Economy

Has the Welfare State gone, well, too far?

Sivakumar

Jan 06, 2017, 11:33 AM | Updated 11:33 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Welfare State refers to a governance model where State plays an active interventionist role for the protection of social and economic well-being of its citizens. The guiding principles of a Welfare state are equal opportunity, equitable distribution of wealth and public responsibility of the state towards citizens who are unable to avail themselves of minimum provisions for a good life.

It would be too simplistic to view welfare state from the lens of left or right-wing economic approaches. In fact, no country can deny being a welfare state! Ironically Thatcherian Britain continued to embrace a public healthcare system (NHS), while a Nehruvian India hardly developed a social security system. Nordic countries are perhaps the best example of functional welfare states.

Many in India see welfare state as a politically correct term that describes the ideal model of governance. UPA government was committed to remain a giant welfare state; despite criticisms of mai-baap sarkar. The campaign of 2014 general elections witnessed a virulent battle of opinions between welfare statists and naysayers.

Who exactly are the naysayers?

They come in different shades right from unapologetic Friedman’s free marketers to Desi entrepreneurial Swarajists. As the new government is reviewing several legacy policies and being witness to performance of welfare state for 40 years, is there a better time to ask, has the welfare state gone, well, too far?

Welfare in micro-economics literature refers to the sum of producer and consumer surplus. At a macro level, it encapsulates the well-being of both producers and consumers. The objective of this article is NOT to analyze the merits and demerits of a welfare state. That question requires a more fundamental treatment. And there is no guarantee that we will find a right answer; because the nuances are in the epistemology. Instead, we take welfare state as an acceptable social outcome, and assess whether the prevalent implementation model (in India) lives up to the principles of original definition.

This article presents a five criteria framework to assess the functioning of a welfare state. To illustrate concepts better, we use the case of State of Tamilnadu; which has been receiving rave appreciation and brickbats at equal measure for being a successful welfare state. The choice of Tamilnadu (TN) is driven by two factors

(a) Representative Sample – it is a touted as a model state by many pundits who are urging other states to emulate it. Media reports suggest that many of the TN practices are being copied all over India.

(b) Convenient Sample – the writer has firsthand knowledge to make discretionary calls.

Please note that this article is neither a comprehensive critique nor an evaluation report on the case of TN. Instead our interests lie in understanding the broader concept of how far can/should a welfare state go!

The Framework

The proposed framework for assessing the functioning of a welfare state is schematically shown below. The rest of article introduces these five criterions with an explanation on its importance. We also intersperse examples from the case of TN to illustrate the concept. Click here for the official list of welfare schemes offered by TN government.

1.Is it Viable?

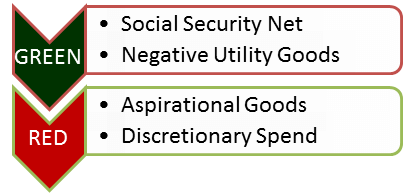

A welfare state recognizes that people exist within the society who can’t/won’t avail certain goods/services on their own volition. It is the public responsibility of the state to support them to avail those minimum provisions for a good life. It includes a social security net to support disadvantaged people. In India, we recognize social and economic backwardness of the group, age, gender and physical/mental disabilities as disadvantages requiring intervention. It also includes certain goods/services that won’t be purchased due to its current negative utility, but lack of it will hurt certain people the most in the future.

But what about goods/services that are aspirational in nature for a common man to acquire, but is unable to acquire them due to current budget constraints? Such aspirational goods are of no concern to the welfare state. One can even argue that without aspiration there is no motive for economic activity. Hence, for an intervention to be viable, it should qualify either as a social security net to the disadvantaged, or as a good with current negative utility but with risk of high impact in the future.

Tamilnadu offers social security net in the form of cash assistance to disadvantaged people such as unorganized labour suffering from disabilities, potters and fishermen who suffer during lean periods, differently-abled, and old-age pensioners. TN financially supports availing of certain goods with negative utility, such as Crop/Health insurance, pre and neo-natal maternity care. Such measures are explainable and can be tagged in GREEN.

What about free rice to every PDS cardholder or baby care kits to newborns? Free rice is a social security net; when well targeted it prevents starvation. But in the current form, it distorts the food habits of people who were consuming coarse grains and creates an imbalance in the grain supply chain. Baby care kits can help arrest infant mortality when parents aren’t aware of neo-natal hygiene. But in current form, it converts an aspirational expense into an entitlement. We can only tag such border-line measures as AMBER.

