Economy

This Category In E-Commerce Can Fuel India's Journey To $1 Trillion In Exports By 2030

Tirumala Venkatesh

Mar 16, 2024, 06:00 AM | Updated Mar 18, 2024, 12:58 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

India has set a goal of reaching $2 trillion in exports by 2030 — $1 trillion of this amount from exporting goods/merchandise and $1 trillion from services exports.

This target was announced on the back of a record $776 billion of total exports achieved during financial year 2023 (FY23) — out of which $451 billion came through export of goods and $325 billion through services.

This FY24, though, because of global challenges, the combined exports in goods and services during April-January 2024 have remained stagnant at around $640 billion, and it’s expected that the total exports would remain in the same ballpark. The target for 2030 therefore has become stiffer.

How would India achieve $1 trillion in goods exports?

One part of the solution is to strengthen the manufacturing ecosystem, which is happening because of the phenomenon we termed ‘Akamaisation’ — shifting of global value chains into India due to geopolitical compulsions and stricter domestic quality requirements, supply chain optimisation, and opportunities provided by India.

However, the more profound and pertinent solution towards $1 trillion of goods exports by 2030 will be based on what Prime Minister Narendra Modi stated during his 2019 Independence day speech:

“Each district of our country has a potential equal to that of one country, each of our districts has the capacity equal to a small country in the world. Why should each district not think of becoming an export hub? Each of our districts has a diverse identity and potential for global market.”

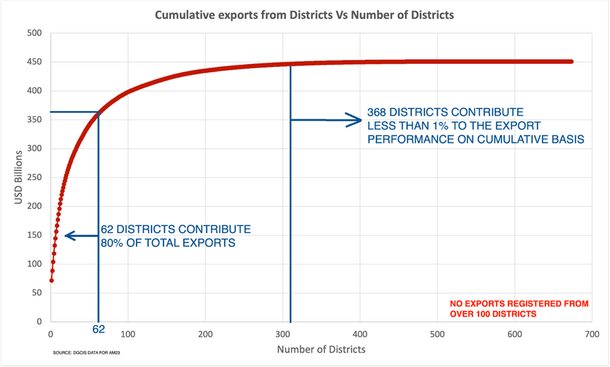

To appreciate the profound significance of the statement, it's essential to delve into specific data points. The first data point of interest focuses on the cumulative value of exports from the districts.

According to the data for FY April 2022-March 2023, 10 per cent of our districts account for over 80 per cent of our exports. There are around 100 districts that do not export. Even among those that do, there are over 350 districts that together make up less than 1 per cent of total exports.

This is where the importance of Prime Minister’s statement comes into picture. Unless most districts perform, we will not be able to ramp up exports meaningfully and inclusively. And not all these districts can become an automobile hub or host an electronics hardware park.

Therefore, one needs to look beyond the traditional export products, and stretch the existing export ecosystem framework to include products that are not exported in the current ecosystem. This has started happening through cross-border e-commerce exports where goods are being sold online, using digital medium, directly to consumers and businesses abroad.

Central to our discussion is what we may term the ‘Box of Opportunity’ — a domain ripe for the growth of micro, small and medium enterprises (MSMEs), skilled artisans, and the vibrant sectors of handicrafts and handlooms, particularly within rural India.

This realm stands to gain immensely from the global export market, provided the right catalysts are in place. E-commerce exports represent one such pivotal catalyst, but which sectors stand to benefit most from this digital gateway, and to what extent?

To answer this, we need to delve into the Harmonised System (HS) of trade classification, which categorises goods into 99 chapters at the two-digit level. The initial chapters, 01 to 24, encompass primary agricultural products and their processed derivatives.

In contrast, chapters towards later parts from 80 onwards cater to fields like engineering, automobiles, and electronics — sectors traditionally linked with significant capital investment and global value chains, including mobile phones, electronics, automobiles, and aircraft.

Among the chapters, we can broadly identify sectors inherently suitable for MSMEs — such as toys, textiles, leather, food products, wood and glassware, brass and metal ware, handicrafts, and handlooms, ayurvedic medicines and preparation, among others.

These areas, characterised by their potential for artisanal and small-scale production, are particularly poised for leveraging e-commerce for global outreach, when compared against heavy industries (petroleum, chemicals or steel) or sectors falling under global value chains (electronics, large consumer appliances). This brings us to the second data point.

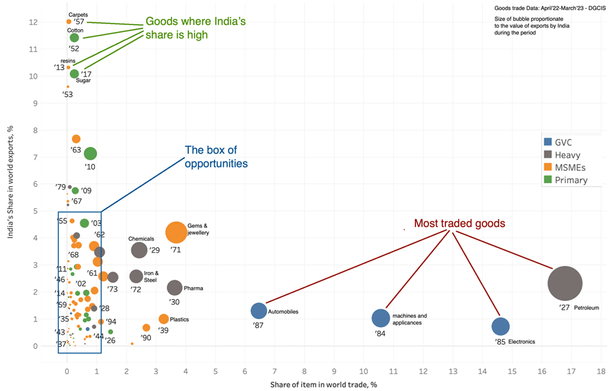

In the visual depicted above, the most extensively traded commodities are positioned towards the right, with the bubble's size reflecting the export value of each item from India during FY23.

