Economy

Despite Two Mistakes, Rajan Was Probably Manmohan Singh’s Best Appointment

Shanmuganathan Nagasundaram

Jun 20, 2016, 06:28 PM | Updated 06:28 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The world of central bankers

is a very strange place.

Alan Greenspan, for all of the bubbles (the dotcom bubble, the housing bubble) he created with his ultra-low interest rates policy, was knighted. Paul Volcker, whose effigies were burnt when he was the US Fed chairperson, was the principal reason behind the sustained economic boom from 1980 to 1998. While subsequent understandings have corrected at least some of the above mistakes in US monetary history vis-a-vis public opinion, in India we continue to suffer from the delusional effects of monetary heroin.

To be sure, the US is yet to witness complete withdrawal symptoms after its “experiments with easy money”

through Greenspan, Bernanke, and (now) Yellen. By the time the dollar bubble

fully unwinds, the inflationary depression is going to be so bad that US

citizens may well root for the return of Paul Volcker, who killed inflation by

raising rates significantly.

Much in line with what has

happened in the US, we still treat our past Reserve Bank Governors with

undeserving respect. YV Reddy was a serial bubble man and was the principal

reason behind the mess in the housing and infrastructure sectors today. As

I wrote back then in October 2008, India is now paying the price with huge bad

loans after the bubbles unleashed by Reddy burst. Those bubbles lay hidden

during Reddy’s tenure.

Let’s now turn to the man at

the centre today, Raghuram Rajan. He deserves a whole lot of praise for bringing

the focus back to inflation (especially by making the consumer prices index central

to decisions on rates), forcing banks to recognise bad loans, and so on. The list is long, and I will not expand on the same here as there could be many authors who may

do the same. Instead, let me focus on what I think are the two main substantive

mistakes that Rajan made during his tenure.

1) He was misguided by the never-in-the-offing US Fed lift-off.

Rajan assumed office under conditions of faltering

growth and growing inflationary trends in India. On the international front, developing

economies were concerned about a return to normal US interest rates, and Rajan made

his plans around the threat of a US dollar exodus from India. But as I have

written many times earlier, normalisation of interest rates - or a “lift-off”,

as was referred to back then - was never on the cards as far as the US Fed was

concerned. Their job was, is, and will be to pretend that every Fed meeting is

a “live one” with the possibility of a rate hike while never delivering one.

Wasn’t the 25 basis points (0.25

percent) increase last year part of a lift-off? Not at all. A lift-off, by

definition, implies a series of hikes in quick succession to “normal” interest

rate levels. In the case of the US, even going by their claims of inflation

hovering around 1-1.5 percent, this would imply an interest rate of at least 2-2.5

percent. Not only is the US Fed nowhere close to that, but even today, it is

reinvesting the interest income in US treasuries, bloating its balance sheet

further. Given the enormous buildup of expectations last year, the 25 bps

increase was merely a face-saving measure. Current Fed chairperson Janet Yellen must

have been desperately hoping that this meagre increase doesn’t prick the re-inflated

housing bubble, the student loan bubble, the auto loan bubble and, most

important of all, the underlying US Treasury bubble.

So without a currency crisis,

the US Fed will never normalise its monetary policy. In other words, rapid increases

in interest rates in the US will not happen under conditions of a strengthening

economy but a rapidly deteriorating one.

So Rajan needs to

ponder whether all the famed lift-off preparedness with the accumulation of

high-interest-bearing dollar deposits was worth it. Sure, Rajan could claim

that he never believed in the lift-off himself but was doing so as a

precautionary measure, just in case the US Fed did indeed raise interest rates.

Possible? Yes. But for a person who speaks his mind freely on topics not even

related to monetary policy (it is a welcome change to have an RBI Governor who

has the moral and intellectual courage to do that), such self-imposed reticence

on monetary policy is quite unlikely. It is more likely that he believed in the

normalisation speeches of Bernanke and Yellen.

2) He cut rates too soon and too fast.

The second substantive flaw in Rajan’s

monetary stance was in cutting interest rates in India too soon and too fast. Ever

since Rajan took over, we have witnessed a slowdown in inflation rates, i.e., from nearly double-digits to around five percent. Of course, I always see

inflation as surreptitious taxation by the government so that its effects can

be blamed on extraneous factors. So even five percent is bad. That, of course, is a

topic for another day.

But now there are early signs that inflation is beginning to rear its ugly head again. Should Rajan have seen this coming and not been adventurous in cutting rates too soon?

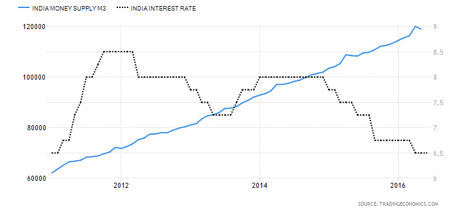

Of course, yes. The Wholesale Price Index (WPI) and Consumer Price Index (CPI) are both terribly flawed (the former much more than the latter) measures for measuring inflation, as they are lagging indicators of inflation. The leading indicator is money supply growth, and that has shown no signs of flagging under Rajan. Whatever the “Rajan CPI Dip” was caused by, it’s gone, and we are looking for inflationary days ahead.

But when Rajan said

“inflation is inflation” as part of his “day zero” remarks, he was entirely correct. I hope subsequent RBI Governors do not hide behind the smokescreen of a “supply

side response” to do what really needs to be done – that is, increase interest

rates to bring down money supply growth, which has averaged nearly 13 percent

annually during 2012-16, to acceptable levels. Money supply need not grow more

than 1-2 percent ahead of real GDP growth rates. Of course, given the political

conditions around Rajan’s exit, none of his successors are likely to do that.

Notwithstanding the above two issues, appointing Rajan was one of the few decisions that Manmohan Singh took which actually benefited India. He has done his job with admirable competence and grace.

But the all-important question is: “Was Rajan a Karma Yogi?” No. Far from one. A Karma Yogi would have abolished the institution of RBI and put India on the classical gold standard.

Shanmuganathan N (aka Shan) is an Economist based in India. He is the author of the recently published book "RIP U$D: 1971-202X …and the Way Forward" and can be contacted at shan@plus43capital.com