Aspirational durable goods such as television/mixer/grinder/fan, subsidized mineral water/cable TV/cinema tickets at ₹ 25 are clearly in the RED.

2.Is it Productive?

Justification of an intervention in a welfare state is to help disadvantaged people acquire productive assets that create a level playing field of equal opportunity to all citizens. Thus, it is imperative that an intervention results in creation/delivery of a productive asset. If not (a) it is not sustainable, (b) it also distorts the level-playing field in the society. The asset can be individually or collectively owned, as long as the targeted section has both access and accountability for it. If the asset is transferable to another person or gets devalued quickly then the target remains perpetually disadvantaged.

Tamilnadu supports school children from disadvantaged sections of the society with free education, hostels, mid day meals, stationary items, uniforms, slippers, bus passes, bicycles, laptops, woollen clothes and sanitary napkins for school girls. These interventions go towards creation of the productive asset; knowledge. Diversion of purpose is minimized by the demand of continuous use of these materials under school curriculum. Credit linkages for budding entrepreneurs, health services under the ambitious TNHSP program are also in the GREEN. What about milch and farm animals such as cows and goats? They are no doubt a productive asset that can make multi-year contribution to GSDP. However, they are transferable (sold in open market) or run the risk of reduction in productive value (due to poor maintenance) making them AMBER.

Clearly aspirational goods such as mixer, TV, grinder, subsidized mineral water etc. are not productive assets. Although services such as Amma Canteen free valuable time for productive activities, they are at best an operational assistance without guaranteeing creation of a sustainable productive asset. Some schemes involve multiple components and all can’t be treated at par. (e.g.) Marriage assistance program in TN provides 4g gold for making the Mangalyam and a cash assistance to conduct the wedding. As Prof. Vaidyanathan mentions gold is both a social security net and a fungible liquid asset for Indian women. However, the cash component in this scheme is clearly a dole that is unlikely to be productive.

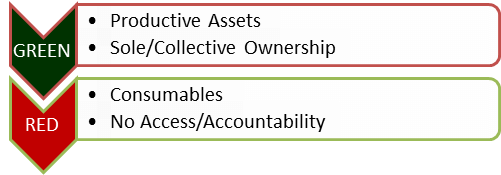

3.Is it Virtuous?

Practices of welfare state can sometimes trigger a virtuous cycle of economic activity in the lines of Keynesian principles. If the intervention in one section spurs economic activity in another section of the society, then it leads to a virtuous cycle. Clearly, such interventions are preferable. There are other types of interventions that can hurt regular economic activity. This can be of the form of reduced margins to existing players or crowding out players who operate in the fringes of the market. Although such interventions are hurtful, they aren’t debilitating. There are a third category of interventions that debilitate a competitive market and create localized monopolies leading to extreme rent seeking behaviour. These are clearly Pareto sub optimal.

Freebies of durable goods such as mixer, grinder, fan, television, laptop etc. may have failed other tests of welfare intervention, but do trigger a virtuous cycle of production of these goods; often involving local MSMEs. Media reports suggest many MSME units around Coimbatore were thrilled to get increased order volumes for mixers and grinders. There is a joke that the market share of the laptop makers such as HP and Dell can be reversed in no time; if CMs such as Jayalalitha and Akhilesh Yadav change their mind. Such virtuous interventions are clearly in the GREEN.

Certain other interventions such as Amma Canteen, Arasu Cable TV, mineral water, theatres, and salt etc. compete with other players in the market. If the subsidized intervention touches only segments that are otherwise not covered, it can be called harmless. If strict differentiation in quality is implemented in these subsidized services, appropriate sections will self-select themselves. Arasu Cable TV has done exactly this by limiting itself to free-to-air channels enabling self-selection. Whereas Amma Canteen is visibly stamping out livelihoods of pushcart food vendors. All other examples above eat into the margins of other players and/or stamp out weaker players who operate in the fringe. We have to tag such interventions as AMBER.

Interventions such as monopolized liquor retailing, sand quarrying, bus services (that perpetually make losses), etc. fall into the RED category. They not only eliminate a competitive market for these goods/services, but also create localized monopolies. Only contractors and suppliers favoured by netas/babus are able to win these orders. The society pays for it in terms of influence rents that seriously hurt the overall welfare.

