Economy

NSEL-FTIL Merger: Jaitley Strikes Against Cronyism; Now It’s Upto Courts

R Jagannathan

Feb 19, 2016, 03:32 PM | Updated 03:31 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Supreme Court, the other day, expressed concern about businesses not paying up hundreds of crores due to banks. While its intervention is belated and not quite its job, there are however many areas where it can push the envelope to ensure that cronies don’t get away with murder. Many debt defaults and fraud cases end up in courts, and this is where the court can act to send a strong message that it stands four square behind banks and hapless investors against crony capitalists.

A case that will surely come to the Supreme Court is the Rs 5,600 crore National Spot Exchange Ltd (NSEL) scam, which left thousands of investors in the lurch after being promised returns of a certain magnitude based on commodity contracts and price arbitrage.

If this case is decided against cronies, it will set the stage for action in the Kingfisher case, where Vijay Mallya has left banks holding bad loans of Rs 7,000-and-odd crore even while he is gallivanting around the globe cavorting with calendar girls and buying up cricket teams in the Caribbean. Right now banks are unable to get at Mallya’s other assets as they are insulated from his Kingfisher liabilities – often with the help of courts. Mallya owes money not only to banks but to employees, the taxman and the provident fund organisation.

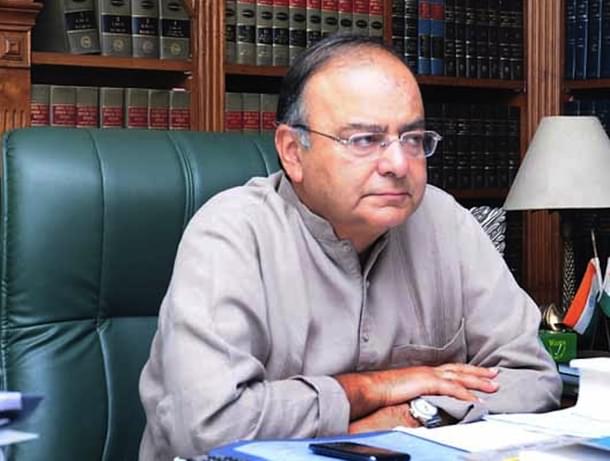

But let’s talk about NSEL first. Last week, Finance Minister Arun Jaitley, who also holds the company affairs portfolio, struck a telling blow against crony capitalism when the ministry of corporate affairs (MCA) ordered NSEL to be merged with its parent Financial Technologies India Ltd (FTIL), the nearly 100 percent owner of NSEL. Since the scam happened right under the nose – if not connivance – of FTIL boss Jignesh Shah, known for his high connections in the UPA (and possibly the NDA too), it is obviously morally right that FTIL should pay for Shah’s follies in NSEL.

The scam was simple: NSEL brokers were promising investors high returns by asking them to buy short-duration commodity contracts (T+2, where contracts are settled two days after the transaction) and simultaneously sell T+25 (longer-duration) contracts in order to benefit from the price arbitrage of around 13-14 percent (pre-tax). But on 31 July 2013, the exchange went bust, and investors found that their contracts were not backed by either money or underlying commodity assets. Shah’s exchange, which was the counter-guarantor for contracts, was clearly the guilty party either for not checking the activities of its member-brokers or for actively conniving with them to push volumes on the exchange.

As the sole effective owner of NSEL, Jignesh Shah’s FTIL can hardly escape liability, though there are legal loopholes which can give him an out. He can claim that forcibly merging FTIL without consulting its own shareholders is illegal. He surely has a technical point there, and there are already cases in high courts challenging the draft merger proposal mooted by the MCA some years ago. In October 2014, the ministry passed the draft merger order, and in April 2015, it had even issued a gazette notification on it. A few days ago, the ministry made a detailed order confirming that it was merging the two companies under powers vested in it by section 396 of the Companies Act, reports Business Standard.

Jignesh Shah is no innocent done in by rogue brokers who sold contracts they were not authorised to sell. He was actively involved in running the exchange and was also well connected politically. He has also used the courts to harass those who wondered how well he was running his exchange. Ajay Shah of the National Institute of Public Finance & Policy (NIPFP) was sued in several courts by Shah for questioning his credentials in running an exchange. Shah’s FTIL started as a supplier of trading software for the National Stock Exchange, but at some stage, he set his sights higher and saw the running of an exchange as a more lucrative proposition. The NSEL scam, worth Rs 5,600 crore, was the result of Shah’s push for huge volumes which ended up in a bust when the contracts were found to have no underlying assets. His exchange was trading thin air in order to grow quickly.

Since there are technicalities involved in whether or not FTIL can be merged forcibly without the consent of its shareholders, the case is sure to come up in the Supreme Court sooner or later.

The Supreme Court can prove its anti-crony activism by ensuring two things: that the high courts make their decisions quickly and don’t delay justice to looted investors indefinitely; and when the matter comes to it, as it surely will, it should uphold the validity of section 396, which allows the government to merge companies in the public interest.

Right now, the fight against cronyism is clearly in the public interest. It is also a fact that FTIL is nearly 100 percent owner of NSEL, and hence liable for the latter’s scam.

Jaitley has done his job to fight cronies; it is upto the Supreme Court now to do the rest once the high courts are done with the matter.

If Jignesh Shah gets his comeuppance for his role in the NSEL scam, Vijay Mallya is the next wilful defaulter to go after.

Jagannathan is former Editorial Director, Swarajya. He tweets at @TheJaggi.