Economy

Success Of Make In India Difficult Without Simple Dispute Resolution Mechanism

Abhishek Dwivedi

Aug 25, 2015, 06:55 PM | Updated Feb 24, 2016, 04:30 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The scheme of Make-in-India requires India to have a predictable and easy commercial dispute resolution mechanism to attract foreign investments and thus, it is time, the government amended the arbitration law.

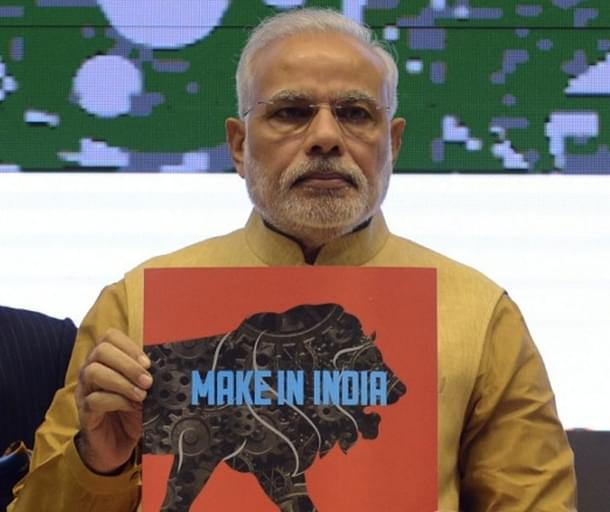

On 15th August 2014, when Mr. Modi, as Prime Minister, announced the scheme of Make-in-India from Red fort, inviting foreign investors to invest and manufacture in India, it generated a lot of positivity in the markets. Subsequently, the Companies Act, 2013 was amended among a host of other amendments. FDI limit in insurance and defense sectors was increased. While most of changes and amendments were brought in the substantive and regulatory laws, the dispute resolution aspect of the commercial transactions remained unaddressed.

In December 2014, an ordinance to amend the obsolete Arbitration and Conciliation Act, 1996 was approved by cabinet prompting a positive response in the markets. However, it was never sent to President for his assent. Again, in February 2015, the Law Ministry hinted on bringing a bill in the Budget Session to amend the act. The rumors appeared once again before the Monsoon session that the Bill may be introduced in Parliament. The rumors, in both cases, turned out to be just that, rumors.

The government so far has failed to even introduce the amendment act. The latest news on the issue is that the bill has been approved by Cabinet and will be presented in the winter session. This is an issue of concern to foreign investors who are waiting to see if the actions of this government match its tall promises.

While the arbitration law in India requires amendments for domestic as well as foreign arbitrations, the present article limits itself to amendments required to sort the issues concerning foreign arbitrations. This is specifically in order to emphasize the need to attract and protect foreign investments in the country.

What is the need for an amendment?

The requirement of amendment to the present Act arises on four counts.

1. It is just

It is nothing less than injustice when commercial disputes remain pending for years in want of effective means of resolution. Despite the notion of arbitration based on the principle of least judicial intervention, the courts have failed to exercise restrain while dealing with matters of arbitration. The entire process of arbitration becomes redundant as the Act gives Courts wide ranging powers and discretion to review it. This judicial intrusion renders the decisions of the arbitration tribunal (called awards) practically unenforceable in many cases.

2. Provides stable business environment

There is no doubt that investors require a stable business environment along with a predictable and efficient system of resolution of disputes. The present Act fails to provide that predictability as it has been subject to extensive interpretations due to large number of ambiguities it contains. Different High Courts have taken different views on same issue. The apex court has also been changing its stand periodically on a number of issues, especially on issues of foreign seated arbitrations.

3. Catching up with time

The present act, nearly 20 years after, appears to be a complex and incomplete piece of legislation due to tremendous progress in the field of arbitration. For instance, it has failed to keep up with the notions of institutional arbitration [ICC/SIAC] and emergency arbitrators. Supreme Court has also held that the law of arbitration should be made simpler, more responsible and less technical in order to ensure justice to the parties. The Act needs to be amended to bring it in line with the new developments in the field.

4. Avoiding investment treaty claims

The amendment is needed to avert any future investment treaty claims which may arise under the notion of denial of justice or due to failure of India to provide effective means of justice to foreign investors. The White Industries Award against India was nothing less than a rude shock to the Government which forced it to revise its Model Bilateral Investment Treaty. However, while it may be acceptable to revisit the entire BIT mechanism, it is preferable to address the root cause of such claims i.e. unresponsive dispute resolution system as it exists in India. There is a dire need to make the process of adjudication of claims relating to foreign investors easy and efficient.

The Proposed Amendments

The Law Commission of India [LC], through its 246th Report, has suggested a number of amendments to the existing Arbitration and Conciliation Act, 1996. It brings a lot of certainty in the act in matters of foreign arbitrations.

Firstly, the proposed amendment reforms the definition of international commercial arbitration by eliminating the reference to company. This will ensure that “residence” of a company will be determined by its place of incorporation and not by its place of management/control. Further, the proposal brings institutional arbitration into the legal framework within the act. This will encourage party to opt for institutional arbitration centers like ICC, LCIA and SIAC.

The LC, in its one of the finest recommendations, has proposed to make High Courts the Court of first instance to hear matters arising out an international commercial arbitration. This will decrease chances of an investment treaty claim against India while awarding easy and effective access to justice to foreign investors.

In a major relief to foreign investors, the power of the Indian Courts to interfere in foreign seated arbitration has been expressly reduced affirming the BALCO ruling of Supreme Court. Earlier, the Courts used to treat foreign seated arbitration on par with domestic arbitrations in many scenarios. The amendment, however, rightfully allows Indian Courts to exercise jurisdiction to grant interim reliefs even in a foreign seated arbitration. It has also been proposed that the scope of public policy for opposing the enforcement of foreign awards (Decision by a tribunal in a foreign seated arbitration) may be limited as compared to the scope for domestic awards. Now, a foreign award may be set aside on public policy grounds only if it conflicts with basic notions of morality or justice or goes against the fundamental policy of Indian law.

Another important proposal is to make matters of fraud expressly arbitrable following the judgment of Supreme Court in Swiss Timings. This will bring India on par with nations like Singapore and England which have developed themselves into preferred destinations for arbitration. Finally, the arbitrations will be time-barred and fixed fee affair if the LC report is accepted. This will ensure that proceedings are conducted timely and the issue of high costs is also addressed effectively.

Ensuring flow of foreign investments

There is no doubt that India needs foreign investment in order to ensure that Make-in-India is a success story. Foreign investments will flow, as stated above, only if a stable legal and business environment is ensured in the country. An efficient and effective dispute resolution mechanism is an integral element of a stable legal environment. There can be no complacency just because the investors are feeling positive about India because of the pro-business image of the NDA government.

While Prime Minister Modi has been quite successful in travelling around the globe and assuring foreign investors of a business friendly regime, it will not be helpful in long run if the dispute resolution mechanism remains the mess it is. It will be similar to entering a gunfight with a knife. Most of the changes suggested by the Law Commission are futuristic and well-intended. It is advisable to seriously consider the same and bring the amendment as soon as feasible.

Abhishek Dwivedi is an independent advocate and arbitration counsel who practises in Lucknow and Mumbai. He specialises in infrastructure, commercial and civil disputes.