Economy

GST Bill Procures States’ Support At Ministers’ Meeting

Seetha

Jun 14, 2016, 07:04 PM | Updated 07:04 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

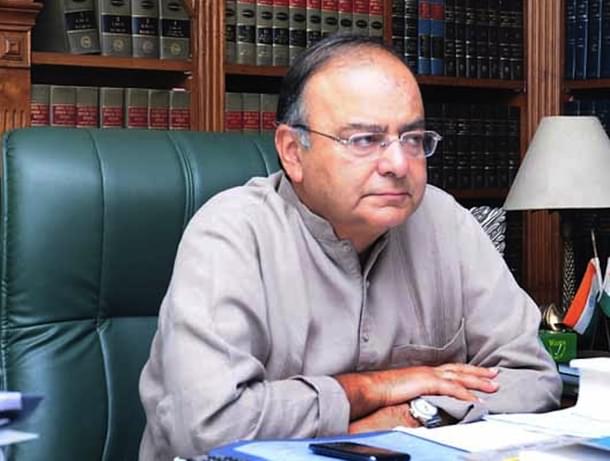

The country has moved a step closer to getting the much awaited goods and services tax (GST) law. At the end of a meeting of the empowered committee of state finance ministers in Kolkata on June 14, Union Finance Minister Arun Jaitley and West Bengal Finance Minister Amit Mitra (who heads the empowered committee) sounded upbeat, saying all states had supported the GST Bill, barring Tamil Nadu which had some suggestions; these are being examined.

The meeting was attended by finance ministers of 22 states and representatives of seven others. So if Jaitley and Mitra could strike the optimistic note that they did, then perhaps significant progress has been made.

Will the Congress, finally, realise that it is hopelessly outnumbered on this issue and allow the Bill to be passed in the Rajya Sabha? The National Democratic Alliance may have upped its share of seats in the Rajya Sabha, where the GST Bill is stuck, but it does not have a comfortable majority. And the Congress could still play the spoiler, even though its tally in the Rajya Sabha has been reduced.

The Congress first put forth three conditions for its support - removing the 1 percent additional tax on inter-state movement of goods and an independent dispute resolution mechanism and capping the GST rate at 18 per cent in the Constitution Amendment Bill. The government has indicated its willingness to consider the first two (something the empowered committee meeting also agreed to) but has rightly rejected the preposterous third demand. But the Congress is making this a prestige issue.

Jaitley has indicated that if the Congress does not come around, the government could put the Bill to vote in the monsoon session. He should make good this threat. The Congress forced the government to retreat on the land acquisition law but there was a way out in that case – states could pass their own laws. That circumventing is not possible in the case of the GST Bill and a party with 109 members across both Houses of Parliament cannot be allowed to hold the country to ransom.

At the same time, the BJP needs to be extra careful to keep other parties in good humour. It should not give the Congress an opportunity to fish in troubled waters. That is why it will need to rein in its fringe elements; the smallest and most unrelated of incidents will be used to somehow disrupt Parliament and put the GST Bill in peril. If the BJP is not able to get the larger Sangh Parivar outfits to behave, then the government must openly and decisively distance itself from their actions and words. The government needs to step up its political management; the GST is too important to be sacrificed at the altar of some extreme-Hindutva hobby horse.

There is, of course, the all-important issue of the revenue neutral rate that needs to be sorted out. The success of GST will depend on this. Jaitley and Mitra said that this would be taken up at the next meeting of the empowered committee and that the chief economic adviser Arvind Subramanian would make a presentation related to this. Last year, Subramanian had headed a committee on the GST and in its report suggested a standard rate of 17-18 per cent.

This will mean a price increase of some goods and services (though that of others may come down). This may be a slightly difficult sell, then. But if the rate is to be lower than this, then a whole lot of other state-level items that are currently out of the regime will need to be brought in; the more the items in the GST, the more the possibility of a lower rate while the more the exclusions, the higher the rate.

There are other issues to be sorted out – the threshold levels for application of GST, place of supply rules, the problem of trade diversion. But these may not be make or break issues and if the GST Bill does clear the Rajya Sabha, then progress on these could come sooner rather than later.

Even as all this is being worked out, states need to start preparing for the eventual rollout of GST. There is a lot of paperwork involved, systems have to be set in place, the bureaucracy and businesses trained. With hopes brightening, there’s no time to waste if GST is to roll out from 1 April 2017.

Seetha is a senior journalist and author