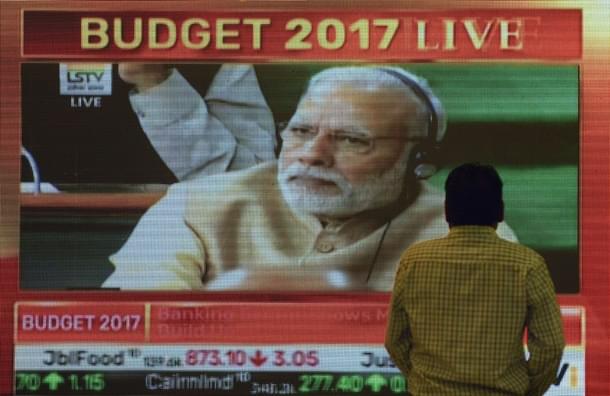

Budget 2017 May Lack Flamboyance But Touched Right Points

Seetha

Feb 01, 2017, 03:32 PM | Updated 03:32 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Every budget of this government has been expected to be a landmark, make or break one. But there’s no denying that Budget 2017-18 was to be a watershed one. Operation Demonetisation had changed a lot of things, most importantly putting the economy into a bit of a slowdown. Pulling it out was the biggest challenge for Finance Minister Arun Jaitley, as was the issue of tackling black money, improving tax compliance and ensuring a more taxpayer-friendly administration. How did Jaitley’s budget speech measure up?

Well, there was no flamboyance, but it touched most of the right points. Most importantly, it has not deviated from the path of fiscal consolidation (there’s scope for some quibbling here, but more of that later). And it has taken steps to give the much-needed demand boost to the economy.

The boldest move in the budget is not economic, but political. A constant refrain in the post-demonetisation debates was that the supposed aim of tackling black money was meaningless without reform of political funding; that the government will never do this. Well, it has. No cash donations above Rs 2,000, only cheques and digital payments, electoral bonds that can be bought from designated banks that can be redeemed only in the accounts of political parties. Only parties that comply with this will get the income tax exemption they are entitled to. The announcements of reforms in funding of political parties is something the Bharatiya Janata Party (BJP) will be brandishing for a long time now.

The second big move clearly relates to personal income tax, though some will be disappointed on this score. The quiet acceptance of the inconvenience of Operation Demonetisation by the middle class warranted, almost all economic commentators said, some reward in terms of reduced tax burden. The call was for doubling the exemption limit from Rs 2.5 lakh to Rs 5 lakh. Jaitley hasn’t conceded this but has halved the tax burden on those in the Rs 2.5 lakh-5 lakh income bracket. They will now pay only 5 per cent tax, not 10 per cent. There are some caveats, but overall, along with the use of existing exemptions, this will mean a huge cut in tax liability, practically zero in some cases.

Will this make India a more tax-compliant society? Will it make people who hitherto have stayed out of the tax net, start filing their returns? It’s too early to tell; people will evade paying even Re 1 as tax if they feel they can get away with it, so this will have to be accompanied by other measures to ensure that people are brought into the tax net.

But what this could do is to give a spending boost to the economy, necessary to pull it out of post-demonetisation blues. It will however, have to be accompanied by withdrawal of all cash limits.

Jaitley has also tried to give a demand boost through public expenditure. He has announced a 25 per cent increase in capital expenditure over last year’s outlay. On the face of it, that’s good, but the details will be important. Till the time of writing the budget documents with the details had not been uploaded. The allocation for all infrastructure ministries has seen only a 10 per cent increase. Within this all the transport related ministries have got 11 per cent higher allocations. Infrastructure spending has a huge trickle down effect and how this plays out will have to be seen. If this infrastructure push is going to be largely public sector driven, will insufficient state capacity be a hurdle? Will this push bring in private sector investment? These are questions that remain unanswered for now.

Another big plus is the government sticking to the path of fiscal consolidation. There was speculation that the Finance Minister would use the report of the N K Singh committee reviewing the FRBM and relax the fiscal deficit targets. But he has not; the fiscal deficit has been kept at 3.2 per cent. This sends out the right signals. What’s even more important, at first glance, is that the quality of spending appears set to improve – revenue deficit as a percentage of fiscal deficit is budgeted at 58 per cent; it has been 65 per cent plus for decades now.

Other good points – the announcement of a law to confiscate the property and assets of economic offenders who flee the country (though it will affect Vijay Mallya only if it has retrospective effect), abolition of the Foreign Investment Promotion Board (FIPB), big push for digital payments.

But there are disappointments too. Some bold moves suggested in the Economic Survey don’t find mention. Budgets don’t generally implement suggestions in the Survey, but Jaitley could have made a departure.

There was nothing on the issue of dealing with the twin balance sheet problem – stressed balance sheets of corporates as well as the non-performing assets of banks. All that the budget had was a recap of measures taken in the course of the year.

Disappointing also was the silence on strategic sales/privatisation. The government is going ahead with its focus on listing public sector undertakings (PSU). Jaitley spoke about strengthening PSUs through consolidations, mergers and acquisitions and continuing with exchange traded funds.

Nothing also on even experiments with a basic income scheme or a fundamental recasting of how welfare is delivered. Instead the notoriously leaky NREGA gets a 24 per cent increase in allocation.

All in all, a competent budget, not a watershed one, barring a few bold moves.

Seetha is a senior journalist and author