4.Is it Effective?

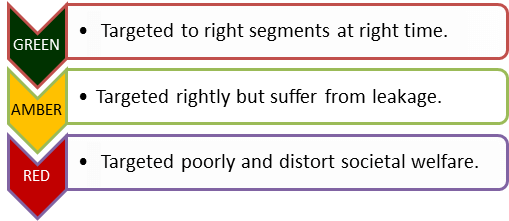

For interventions to be effective, it is important to get both the segments reached and the timing right. Effective targeting can either be achieved by precisely identifying disabilities that require intervention or by allowing self-selection of the disadvantaged. The later approach will only work when there is a visible difference in quality. Some interventions are plagued by pilferage or persistent leaks that render them ineffective. The worst forms of interventions are those that are poorly targeted i.e. towards sections of society that suffer from no visible disadvantage. Such forms of poor interventions distort the level playing field and defeat the very objective of a welfare state; equal opportunity to all citizens.

Certain schemes like Arasu Cable TV, mineral water, Amudham retail stores, Amma Canteen and Pharmacy are suitable for self-selection. As long as the state can maintain a marked quality difference in these products/services with rivals available in the market, consumers will self select nicely. Arasu Cable TV limits itself to free to air channels. Amma canteen can restrict itself by select localities and food menu, Amudham store and Pharmacy can restrict their catalogue/assortment range; by doing so they can stay in GREEN.

Interventions such as the Mid-day meals in schools, health check-ups by TNHSP are targeted at a well defined segment of the society. Such interventions are effective. Interventions such as free rice although well intentioned, are extremely leaky. There are diverted to open market, used as cattle fodder and sold as batter to hotels. Cash assistance schemes such as social pension and education scholarships are also prone to leakage. They can be diverted to unintended end-use and/or undeserving individuals. Such interventions have to be classified as AMBER. But the poorly targeted doles such as the long list of durable goods and free electricity are disastrous to the society.

Free electricity to agriculture/thatched households is both diverted towards unintended purposes and also wasted on unproductive tasks. Free electricity and uncontrolled tapping of ground water table have created a double whammy. They not only distort the crop demography of the state but also tax the other paying consumers unfairly.

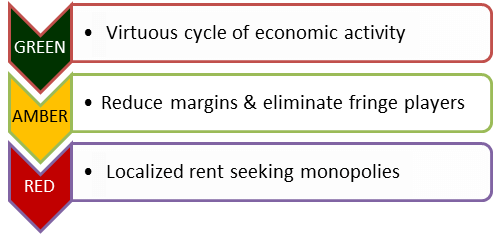

5.Is it Goal Oriented?

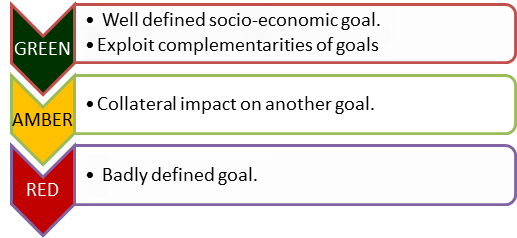

The justification of a welfare state intervention is attainment of certain socio-economic goals that would otherwise not happen via market mechanisms. So, it is of paramount importance that these goals are identified, communicated and tracked for attainment. However, what we observe are schemes launched mindlessly without well defined socio-economic goals. Such interventions are an absolute waste of public money. There are also schemes that are narrowly focused towards a single objective, that they fail to see the collateral impact on another objective. It manifests due to the existence of Chinese walls in the war rooms of the welfare state. On the contrary, qualification criteria of some schemes can be cleverly designed to exploit complementarities of goals.

Many health interventions in TN have well defined socio-economic goals. The ambitious TNHSP program, health insurance for disadvantaged, free ambulance services, cash assistance for maternity etc. are such examples. The desired outcomes are trackable. Education interventions to disadvantaged students such as mid-day meals and education kits have well defined goals. But they can’t be tracked properly because of their poor linkage to desirable outcomes. If we are generous we can tag such schemes as GREEN.

