Economy

What is Inflation Targeting?

Avinash Tripathi

Oct 07, 2014, 06:01 PM | Updated Feb 19, 2016, 06:32 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Reserve Bank of India could be moving towards an Inflation Targeting (IT) framework for formulating monetary policy. We explain what IT means.

Following the submission of Urjit Patel Committee report (officially known as the External Committee to Revise and Strengthen Monetary Policy; we have referred to it simply as the Committee in the rest of the article), Inflation Targeting (IT) has become a widely discussed topic among RBI watchers. It is being argued that the report and recent actions of RBI governor Raghuram Rajan are aimed at moving Indian monetary policy towards an IT framework.

What is monetary policy? How does it work?

Monetary policy is one of the two macroeconomic levers (the other being fiscal policy) through which policy makers try to influence the real economy (the part of the economy that is concerned with actually producing goods and services, as opposed to the part of the economy that is concerned with buying and selling on the financial markets) and meet macroeconomic goals such as containing output volatility, maintaining price and financial stability etc.

Monetary policy mainly works by altering the supply of liquidity and credit. Exact pathways through which monetary policy affects the real economy remains a matter of active research, but it is widely believed that it does so through changing cost of capital (ie. interest rate), availability of credit and altering exchange rates.

What is Inflation Targeting? How does it differ from the current monetary policy framework?

Inflation Targeting is a novel approach for formulating monetary policy that has deep theoretical underpinnings and has been successfully adopted by a number of central banks around the world.

It differs from the existing framework in three essential respects:

First, it emphasizes curbing inflation, measured by a pre-defined metric as the primary objective of monetary policy, even to the exclusion of other objectives. This approach contrasts sharply with the more orthodox approach where a central bank is called upon to meet a menagerie of often conflicting objectives.

Secondly, IT literature emphasizes the need to adopt a less ad hoc policy response and make monetary policy more rule-based. While earlier approaches viewed the inflation management problem as a sequence of isolated challenges, each amenable to a response tailored for it, IT looks at ‘policy rules’—a definite predictable response function that relates deviation from required inflation and actual inflation to the actual conduct. It may be described as the ‘algorithmization of monetary policy’—a pre-planned step-by-step decision-making procedure.

Thirdly, an IT framework emphasizes transparency and communication. In earlier eras, monetary policy used to be shrouded in mystery and surprises were seen as formidable weapons that a central banker could count upon to deliver the economy from recession. In the Inflation Targeting approach, both the goals and the policy response are not only made public but policy makers try to be credible and not become another source of uncertainty.

Of course, in practice, most central banks, even those who have adopted an IT framework, continue to retain a fair degree of discretion, leading to hybrid approaches like ‘flexible inflation-targeting’.

What is the Taylor Rule?

The Taylor Rule, named after Stanford University economist John Taylor, is a particular monetary rule that has used widely both prescriptively (that is, central banks should follow it to stabilize inflation and output volatility) and also descriptively (that is, for predicting the response of central banks). In one popular formulation it reads as:

nominal interest rate = target inflation rate + real interest rate + 1.5*(inflation rate – target inflation rate) – 0.5(output – target output).

To Taylor Rule suggests that interest rates should be raised when the inflation rate is above target inflation and vice versa. Conversely, the interest rate should be lowered when output lags behind target output. Coefficients measure the relative weights assigned to the twin objectives of maintaining inflation and output.

How is it supposed to tame inflation?

Inflation is a function of output gap (actual growth rate relative to potential/ trend growth rate) and inflationary expectations. Like many other economic variables, inflation is largely a result of what businessmen and consumers expect it to be. When consumers expect higher inflation and prices in the immediate future, they require higher compensation for their work.

Similarly, since firms are interested in real profits, they factor in expected inflation in setting prices. This wage-price spiral can be seen more starkly in economies suffering from hyperinflation, but a similar dynamics is at work in other economies where elevated inflation remains a matter of concern.

Inflation Targeting mainly works by breaking this spiral. Since the central bank commits to a specific time path of inflation and actively tries to defend it, even if it involves enduring some costs, economic agents expect lower levels of inflation. Lower levels of expected (future) inflation affects the wage/ price formation and delivers lower level of inflation in current periods!

