Economy

US Fed And RBI Governor Changed The Rules Of The Money Game: Did You Win Or Lose?

R Jagannathan

May 06, 2022, 11:45 AM | Updated 11:45 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

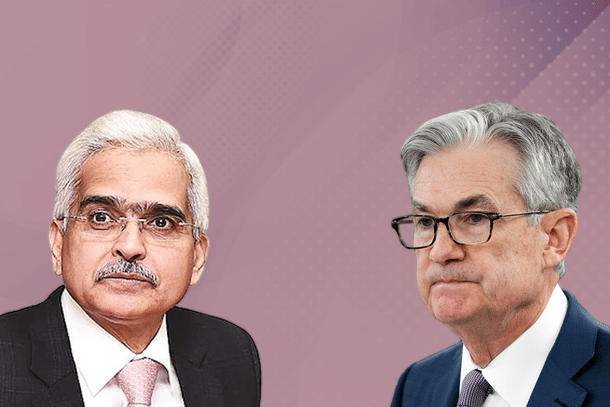

The ground rules for managing your money have changed dramatically since Wednesday’s announcements by Reserve Bank of India Governor Shaktikanta Das and US Fed Chief Jerome Powell’s decision to raise interest rates and curtail liquidity to fight raging inflation.

While the Fed’s announcement was expected, Das’s came out of the blue, midway between two policy meetings of the Monetary Policy Committee (MPC). The most likely explanation for Das’s move was the possibility of the Fed hiking rates beyond the 0.5 per cent that was factored in by the markets. He pre-empted any panic in the Indian stock and money markets by moving a few hours ahead of the Fed.

Since Das changed both repo rates (by 0.4 per cent) and the cash reserve ratio (CRR, by 0.5 per cent), the impact on interest rates will be felt almost immediately. Deposit and loan rates, including retail equated monthly instalments for home and auto loans, have already begun rising.

It is safe to assume that the MPC will raise rates by 0.5-1 per cent by March 2023 at the minimum.

Here's how the money power balance is changing.

#1: Over the next one year, savers will get better options than borrowers. Right now, it is the other way round, with borrowers paying almost negative rates (after adjusting for inflation) and savers losing to inflation.

#2: Rising rates shift power from the young to the old (especially fixed income savers) as the young are more likely to be borrowers than lenders, and senior citizens more likely to be savers than borrowers.

#3: Government’s interest costs will rise, as it has been the biggest beneficiary of low rates for over two years now. On some tenures, especially long-dated securities, it will be paying positive real interest rates on its borrowings after a long time. Lenders will either ask for higher rates or more floating rate notes.

#4: Stocks will feel the pressure for some time, for higher rates result in changes in how investors discount stock prices. But over the medium term, stock values will regain their composure, for equity is the only asset class that consistently beats inflation over the long term.

#5: Stock valuations will favour sectors which are less rate sensitive (software, pharma, FMCG), and away from the rate sensitive (realty, autos). Banks, which control both ends of the rate process, ie, deposits and loans, will be able to weather the storm as long as they are able to reprice risks, match liabilities with assets, and the demand for borrowing remains reasonably strong. Short-duration debt and floating rate notes will be the short-term flavours in debt.

Be warned, you are in for a roller coaster in fiscal 2022-23.

Jagannathan is former Editorial Director, Swarajya. He tweets at @TheJaggi.