There are some schemes that exploit complementarities of Goals for example one of the qualification criteria for the 4g gold Mangalyam under marriage assistance scheme is for the bride to have passed at least Class-10. This is a big motivation among rural families to let their daughters study until class-10; a desirable complementary goal. Schemes such as liquor retailing are a classic case of missing the woods for the trees. They started as interventions to arrest flow of spurious liquor and curbing avoidable deaths. They have morphed into multi-headed hydras that can seriously impact social harmony and adult life expectancy. Isn’t it ironical that the money from TASMAC liquor retailing is used to reduce infant mortality (baby care kits) and skew in gender ratio (Amma Cradle scheme)?

Little do administrators realize the collateral impact it has on adult life expectancy and other health indicators. Free electricity has a collateral impact of promoting unsustainable farm practices and undesirable cropping patterns. Amma canteen was supposed to be a productivity booster for a working couple. However, the scheme has potential to hurt the social fabric of families. Liberal award of Social pensions has restricted available pool of labour in the market. For example construction labour in TN is now entirely sourced from eastern states of India, as the local labour splurge social pensions towards unhealthy lifestyle. We are really being generous by tagging such schemes as AMBER.

Schemes such as free durable goods and subsidized theatre are clear RED herrings. Monopolized sand quarrying was touted as a measure to regulate mining and control factor prices for construction industry. But those in the industry would laugh at this statement if this objective was read out to them. These are clearly RED schemes that lack clarity in socio-economic goals.

Conclusion

The proposed five criterion framework is drawn from the very tenets of what a welfare state ought to be. What should worry readers is the sheer volume of number of interventions that fail to pass these critical tests of functional welfare state.

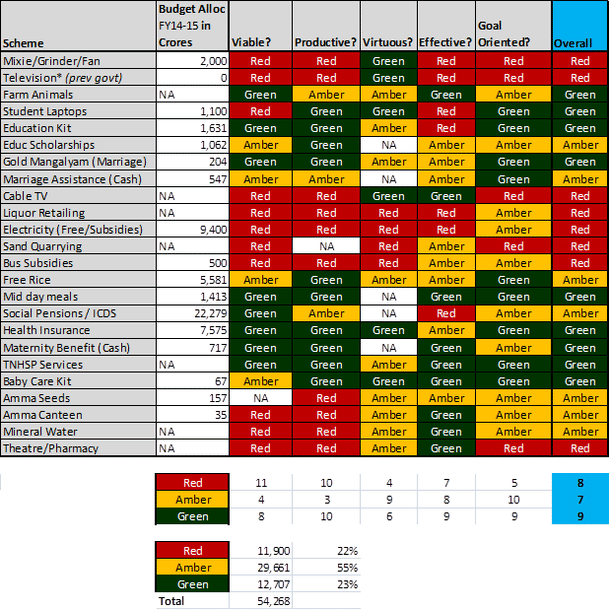

While we are at the case of Tamilnadu, our assessment of 24 arbitrarily picked welfare schemes is provided at the end of this article for readers to chew over. We have added the budgetary allocation to these schemes (where available) from FY2014-15 Tamilnadu budget, to help the readers make a better assessment. For those who care only about the summary; of the 24 schemes assessed, 9 are in GREEN, 7 in AMBER, and 8 in RED; thereby leaving a 1/3rd split pie. In terms of financial figures, roughly 55% of this pot appears to have been thrown towards AMBER schemes, while the balance is equally split between GREEN and RED schemes

Beware TN is one of the best managed welfare states in India and if these figures are indicative of a larger trend, the situation in other states is expected to be far worse! And if you add the Centre (UPA) induced interventions such as NREGA, NRHM, NRLM and RTE etc. the pot is going to be a lot murkier!

Given these points, readers must wonder which of these interventions are truly desirable; and they exist for the welfare of whom? Policymakers should take a step back and ask themselves if a course correction is overdue? Social thinkers should ask themselves whether it is high time we recalibrated our ideological positions; as it appears to have swung far too much from the original objective.

But, Hey! Wait! We still haven’t questioned the need for the welfare state in the first place! Ironically, not withstanding that what we see is a chequer-board of interventions riddled with potholes and quick sand. So let us not even dare to ask those fundamental questions! Even if we accept welfare state as a socially desired outcome, is our implementation genuine to the guiding principles of what a welfare state ought to be? Not sure? Just go back and read the first two lines of this article once again and have a laugh!

Assessment of Certain Tamilnadu Welfare Schemes