Economy

Marx Had A Point: Capital Glut Makes Job Creation Tougher

R Jagannathan

Feb 20, 2017, 02:25 PM | Updated 02:18 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

If the world is turning protectionist, from Donald Trump’s America to Theresa May’s Britain to even mainland Europe, where right-wing and anti-immigrant parties are growing in strength, there are several reasons for it. Jobs, growth and incomes have not been rising in the western world.

But underlying this “secular stagnation” is a stark reality of the global political economy: the balance of power between capital and labour has tilted dramatically in favour of capital in recent decades, thanks in part to globalisation, automation, and the relatively greater freedom and tax benefits given to facilitate global capital movements relative to labour.

Put simply, capital moves more easily across borders than labour, and capital owners are taxed less than those making a living from labour, whether physical or mental. This is why Warren Buffett, the iconic investor, says he pays a lower tax rate than his secretary.

This state of affairs makes even less sense when the world is awash with excess capital and an abundance of relatively less skilled labour (hence the voter attraction to Trump, and for Brexit), which ends up making things worse. When capital is in surplus and cheap, and returns on capital taxed lower, it is even more tempting to replace labour with capital (which means more automation, and a dramatic shift in the focus of employment from the less skilled to the more skilled, which further increases income skews and the creation of even more capital surpluses).

To give just a few illustrations of the kind of cash sloshing around with corporations, here are some pointers.

Apple Inc alone has $246 billion in idle cash right now. Around the middle of last year, the top five tech companies (including Google, Oracle, Microsoft and Cisco) accounted for more than $500 billion in corporate cash holdings.

A CNBC report says that US corporations are holding around $2.5 trillion (more than India’s GDP) abroad, and another $1.94 trillion in domestic assets. Over and above this, the US money markets held $2.66 trillion in investor cash, while banks were stashing another $2.15 trillion in excess reserves with the Fed. Taken together, that’s $9.25 trillion in idle cash – half the size of the US economy.

In Japan, thanks to two decades of flat or shrinking demand, corporate savings have been consistently over 20 per cent of GDP for some years now.

In Britain, the FTSE companies were sitting on $66 billion of free cash some time ago.

In our own country, cash-spewing companies are not that many in number, but concentrated in the tech sector. According to a Business Standard calculation, Infosys hold nearly 15 per cent of its market value in cash, TCS 8 per cent, HCL Tech 8 per cent, and Wipro a massive 27 per cent. Such high cash levels in these companies are indicative of low investment opportunities at current valuations.

But India’s tech companies are exceptions, and pale in comparison to the first world’s growing cash surpluses. These indicate low possibilities of profitable investment, especially in a climate where the central banks have been offering almost zero-cost money to borrowers. The people gaining most from this free money are speculators, who have used cash to invest in shares and other assets, including bonds at low yields, increasing income inequalities and the wealth skew.

The global financial crisis of 2008 and consistently misdirected policies of central banks – especially endless cheap money – have helped enrich exactly those people who brought the financial sector crashing eight years ago.

The only way to start ending this capital glut is to reverse the current tax situation, where earnings on idle capital (capital gains on shares, interest income, dividends) are given kid-glove treatment, and income and corporate taxes are higher. It is time to tax earnings on passive capital on a par with earnings from business and wages/salaries.

Tax incentives must be focused on encouraging real job-creating investments, including public and private investment in public infrastructure, and not retention of savings with cash-rich companies.

Rebalancing the taxation of capital and labour earnings will, hopefully, lead to more job creation and less capital-intensive investment.

The world is simply too awash with capital to really create jobs. Beyond a healthy level of corporate savings, surplus cash is counter-productive. The more capital accumulates, the easier it gets to invest in labour-displacing investment.

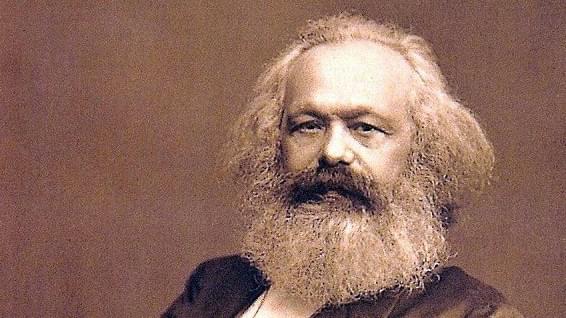

It’s time for capitalists to read Karl Marx, who predicted precisely this kind of capital glut and a maldistribution of incomes that reduces the possibility of expanding markets. Marx got many things wrong about capitalism, but this capital glut dilemma is now playing out in 70mm.

Jagannathan is former Editorial Director, Swarajya. He tweets at @TheJaggi.