Economy

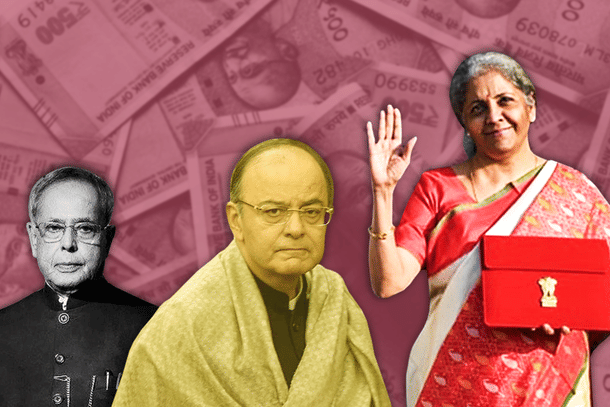

Retro Tax: Sitharaman Finally Fixes What Mukherjee Messed Up, And What Jaitley Failed To Reverse

R Jagannathan

Aug 06, 2021, 01:09 PM | Updated 01:09 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Better late than never. This is the only comment one needs to make about Finance Minister Nirmala Sitharaman’s decision to introduce a bill to amend the Income Tax Act so that the retro tax on Vodafone, Cairn and some 15 other companies is withdrawn.

Retrospective taxes are bad in law and have nothing to do with the sovereign’s power to tax, which is the argument we have used at international courts to justify the tax legislated by the United Progressive Alliance (UPA) government. The late Pranab Mukherjee introduced this law in 2012 to nullify the verdict of the Supreme Court in the Vodafone capital gains tax case the same year.

Let’s be clear about one thing: the fact that Vodafone won the case does not mean it has a clean pair of hands. We can’t be sure, but it is more than likely that it got a lower price for the majority stake in Hutchison’s Indian telecom operations because it saw that our law on capital gains tax had some loopholes on overseas deals.

The tax was actually payable by Hutchison on its capital gains, with Vodafone only being the deductor of the tax at source. But Hutchison got away, and Vodafone used the loose wordings of Indian tax law to wriggle through. The babus in the Finance Ministry, upset over the loss of so much revenue at the wrong time in the economic cycle, must have come up with the idea of the retrospective tax, which was inserted as a clarificatory clause for the law as it stood earlier.

There are many lessons to learn from the retro tax fiasco beyond the fact that no tax should be retrospective in nature. Even though the late Arun Jaitley is credited with the idea that the sovereign right to tax cannot be questioned in any jurisdiction, it is worth recalling that when he introduced the long-term capital gains (LTCG) tax in the 2018-19 budget, he did not use the same argument to retrospectively charge long-term capital gains tax. The old provision for tax exemption was “grandfathered” and the new tax applied only prospectively.

The lessons to learn are the following.

First, draft better laws, and make them simpler. The purpose of drafting any law is to make it easy for those who are affected by it to understand it, and also simple to comply with. If you create a law with ambiguous wordings, a retro tax will not cover the loophole. Consider how many times the Insolvency and Bankruptcy Code has been amended since birth in 2017, and also many other laws.

Second, when a mistake (or oversight) has been made, or a problem needs rectification, don’t stand on prestige if the courts read the riot act to the government. This is not about pride and prestige. More pride and prestige should be invested in how much trust both Indians and foreigners have in the fairness of our system rather than on whether or not we lose a case based on our own mistakes.

Third, speed. Why did it take seven years for the Narendra Modi government to correct a flaw in the law, and that too only after Cairn and other litigants are busy asking foreign courts to commandeer Indian assets abroad and pay them from the proceeds? Air India, and some Indian government properties in France are in the process of being blocked from transfers. To wake up only after your assets are threatened does not do credit to India.

Fourth, even in the Cairn case, much needs to be carefully negotiated even after the retro tax goes. This is because the changes do not include payment of interest on the money to be repaid to Cairn, and also require the litigant to end all court actions. Clearly, this will happen only if Cairn and the government agree to a comprehensive deal first. Our babus need to coax Cairn to do a decent deal instead of threatening them with more litigation.

Fifth, India has also lost a non-tax related case with Devas, which has won court orders against India for cancelling its deal with ISRO’s commercial arm, Antrix, which had agreed to build two satellites for Devas. But the deal was cancelled by the Manmohan Singh government after it became a political hot potato and allegations of favouritism were made. The company sued Antrix for breach of contract and won its case in international courts. A US court has allowed Devas to claim damages, including costs from India.

In this case, India’s best bet would be an out-of-court deal where the damages payable are lower than what the court ordered.

Jagannathan is former Editorial Director, Swarajya. He tweets at @TheJaggi.