What are the specific recommendations of Dr Urjit Patel Committee that are more in tune with the IT approach?

The Committee has recommended the combined Consumer Price Index (CPI) as the nominal target of monetary policy. It has laid down a road map of inflation management, whereby inflation has to be brought down to the level of 6 per cent by January 2016. After gradual reduction, RBI is required to adopt a four percent rate of inflation as its official target, with +/-2 per cent band around it. Moreover, the committee has also made recommendations for institutional evolution required for policy transition such as constitution of a Monetary Policy Committee (MPC) and laid down a monetary operating procedure.

Are food and fuel prices amenable to monetary policy? Why has combined CPI been chosen as a target?

The Committee deliberated on the issue and weighed the pros and cons of including food and fuel in the consumption basket whose prices must be stabilized.

There is a strong argument against including them in the Inflation Targeting basket (CPI in this case). Most of the inflation in food and fuel arguably has its origin in the supply side of the economy and related to regulations in agricultural sector and external political environment, both of which are beyond the control of the central bank.

However, the committee decided for their inclusion in the basket for the following reasons. Food and beverage, and light and fuel account for 47.5 per cent and 9.5 per cent respectively in the new CPI (combined) consumption basket. By excluding these commodities, the rate of inflation arrived at—the so-called core inflation—will be a misleading indicator of the actual inflation faced by consumers and will not reflect their true cost of living.

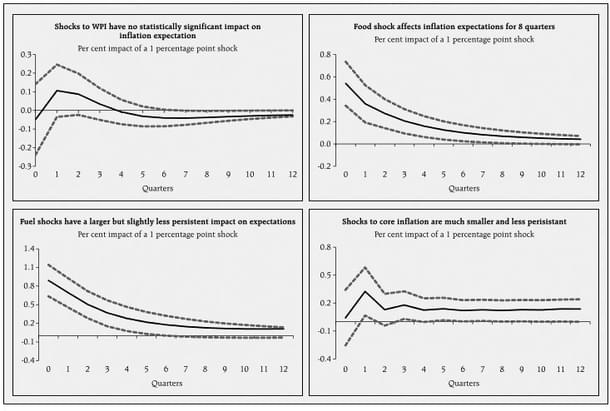

Even more importantly, the Committee found that food and fuel have large and persistent impact on inflation expectations. One percentage point increase in food prices raises expected inflation by 0.5 percentage points and persists for around eight quarters. Increase in core inflation has a somewhat subdued impact on inflation expectations and persists for only around two or three quarters. More interestingly, Wholesale Price Index (WPI) inflation has no statistically significant impact on inflation expectations at all. (See graphs below)

Is Inflation Targeting Keynesian or Monetarist?

Perhaps both and neither! The IT framework is a culmination of 50 years of macroeconomic research and synthesizes both the insights of monetarist and Keynesian schools of thought. It is monetarist in so far as it emphasizes the ‘rules’ and not ‘discretion’. But it is Keynesian as the target of choice ‘rate of interest’ is Keynesian in nature (Leading monetarist economist Milton Friedman was sceptical of interest rate as an instrument of monetary policy and emphasized stock of money (M1/M3) as monetary targets).

Which other countries have adopted IT framework?

Around 23 emerging market economies and nine advanced economies have adopted the IT framework so far. Important among these are Chile, Israel, Indonesia, Australia, Canada, New Zealand and South Korea. Among the countries which have not (officially) adopted IT so far are the US, the European Central Bank, China, Russia, Malaysia and India. However, countries such as the US are arguably de facto inflation targeters and no country so far has discarded inflation targeting after adopting it once.

One of the earliest and most successful examples of efficacy of the IT framework was Chile. In 1991, when the Central Bank of Chile adopted the IT framework, annual CPI was quite high (24 per cent). It was brought down to less than 5 per cent within a decade. In 2013, the Central Bank of Chile adopted an annual inflation target of 3 per cent with a 1 per cent tolerance band.

Avinash Tripathi is an economic researcher keenly interested in theory and institutional evolution of Indian economy