One may notice the era's defining globalisation trend, where most of these globally traded goods, with share of over 5 per cent in global trade, are those that are integrated into supply chains overseen by multinational corporations.

These high-volume items, and petroleum products, contribute almost three fourths of the total global trade.

Currently, India's contribution to the trade of these high-volume items remains modest at 1.4 per cent (CY22). Strategic initiatives focused on bolstering the manufacturing sector — underscored by policies like the production linked incentive (PLI) scheme, PM-MITRA, and significant infrastructure enhancements — are in motion to alter this dynamic.

However, the area of interest for E-Commerce growth are the commodities highlighted within the rectangular box of opportunities, revealing insights into potential areas for growth and increased participation in the global trade ecosystem. If we zoom into the box, we see the visual below.

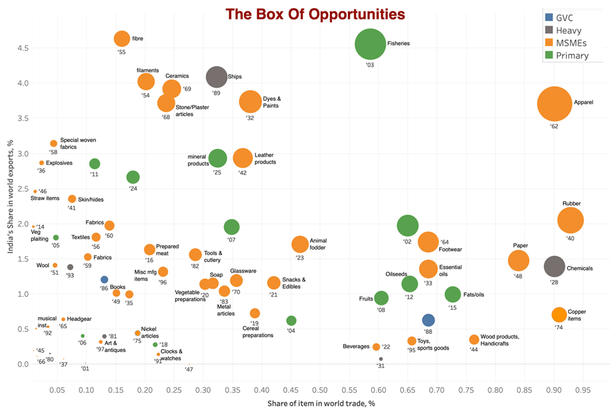

In this 'box of opportunities', we can identify many sectors ripe for MSME engagement yet markedly underrepresented in global trade.

As previously discussed, the x-axis represents the share of the item in world trade as a percentage, while the y-axis denotes India's share in world exports as a percentage.

This zoomed-in view focuses on the 'box of opportunities' where sectors inherently suitable for MSMEs are represented. These sectors, with a share in the global market below 1 per cent, and India's share in global trade of these items under 5 per cent, represent areas of untapped potential.

Easily identifiable among them are the wood and handicrafts, toys and sports goods, ceramics, apparel and textile, leather products, footwear, miscellaneous metal and non-metal manufactured items etc.

E-commerce emerges as a crucial enabler for such sectors, providing MSMEs with a viable entry point to compete on the international stage. Though these commodities individually account for a modest portion of global trade, collectively, they represent a market size exceeding $6 trillion per annum (CY2022), which is a quarter of the total global trade.

India has a share of 1.4 per cent in the global trade for the items which are within the box of opportunities. This points to a great scope for improvement.

To contrast, China’s exports of these items constitute around 16 per cent of the global market. Capturing an additional 10 per cent of this market through supportive measures for MSMEs in the coming years could yield an incremental export of $600 billion from India.

A significant portion of that can come through e-commerce. A good example of this possibility are coir products (chapter 53) and carpet industry (Chapter 57) in which India has a share of around 10 per cent in the world market and we can no longer see them in the box.

As we explore the growth potential of e-commerce exports from India, it's important to note that we are focusing on a specific subset of cross-border e-commerce exports where goods are digitally ordered, paid for, and physically delivered across borders. This subset presents ample opportunities to diversify and make trade more inclusive.

Quantifying the exact volume of goods exported from India through e-commerce channels is challenging due to limitations in data collection mechanisms.

Despite this, estimates suggest that India's e-commerce exports ranged between $2 billion to $5 billion during the fiscal year 2022-23, highlighting the need for more sophisticated tracking and reporting mechanisms. China, the current world leader in cross-border e-commerce, exported $230 billion in 2022 (WTO estimate).

The global market for e-commerce exports is poised for exponential growth, with projections indicating a potential surge from $800 billion in 2022 to $8 trillion by 2030 (GTRI). India is well-positioned to capitalise on this trend, underscoring the importance of strategic initiatives and policies to enhance its competitiveness.

The Prime Minister's vision of districts becoming export hubs emphasises the importance of leveraging e-commerce exports to tap into the local potential and diversity of each district, enabling MSMEs, artisans, and craftsmen to access international markets without heavy investments or intermediaries.

E-commerce exports can help overcome traditional barriers faced by Indian exporters, serving as a key driver for achieving the goal of $1 trillion in goods exports by 2030.

In the next part, we will discuss the regulatory and policy reforms needed to achieve this vision and the paradigm-shifting changes happening in this sector that may affect the future of international trade.

Tirumala Venkatesh is an Indian Trade Service officer currently posted at Director level with the Directorate General of Foreign Trade, New Delhi.